The latest agricultural tractor and combine report from the Association of Equipment Manufacturers (AEM) reported a slight increase in December volumes compared to a year earlier.

Total farm tractor sales were up 0.3% y/y at the end of 2021, while volumes in the self-propelled combined category jumped 25.3% over the same timeframe. Year-to-date volumes were up 10.3% and 24.7% respectively compared to 2020.

Breaking down farm tractor volumes into equipment types, volumes in the less than 40 HP category, which are suited to both flatbeds and dry vans, were just over 3% lower y/y but up 8.9% YTD. In the larger 100+ HP category suited primarily to flatbeds, volumes are up just under 30% higher y/y and up 24.1% YTD.

For the specialized drop deck and lowboy trailer categories, volumes of four-wheel drive farm tractors and self-propelled combines increased 29.1% and 25.3% y/y respectively. Year-to-date retail sales were also up for both categories, increasing by 18.3% and 24.7% respectively.

The winter months of January and February typically see the lowest volumes of the year, so with the best end-of-year result in the last four years, flatbed and specialized trailer demand is looking positive heading into the peak shipping season in Spring.

Find flatbed loads and trucks on the largest load board network in North America.

NOTE: Market rates reported below do not include fuel surcharges

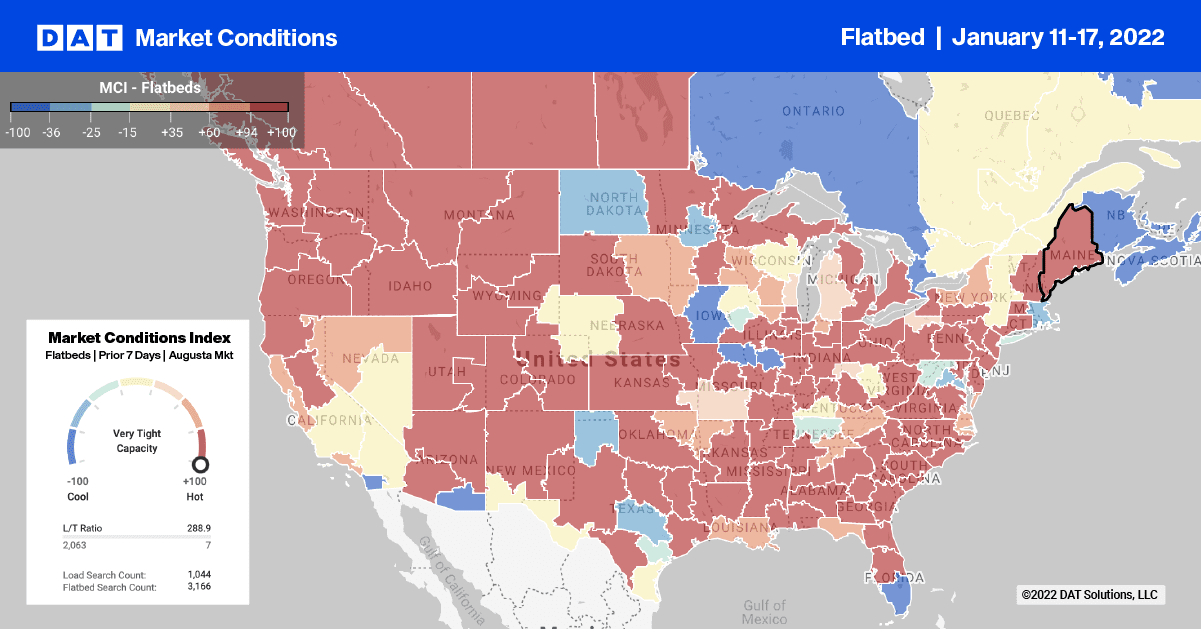

National flatbed volumes continue to trend downwards. Loads moved were down 4% week over week and are now down 11% in the last month.

Even though volumes are down sequentially, capacity remains tight in some markets, including the Gulf Coast where spot rates increased to an average outbound rate of $2.85/mile.

Capacity remained flat last week in Houston following an 11% increase in volumes, keeping spot rates at $2.81/mile.

In Miami, flatbed carriers were in high demand, pushing spot rates up 34 cents to $2.80/mile. There were also capacity shortages along the southern border in El Paso, TX, and Tucson, AZ. Outbound spot rates increased by 26 cents to an average of $2.04/mile in both markets combined last week, with loads from El Paso to Los Angeles paying more at $2.22/mile.

Load-to-Truck Ratio

Even though flatbed load posts dropped 20% last, they are an amazing 89% higher than the same time last year and more than double the same period in 2018. That’s an extraordinary statistic considering the bull market in 2018 was primarily driven by incredible demand for flatbeds. That was because of rebuilding efforts following major hurricanes in 2017, a surging industrial economy, oil market rallying and changes in the tax code.

Carrier equipment posts are only 3% lower than the same week last year and as a result, the flatbed load-to-truck ratio remained unchanged at 86.95 last week.

Spot Rates

After dropping by 3 cents the week prior, last week’s national average spot rate increased by the same amount to end the week at $2.67/mile. The national average is currently 45 cents higher compared to the same period last year and an amazing 61 cents higher than the same week in 2018 when the flatbed spot rate rally was just getting started.