A primary driver of the freight market is the manufacturing sector. The latest report from the Institute for Supply Management (ISM®) Manufacturing Report On Business® indicates that the economic activity in the manufacturing sector grew in September. The U.S. manufacturing sector expanded in September, as the Manufacturing PMI® registered 50.9 percent, 1.9 percentage points below the reading of 52.8 percent recorded in August. A reading above 48.7 percent generally indicates an expansion of the overall economy.

“Manufacturing expanded for the 28th straight month. Panelists’ companies slowed hiring activity; month-over-month supplier delivery performance was the best since December 2019; price growth slowed notably (with the index at 60 percent or lower) for the third consecutive month, and lead times continued to ease for capital equipment and production materials. Markedly absent from panelists’ comments was any large-scale mentioning of layoffs; this indicates companies are confident of near-term demand, so primary goals are managing medium-term head counts and supply chain inventories,” says Timothy R. Fiore, CPSM, C.P.M., Chair of the ISM® Manufacturing Business Survey Committee. “Of the six biggest manufacturing industries, four — Machinery; Transportation Equipment; Food, Beverage & Tobacco Products; and Computer & Electronic Products — registered moderate-to-strong growth in September.”

A few highlights of the report: ISM®’s New Orders Index decreased 4.2 percentage points in September to 47.1 percent compared to 51.3 percent reported in August. This indicates that new order volumes fell back into contraction after one month of expansion. For the supplier deliveries index, “83.2 percent of panelists reported ‘same’ or ‘faster’ deliveries, compared to August. Panelists’ comments reiterate that suppliers performed better in September compared to previous months. Additionally, Customers’ inventories are too low for the 72nd month in a row, a positive for future production growth. Backlogs expanded in September at a slower rate as the New Orders Index level fell, and production expanded minimally in the period. A slowing in price increases is a positive for future new orders growth and backlog expansion,” said Fiore.

All rates cited below exclude fuel surcharges unless otherwise noted.

In the Lakeland, FL, freight market where Hurricane Ian made landfall, inbound load posts surged last week, increasing by 134% w/w. A significant amount of volume came from the Dallas market, where spot rates were up almost $0.20/mile above the prior month’s average at $1.97/mile last week. Lakeland outbound load posts were also up, increasing by 16% last week as the market slowly recovers, while outbound spot rates dropped by $0.26/mile the previous week to $1.74/mile.

In Memphis, the logistics hub of the America, outbound flatbed rates increased by $0.05/mile last week to an average of $2.78/mile following an 8% w/w increase in load posts. Capacity on the high-volume lane to Chattanooga also tightened, with rates up $0.12/mile above the September average at $2.83/mile last week after being flat for the prior two months. Even though load posts were down by 2% w/w in Medford, OR, flatbed capacity was tight following an increase of $0.09/mile to $2.63/mile for all outbound loads. After being flat since July, spot rates from Medford to Albuquerque increased by $0.13/mile to $2.26/mile last week, although that’s still $0.18/mile lower than the previous year.

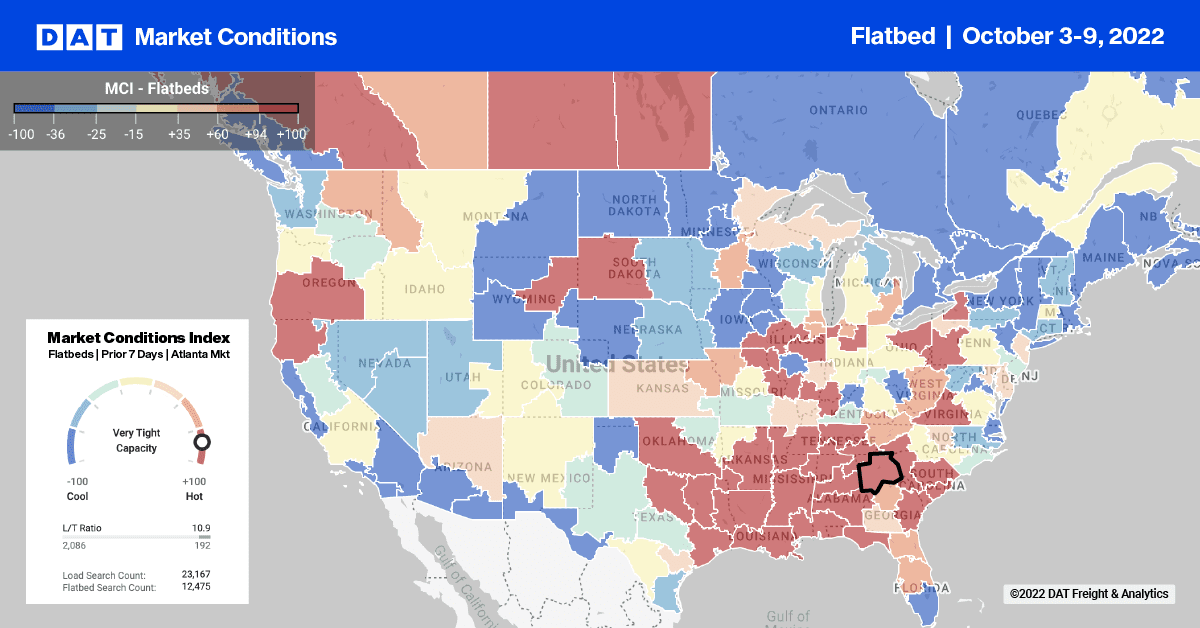

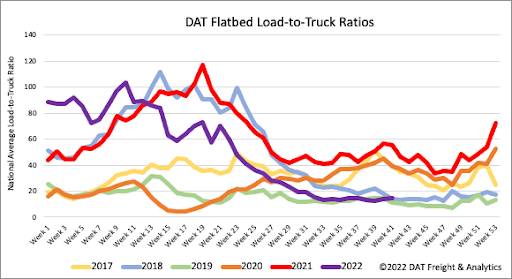

National flatbed load posts jumped last week, increasing 13% w/w and boosted by a surge in Florida inbound volumes following Hurricane Ian, which were up by 113% w/w. Volumes are still a long way off last year’s levels and were around 60% lower last week. Flatbed capacity remained loose though with equipment posts increasing by 8% and still at the highest level in the last six years for the start of October. Equipment posts are even 3% higher than the 2019 peak when capacity was oversupplied. As a result of many more load posts compared to equipment posts, last week’s load-to-truck (LTR) ratio increased by 4% w/w from 13.70 to 14.30.

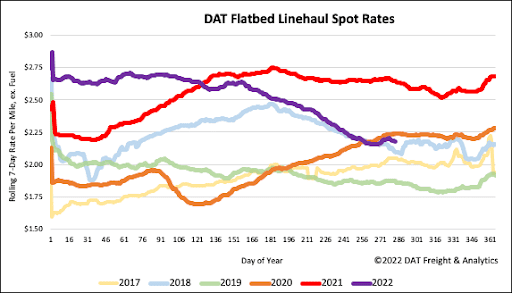

Flatbed linehaul spot rates remained flat last week, boosted by increased load board activity in the Southeast Region following Hurricane Ian. Linehaul rates ended last week at $2.18/mile, which is $0.18/mile lower than the previous but $0.08/mile higher than in 2018. Flatbed linehaul rates have dropped by 17% or $0.46/mile year-to-date, with $0.44/mile occurring since June 1.