The November Logistics Managers Index (LMI) dipped into mild contraction territory following a 7.1 drop to 49.4 following three months of expansion. November’s dip was largely triggered by a decline in inventory levels (-9.1), attributable to fourth-quarter holiday sales. After a noticeable absence, just-in-time shipping appeared this holiday season because a lot of freight moved at the end of November, resulting in the contracting of inventory levels and a surge in spot market freight volumes.

Zac Rogers, Associate Professor, Supply Chain Management at Colorado State University and LMI author, said, “November’s decline seems to have come because firms are selling off inventories quickly. The previous large decline from April 2022 happened because firms had too much inventory and couldn’t sell any of it. These scenarios led to large drops in the overall LMI, but this recent drop is significantly less concerning.”

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

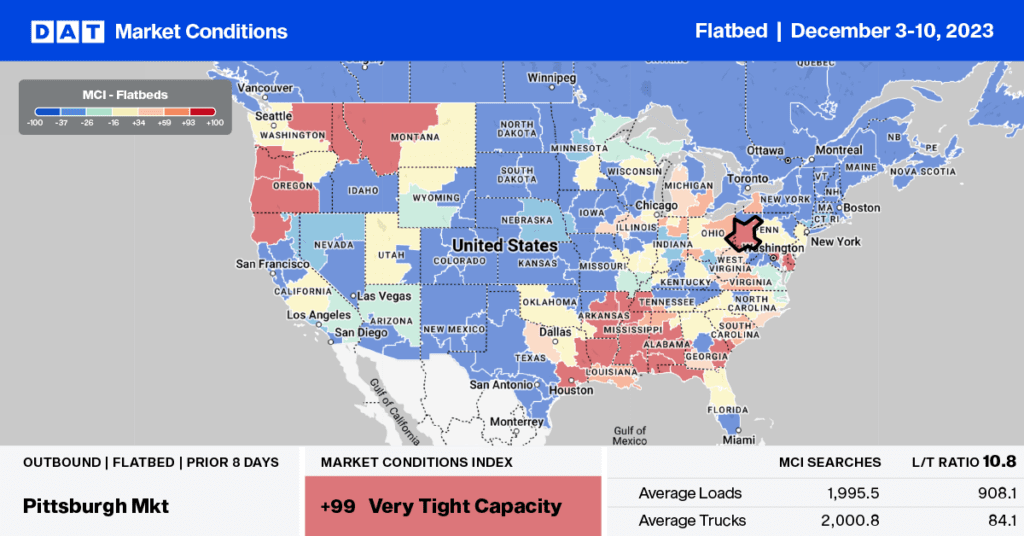

Last week’s national domestic raw steel production was up 7.1% compared to 2022, following last week’s 1% w/w gain, according to the American Iron and Steel Institute (AISI). For flatbed carriers, the Gary and South Bend, IN, markets, where around 30% of domestic steel is produced annually, are a hotspot for steel loads. The overall market is still oversupplied, with flatbed capacity impacting outbound spot rates. They are 6% lower than last year at $2.45/mile and $2.42/mile, respectively.

Short haul loads from Gary to Cleveland averaged $2.62/mile last week, almost identical to last year, while loads to Cincinnati paid carriers $2.89/mile, just over $0.10/mile higher than in 2022. At $2.42/mile, flatbed loads last week from South Bend to Harrisburg were the highest since July but $0.21/mile lower than last year. State average rates in Indiana are $2.41/mile and are $0.13/mile higher than in 2019.

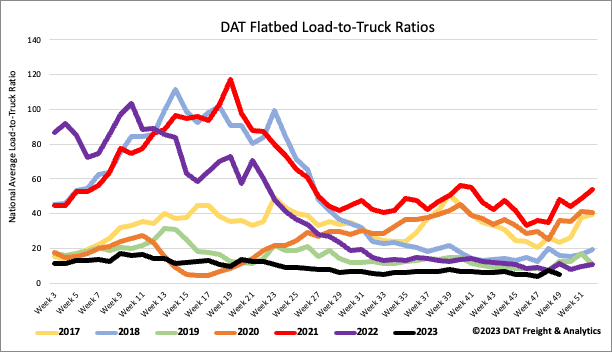

Load-to-Truck Ratio (LTR)

The volume of flatbed load posts (LP) decreased by 25% last week as the market cooled following the prior week’s surge in spot market volume. Carrier equipment posts (EP) increased by 6% w/w, resulting in last week’s flatbed load-to-truck ratio (LTR) decreasing to 5.19.

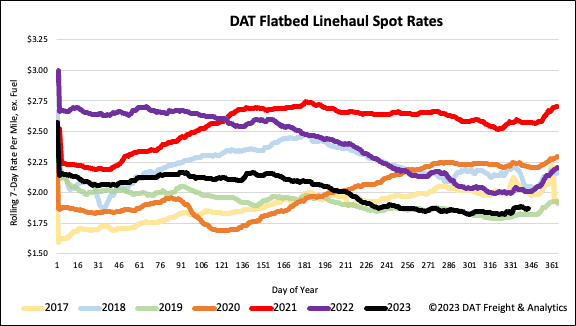

Spot rates

Flatbed linehaul rates averaged $1.90/mile following last week’s $0.02/mile decrease. Flatbed spot rates are $0.14/mile lower than last year and $0.05/mile higher than in 2019. Compared to the pre-pandemic average for Week 46, last week’s national average was $0.02/mile lower and $0.18/mile lower than in 2018.