Sales of farm tractors and combine harvesters continue to track closely with the 5-year average, even though last month’s volume was almost 6% lower than in September 2022. In contrast, heavy-duty four-wheel drive (4WD) crop tractor sales continued to improve, recording a 12.6% y/y and 36% year-to-date (YTD) increase.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

In Canada, tractor sales finished in positive territory in October, up 4.6%, with additional growth in the mid-range and high horsepower 2WD segments. Combines were down for the month, however, falling 16.1%.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

After dropping for the last three weeks, outbound flatbed spot rates in Houston increased by $0.01/mile last week to an average of $1.90/mile. Texas state average rates are $0.06/mile lower than in 2018. Houston to Lubbock loads paid carriers an average of $2.18/mile, the lowest in 12 months and almost $0.60/mile lower than last year. Houston to Laredo loads are 8% lower than last year, with spot rates at $1.69/mile – also the lowest in a year.

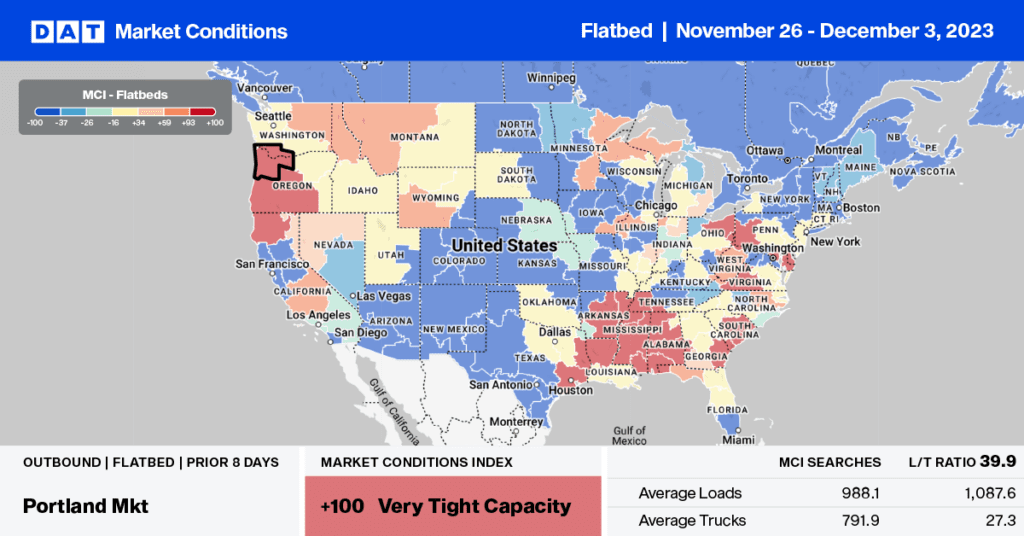

In Oregon, flatbed linehaul rates increased by $0.22/mile to $2.95/mile last week, with gains reported in the Portland market where outbound rates averaged $2.67/mile. Portland to Denver loads were the highest in 12 months, averaging $2.58/mile last week.

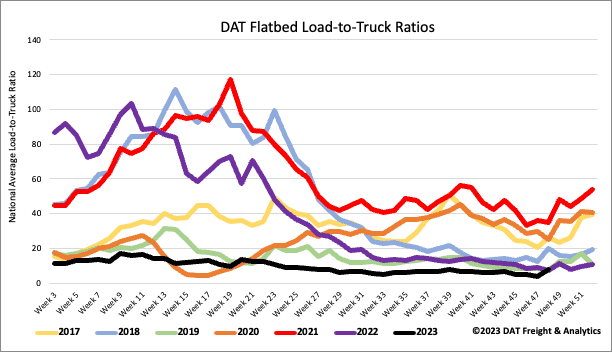

Load-to-Truck Ratio (LTR)

The volume of flatbed load posts (LP) more than doubled last week but remained 35% lower than last year and around half the weekly volume reported in 2019. Carrier equipment posts (EP) increased by 26% w/w, resulting in last week’s flatbed load-to-truck ratio (LTR) increasing to 7.73.

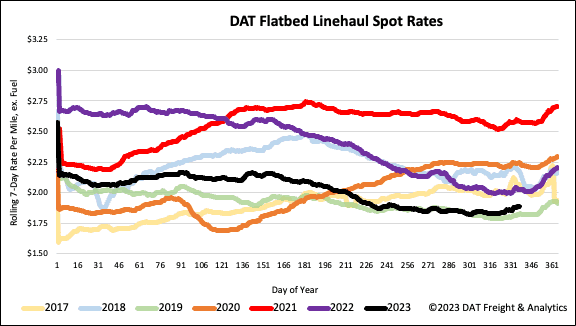

Spot Rates

At $1.91/mile, flatbed linehaul rates are the highest in two months following last week’s $0.04/mile increase. Flatbed linehaul rates are $0.14/mile lower than last year and $0.06/mile higher than in 2019. Compared to the pre-pandemic average for Week 45, last week’s national average was $0.06/mile lower and $0.29/mile lower than in 2018.