There was good news for flatbed carriers last week following the U.S. Census Bureau release of new home construction numbers for December.

The latest report shows total residential housing starts increased 1.4% month over month to an annualized rate of just over 1.70 million from the 1.68 million-pace in November. In the flatbed-intensive single-family home sector, new starts dropped 2.25% m/m and are now down 11.4% y/y. Compared to December 2020, the U.S. housing market built 151,000 fewer single-family homes in December 2021 and 27,000 fewer than the month prior.

Future demand as measured by building permits, which are a proxy for future construction, increased 2% m/m in December, making it three months of successive gains. New construction applications are still down 7.8% y/y, but the gains in Q4 and December’s numbers are at the highest level in nine months, pointing to strong demand even as builders face labor and product supply shortages.

At the regional level, the news was mixed, beginning with the West Region where new home construction dropped 14.63% m/m. In the Southeast, where 56% of all new homes were started last month, single-family home starts dropped 8.23% m/m. In the Northeast (6%) and Midwest (17%) starts increased 11% and 51% m/m respectively, likely boosted by unseasonably mild temperatures in December, which was the warmest on record according to National Oceanic and Atmospheric Administration (NOAA).

NOTE: Spot rates reported below do not include fuel surcharges unless otherwise noted.

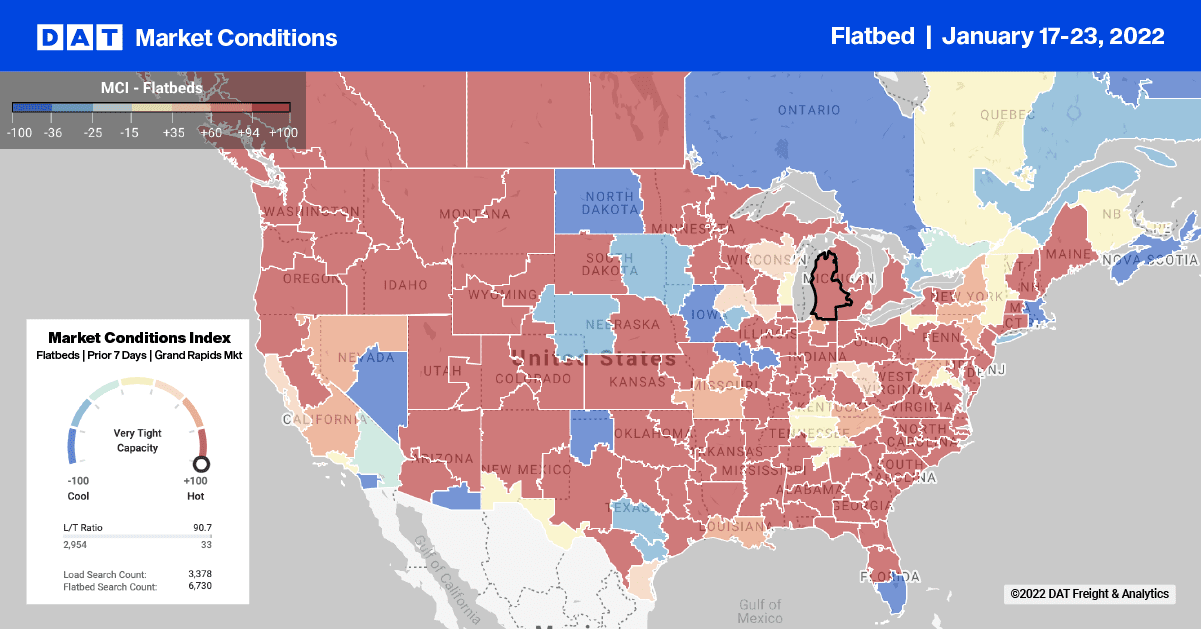

Flatbed volumes continue to decline, with national volumes down around 15% m/m. Despite the downward trend at the national level, some lumber-intensive markets including Montgomery, AL, and Tifton, GA, experienced very tight capacity last week – spot rates were up 45 cents to an average of $3.33/mile after decreasing for the three weeks prior.

In the top flatbed market of Houston, capacity eased slightly, with spot rates decreasing 3 cents to an average of $2.78/mile. Volumes were also down by 5% w/w. On the number one flatbed lane out of Houston, loads moved to Fort Worth, TX, increased by just over 2% w/w with spot rates heading in the opposite direction. After sitting around $3.20/mile for the second half of 2021, spot rates dropped to $2.71/mile last week.

Load-to-Truck Ratio (LTR)

Flatbed load posts continue to climb following last week’s 2% w/w gain. That puts flatbed volumes 87% higher than the same week last year and more than double the same period in 2018. Carrier equipment posts were down 4% w/w and are only 9% lower than the same week last year pushing up last week’s flatbed load-to-truck ratio 86.94 to 92.05.

Spot Rates

After increasing by 3 cents the week prior, the national average spot rate decreased by almost the same amount last week, falling to $2.65/mile. The national average is currently 44 cents higher compared to the same period last year and 56 cents higher than the same week in 2018 when the flatbed spot rate rally was just getting started.