Lower oil prices generally help truckload carriers through lower diesel costs, but they also point to lower truckload freight volumes directly related to drilling activities. Flatbed carriers in large freight markets like Texas have benefited substantially from higher drill pipe and casing demand, particularly in recent years. More drilling rigs translated into more freight volumes and vice versa. On July 21, the number of drilling rigs reported by Baker Hughes totaled 669, but dropped by six rigs from the week prior and 89 fewer than in the same period last year.

Around half of the drilling rigs are located in the West Texas region in the Permian Basin oilfield. Sharp declines led to declining rig counts in Texas and the Permian Basin, where rig counts fell seven rigs to 322 – 43 below the 365 at work across the state last year. New Mexico remained unchanged at 113. Louisiana joined Texas in seeing a decline, while Oklahoma was the only producing state to see an increase.

Looking back over the last decade to when the U.S. Shale Revolution commenced, the number of current oil drilling rigs has dropped by 66% from around 2,000 in November 2011 to 669 in late July 2023. During the peak of the 2018 truckload rate rally, the number of oil rigs had halved to just over 1,000 in mid-June of that year; since then, rig counts have dropped by 37%.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

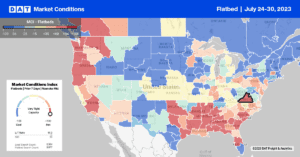

Since the start of May, outbound flatbed spot rates in Texas have dropped around $0.18/mile to $2.17/mile last week. Despite the longer-term downward trend at the state level, some individual markets reported gains last week. In the large Houston market, spot rates increased by $0.02/mile to $2.25/mile after dropping for three weeks. Spot rates were up $0.10/mile to $1.97/mile in nearby Laredo and up by almost the same amount in El Paso, where outbound rates averaged $1.99/mile.

Declining oil and gas drilling rig counts in the Permian Basin impact volumes on the Houston to Lubbock lanes. At $2.42/mile, flatbed carriers were paid the lowest in 12 months last week. Houston to El Paso reported the lowest rate in 12 months at $2.44/mile (on 4% higher volume), while loads north to Fort Worth averaged $2.75/mile, which was $0.03/mile lower than the June average.

In the Southeast, capacity was tight in Miami, where rates jumped by $0.21/mile to $2.09/mile, while loads 500 miles north to Savannah were the highest since last August, averaging $1.53/mile.

Load-to-Truck Ratio (LTR)

Flatbed spot market volumes were flat last week, 64% lower than the previous year and around 36% lower than in 2019. Carrier equipment posts decreased 7% w/w, resulting in last week’s flatbed LTR ratio increasing slightly from 6.24 to 6.79, the lowest flatbed LTR since 2016 for this time of the year.

Spot Rates

After dropping $0.06/mile in the last four weeks, flatbed rates went against the trend, increasing by just a penny-per-mile the previous week. At $2.05/mile, the national average flatbed spot rate is $0.37/mile lower than in 2022, identical to this time in 2020, and around $0.13/mile higher than 2019.