The ACT Research For-Hire Trucking Index increased by 4.8 points in August to 54.5, seasonally adjusted (SA), from 49.7 in July. The improvement reflects both growing goods demand and inventory pre-positioning. Consumption of durable goods rose 4.2% q/q in Q2, imports and inventories are growing, and cross-border shipments are increasing.

Tim Denoyer, vice president and senior analyst at ACT Research, said, “Though, pre-positioning ahead of potential east coast port strikes is part of the story. Despite the strength of the US economy over the past year, for-hire demand has been suppressed by the expansion of private fleets in the past 18 months, despite carriers operating costs being ~40% less per mile. Recent data suggest private fleet growth is moderating and is likely to continue. A welcome and necessary development for volumes to return to the for-hire market.”

The ACT For-Hire Trucking Index is based on a survey of carriers measuring degree and directional changes in operational statistics in diffusion indexes (readings > 50 show growth and readings < 50 degradations).

Find dry van loads and trucks on DAT One, North America’s largest on-demand freight marketplace.

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This week, we focus on the North Carolina freight market, devastated by Hurricane Helene last week. According to Jess Thompson, CEO of All Hands and Hearts, in an interview from Asheville, North Carolina, “We’re seeing devastation like some of the worst storms that we’ve seen affect the United States. I have never seen, in 15 years, in this sector the number of helicopters flying over to deliver supplies because communities remain cut off. We won’t know the full impact of this storm for days and weeks because the landslides have closed the roads, and the cell reception is still out.”

Many roads, including Interstates 26 and 40, are still closed and are expected to remain closed for months. In the case of Interstate 40, which runs through the Pigeon River Gorge connecting Ashville, NC and Knoxville, TN, David Uchiyama, Western Communications Manager with NCDOT, said, “I-40 is going to be indefinitely closed for the foreseeable future. The water rose so high that it washed out all of the trees, bushes, and dirt that helps support the roadway.”

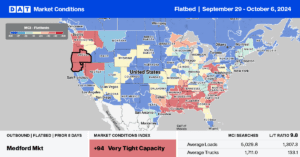

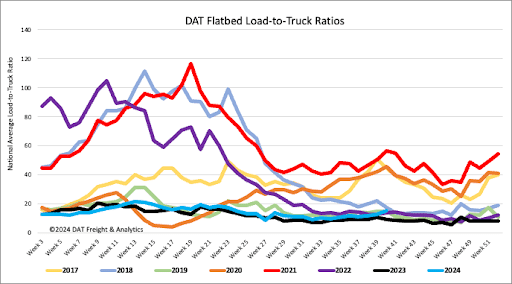

Last week, the number of national flatbed load posts increased by 12%, 23% higher than last year. At the same time, carriers’ equipment decreased by 7% week-over-week. As a result, the flatbed load-to-truck ratio increased by 20%, reaching 15.72, the highest it has been in three years for Week 40. This marks the seventh consecutive week of gains in this ratio.

In the largest flatbed spot markets and suppliers of building materials along the Gulf Coast, load posts in Houston and New Orleans increased by 27% weekly. After being flat the week before Hurricane Helene, flatbed load posts increased by 14% week over week in the Southeast Region, up 23% week over week along Florida’s Big Bend (up 5% week over week the week prior), and jumped by 68% week over week (up 81% week over week the week prior) in Tallahassee, where Hurricane Helene made landfall as a Category 4 event.

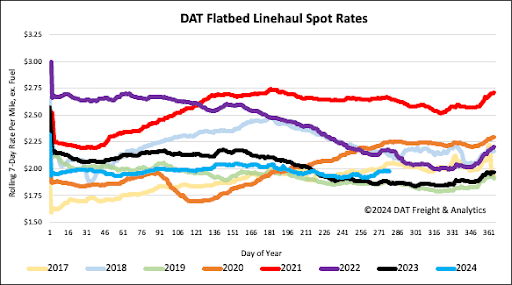

Flatbed linehaul rates increased by another penny per mile last week to a national average of $2.00/mile, only the second time in three months that flatbed spot rates, excluding fuel, have been over $2.00/mile. Flatbed linehaul rates are $0.11/mile higher than last year, $0.10/mile higher than 2019, and identical to the three-month trailing average.

Flatbed volumes nationally dropped 8% w/w but by almost 50% in Tallahassee, where Hurricane Helene made landfall. In the larger Southeast flatbed markets in Alabama, Mississippi, and Atlanta, rates increased by a penny per mile while outbound volumes plunged by 40% last week. Inbound volumes into the same states jumped by 44% w/w, with spot rates rising 7% w/w to an average of $2.45/mile. Freight markets in the path of Hurricane Helene saw outbound freight volumes drop 17% w/w, while spot rates increased by $0.08/mile to $2.29/mile, $0.30/mile higher than last year.