The February Truckload Ton-Mile Index (TTMI) produced by Michigan State University, showed that truckload demand rebounded slightly in February, up almost 1% compared to January and mostly flat compared to last year. The TTMI is almost 1.5% higher than February 2018 and 2019, but down 2.6% from the index peak in March 2022.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The 1% drop in January was most likely caused by a drop in automotive production due to January storms resulting in multiple days of lost production. Prior to that, December’s index reading (up 1% month-over-month) showed we were seeing signs the industry was beginning to exit the freight recession. That was before the recent round of tariffs, announced by the current Administration, sent shockwaves through the global economy.

According to Professor Jason Miller, “My concern is that the profound economic uncertainty introduced by the wild tariff gyrations will slow manufacturers’ new orders as folks elect to wait and see what ultimately transpires regarding tariffs. That is the last thing the trucking market needs now.”

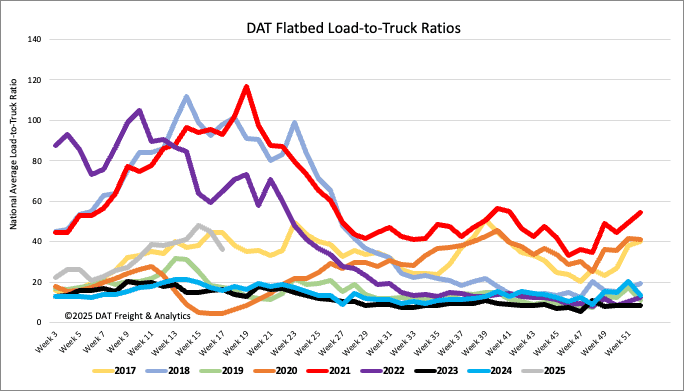

Load-to-Truck Ratio

Flatbed load post volumes were down for the third week, dropping by 15% as open deck demand continues to soften in the spot market. Volumes are still 13% higher than last year. Last week’s flatbed load-to-truck ratio (LTR) ended at 32.41, down 7% w/w.

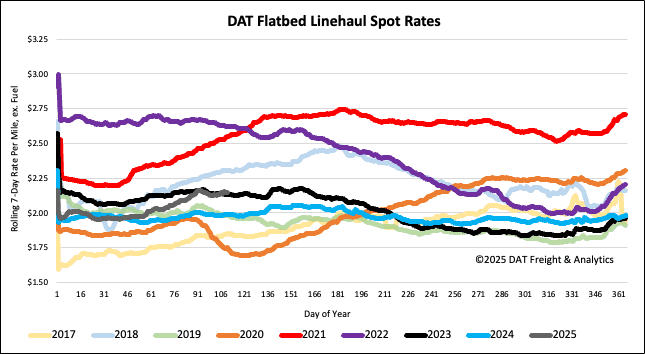

Spot rates

Flatbed spot rates and volumes were mostly flat last week, remaining at $2.16/mile, $0.16/mile higher than last year. Compared to previous years, flatbed linehaul rates are $0.17/mile lower than in 2018 and higher than 2019 by the same margin.