Although housing construction activity has slowed faster than most expected, the extensive construction of new commercial warehouses along our nation’s interstate highways is hard to ignore. The flatbed freight market has been surprisingly robust this year following two years driven mainly by record levels of housing construction. The contraction in the latter has been offset by construction spending boosted by government outlays for infrastructure and a surge in new factory development.

It’s no coincidence that companies like Volvo Construction Equipment (Volvo CE) increased North American sales by 37% in Q1, 2023. Volvo CE reported, “Demand in major markets outside China remained stable this Q1, with notable growth in North America, where many large infrastructure projects and strong commercial construction more than offset weakness in residential construction amid high-interest rates, except China, activity in the construction industry has continued to be good across most markets, driven primarily by ongoing infrastructure investments and by the mining industry, which benefits from continued good commodity prices.

Anecdotal data from specialized carriers support the increased activity in specialized freight related to major construction projects, mainly imported freight from Mexico. Professor Jason Miller recently noted “that in the general freight trucking, long-distance, and truckload market, we are currently witnessing the most rapid correction of prices that the sector has ever seen (data doesn’t go back to the 1980s to look at deregulation). The rate correction is far less pronounced on the specialized freight side of things. This should have interesting implications for differences in carrier exit rates across these sectors in 2023”.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

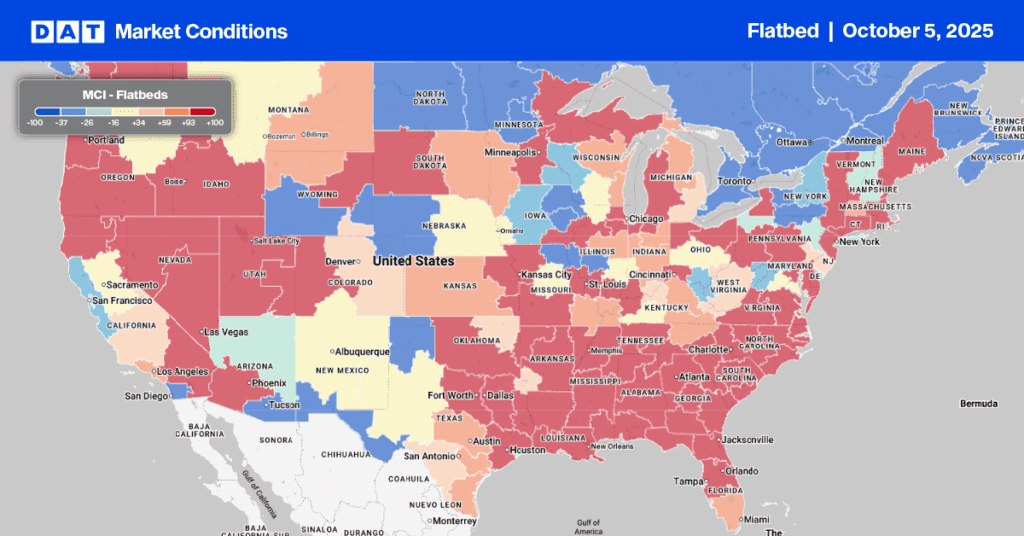

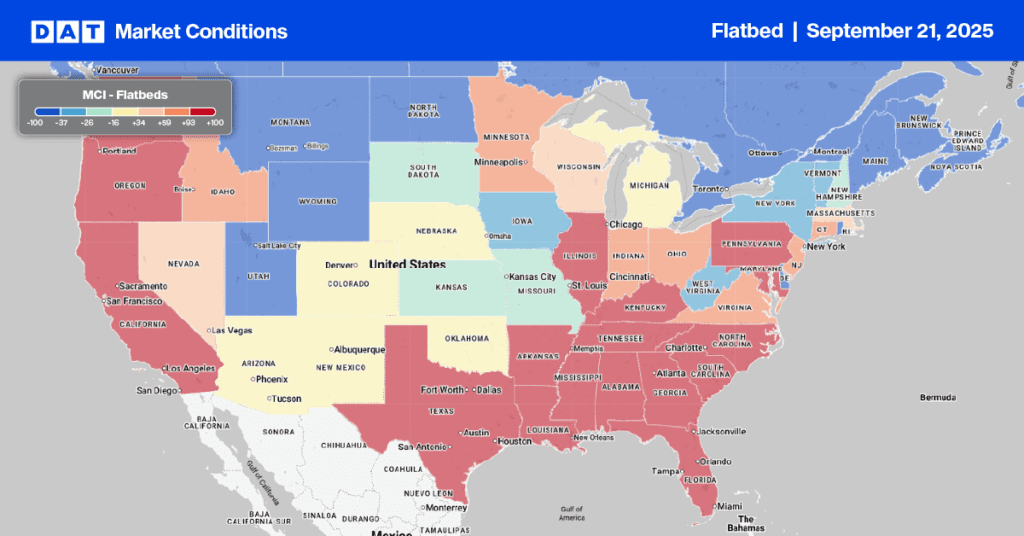

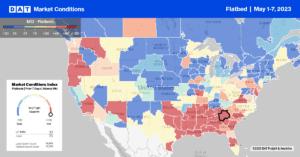

At $2.35/mile, Texas flatbed rates are around $0.02/mile higher than in 2018, as the state remains an attractive option for flatbed carriers. Solid gains were reported in Houston, where outbound rates jumped by $0.8/mile to $2.48/mile after decreasing for three weeks. Loads moved between Houston and El Paso, the highest volume lane in the state, decreased by 3% last week, with rates down slightly to $2.75/mile, almost $1.00/mile lower than the previous year. Loads north to Houston were less than 1% lower last week, with flatbed linehaul rates over $3.00/mile for the first time since last November at $3.03/mile.

Outbound capacity continues to tighten in Little Rock. Linehaul rates increased by $0.05/mile to $2.59/mile last week on a 17% lower volume, while in neighboring Memphis, capacity loosened as rates dropped by $0.09/mile to $2.64/mile on a 13% higher volume. In Flagstaff, AZ, capacity tightened for the third week following a $0.51/mile spike in linehaul rates to $2.20/mile. Outbound rates in this market have increased by $1.00/mile in the last month.

Load-to-Truck Ratio (LTR)

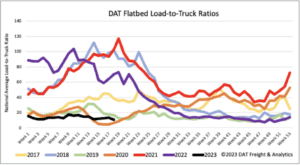

Last week’s spot market flatbed volume erased all the gains from the prior week and is now 16% lower than in 2019. Carrier equipment posts were up 8% last week but also at the highest level in seven years resulting in last week’s flatbed load-to-truck (LTR) ratio decreasing from 13.0 to 10.75, surpassed only by 2020 as the shock of the pandemic rippled through the market.

Spot Rates

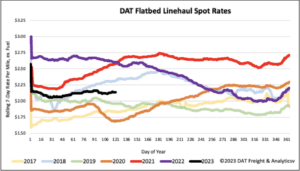

After sitting around a national average of $2.16/mile for the last four weeks, flatbed rates dropped by $0.02/mile the previous week. Linehaul rates are $0.45/mile lower than last year, $0.23/mile lower than in 2018, and $0.16/mile higher than in 2019.