U.S. single-family homebuilding tumbled in March as a resurgence in mortgage rates pushed potential buyers to the sidelines. According to the U.S. Census Bureau, housing starts dropped by 14.7% in March to 1.321M vs. 1.480M expected and 1.549M prior (revised from 1.521M). Single-family housing starts ran at a rate of 1.022M, 12.4% below the revised February figure of 1.167M. Building permits also slid more than expected, falling by 4.3% M/M to 1.458M vs. 1.510M expected and 1.523M prior (revised from 1.518M).

According to the National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI) released recently, “sentiment was flat in April as mortgage rates remained close to 7% over the past month and the latest inflation data failed to show improvement during the first quarter of 2024.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

“With many frustrated buyers back on the fence waiting for interest rates to fall, policymakers can help ease affordability challenges by reducing inefficient regulatory rules that raise housing costs and limit supply,” said NAHB Chairman Carl Harris, a custom home builder from Wichita, Kan.

“April’s flat reading suggests the potential for demand growth is there, but buyers are hesitating until they can better gauge where interest rates are headed,” said NAHB Chief Economist Robert Dietz. “With the markets now adjusting to rates being somewhat higher due to recent inflation readings, we still anticipate the Federal Reserve will announce future rate cuts later this year and that mortgage rates will moderate in the second half of 2024.”

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

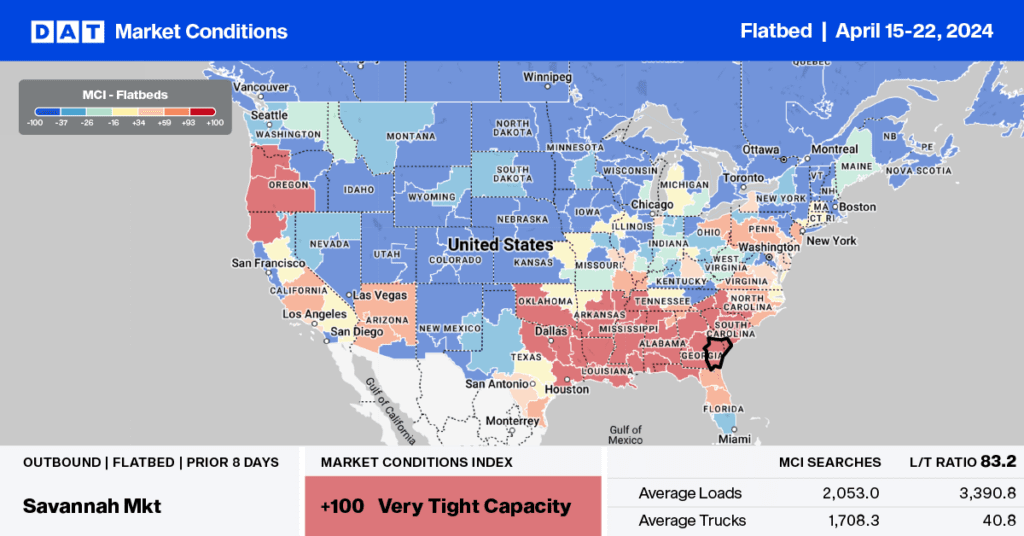

Although the total number of oil and gas drilling rigs has been flat since the start of the year, according to Baker Hughes, rig counts are up 2% in the West Texas Permian Basin, where 51% of rigs are located. Supplying this region with drill pipe and casing is primarily the Houston freight market, where loads moved are up 14% y/y following last week’s 12% w/w increase.

Outbound linehaul rates in Houston have increased by $0.07/mile in the last month. On the number one lane west to Lubbock in the Permian Basin, flatbed carriers were paid an average of $2.13/mile last week. On the number two lane to El Paso, linehaul rates were flat, averaging $2.39/mile on a 13% higher volume of loads moved.

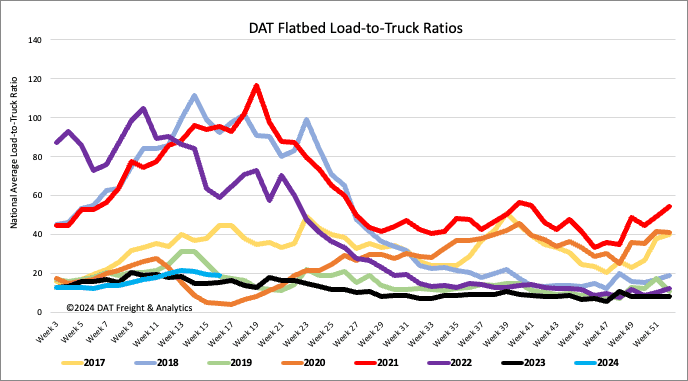

Load-to-Truck Ratio

Flatbed load post volumes fell for the fourth week following last week’s 4% w/w decrease. Volumes are 4% lower than last year and identical to 2019. Like dry van and reefer, flatbed equipment posts increased under 5% w/w, decreasing the load-to-truck ratio by 4% to 18.94.

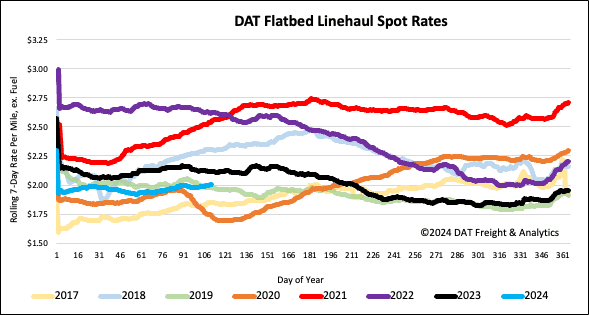

Spot rates

Flatbed linehaul rates remained primarily flat to down slightly for the second week, averaging just under $2.02/mile. Compared to last year, the national average is $0.12/mile lower and $0.02/mile higher than 2019.