Economic activity in the manufacturing sector contracted in March after two months of expansion following 26 months of decline, according to the latest Manufacturing ISM Report on Business. The Manufacturing PMI fell to 49 percent in March, down 1.3 percentage points from February’s 50.3 percent, indicating ongoing economic expansion for the 59th month since a contraction in April 2020. A PMI above 42.3 percent typically signals overall economic growth.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The New Orders Index contracted for the second month in a row, dropping to 45.2 percent from 48.6 percent in February. The New Export Orders Index also decreased to 49.6 percent, while the Imports Index barely expanded at 50.1 percent. ISM Chairman Timothy Fiore noted, “In March, U.S. manufacturing slipped into contraction after minor growth in February. Demand and output weakened, and input increased, which negatively impacts economic growth. Indicators of reduced demand included further declines in the New Orders and Export Orders Indices and a faster contraction in the Backlog of Orders Index. Factory output contracted, prompting companies to adjust production plans downward.”

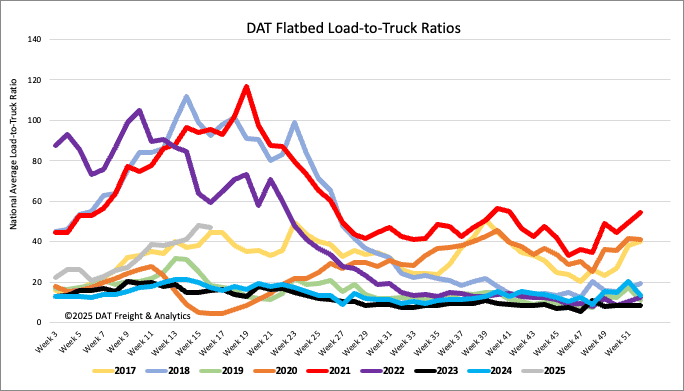

Load-to-Truck Ratio

After increasing for ten weeks, flatbed load post volumes reversed course last week, dropping by 2%. Volumes are still 29% higher than last year and 7% higher than in 2017. Last week’s flatbed load-to-truck ratio (LTR) ended at 46.82, down 3% w/w.

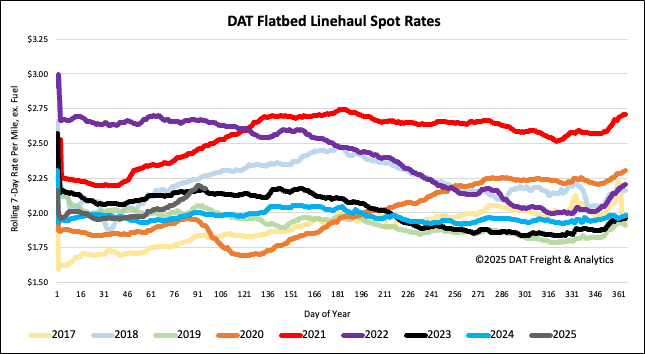

Spot rates

Flatbed spot rates have now recorded eight weeks of gains following last week’s $0.04/mile increase. At $2.19/mile, linehaul rates are $0.18/mile or 9% higher than last year, $0.01/mile higher than in 2023, and just $0.08/mile lower than the bull market in 2018.