Mexican President Claudia Sheinbaum recently announced a project to expand the Port of Progreso in the country’s southeastern state of Yucatan by the end of the year. It is the only container terminal in the Port of Progreso, a deep-water port on the Yucatan Peninsula in southern Mexico, linking Mexican textile and assembly operations to US markets. The port’s area is home to 10 million inhabitants, 10% of Mexico’s total population. Industry in the region is focused on maquilas (manufacturing plants that import and assemble duty-free components for export), factories, and textiles.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The port is currently a gateway to the US, Latin America, and Europe. The expansion aims to allow the 200-acre port to accommodate larger ships carrying more cargo by increasing the port’s channel to a width of more than 500 feet and a depth of 47 feet. According to APM Terminals, the port operator, transit times by sea to Houston, 580 kilometers away, would take an estimated 18 hours by sea, assuming a speed of 15 knots. Miami would roughly take the same time, creating an opportunity for truckload and dray carriers to move through higher volumes of imports from Mexico to the Gulf Coast.

Loadstar reports that in the first eight months of this year, Progreso handled 4.8 million tons of freight, an increase of 20.1% over the same period in 2023. The APM terminal, which is equipped with two mobile harbor cranes and has a capacity of 279,494 TEU, handled around 22 ships a month over the first half of the year, processing 51,171 teams, according to Beatriz Yera, MD of APM Terminals Mexico.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

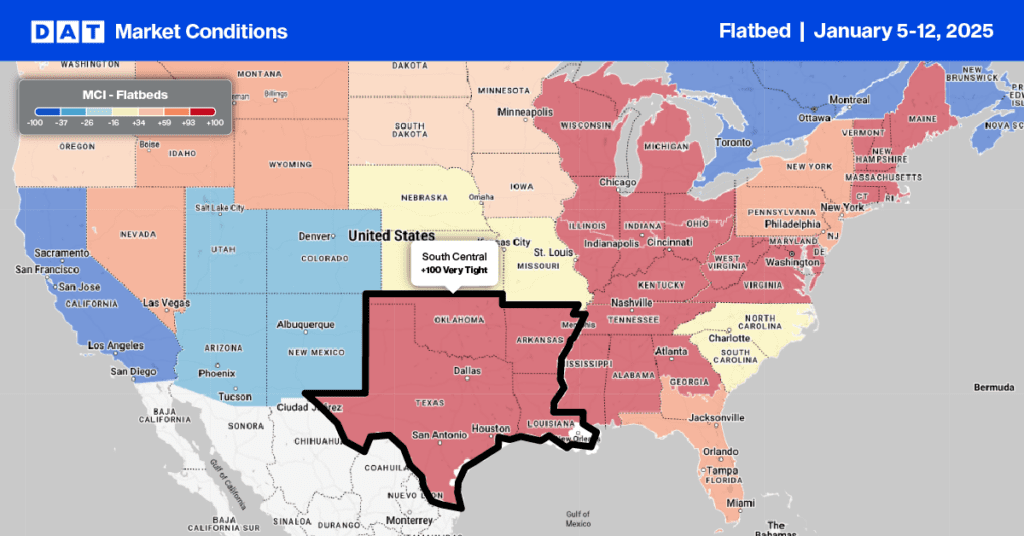

This week, we focus on the South Central Region freight market as a manufacturing powerhouse, encompassing states like Texas, Oklahoma, Arkansas, Louisiana, and parts of Missouri. The region is best known for oil and gas exploration and production, plastic, chemicals, aerospace, and structural steel, pipelines, and heavy machinery used in energy, construction, and transportation industries.

In flatbed truckload volume terms, Texas is the largest in the spot market with Houston making up almost half of weekly outbound volumes. State average rates were up $0.05/mile last week to $2.07/mile for outbound loads, while in Houston rates jumped by $0.10/mile to $2.17/mile, $0.08/mile higher than last year.

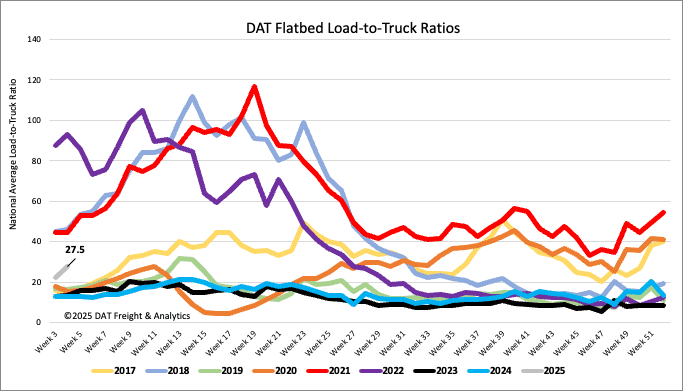

Load-to-Truck Ratio

Flatbedders found the going tough last week as outdoor loading and unloading slowed the freight network. Brokers found capacity much tighter, resulting in load post volumes 7% higher than last year, while equipment posts were around half what they were in Week 2 of 2024. As a result, last week’s flatbed load-to-truck ratio (LTR) increased by 23% to 27.5, double the same period last year.

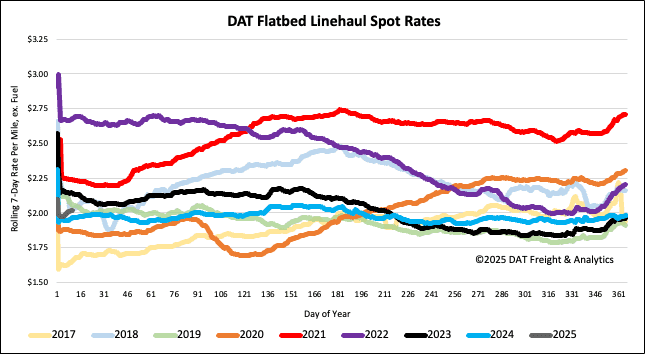

Spot rates

Flatbed accounted for most of the rate gains last week, with linehaul rates increasing by $0.05/mile to a national average of $2.04/mile. Spot rates are $0.05/mile (3%) higher than Week 2 in 2024 and identical to where they were in 2018 as that flatbed-driven rate rally got underway.