DAT’s top flatbed market is in Texas, with the Houston to Lubbock lane typically dominating volumes related to drilling activity in the Permian Basin where almost half of drilling rigs are located. Following the combination of import tariffs being announced by the current Administration, OPEC+’s increased production, and China’s retaliatory actions, Brent crude fell to just over $65 per barrel for the first time since August 2021, while WTI fell to around $62. Lower oil prices typically lead to substantial reductions in exploration and development, and companies shutting down existing wells or reducing drilling activity to avoid incurring losses, a concern for flatbed carriers hauling drill pipe and casing to the oilfields.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

DAT typically sees most the daily volume of flatbed loads hauling drill pipe from Houston to the Permian Basin, estimated to be just over 100 loads per day based on an estimated drilling speed of 500 feet per day per drilling rig. According to Baker Hughes, the count of active oil rigs is 6% lower than last year (317 vs 294 active rigs), while the volume of loads moved on the Houston to Lubbock lane are 3.2% lower over the same timeframe.

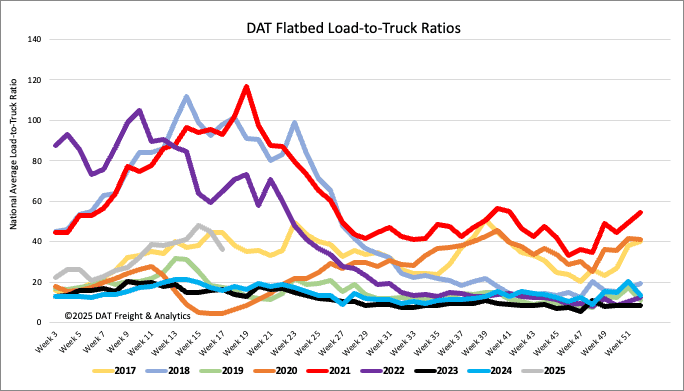

Load-to-Truck Ratio

Flatbed load post volumes were down 13% last week as open deck demand begins to flatten, although volumes are still 23% higher than last year. Last week’s flatbed load-to-truck ratio (LTR) ended at 36.28, down 20% w/w.

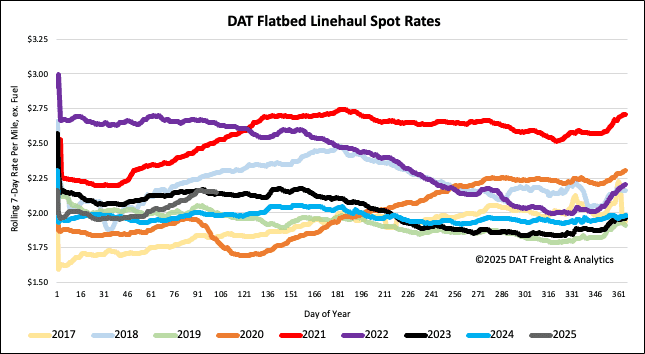

Spot rates

After registering nine weeks of gains, flatbed spot rates reversed course last week, dropping by $0.02/mile to a national average of just over $2.16/mile. Compared to last year, flatbed linehaul rates are $0.17/mile or 8% higher, $0.01/mile higher than in 2023, and now $0.14/mile lower in 2018.