The agricultural industry relies heavily on the flatbed industry for the movement of tractors. According to the Association of Equipment Manufacturers (AEM), U.S. total farm tractor sales decreased 11.7% y/y in August and are down 14.8% YTD. The self-propelled combine harvester category grew 25.8% y/y and is up 2.7% YTD, and this segment has seen growth for the last three months. The 100+ horsepower 2WD tractor segment continues to grow and is up 11.5% y/y and 12% YTD. Mid-range tractors between 40 and 100 horsepower were down -7.2% y/y and -12.6% YTD; however, this segment had a high growth of 24% in 2021, with current volumes appearing to be normalizing. The sub-40hp tractor segment had the most considerable losses and was down -16% y/y and -17.6% YTD. In Canada, unit sales in tractors were up 7.2% with growth in all segments, the first positive month in unit sales since January 2022.

“Demand for everything other than the smallest units remains positive, but supply chain difficulties remain in the way of the supply side of the market,” said Curt Blades, senior vice president, industry sectors and product leadership at the Association of Equipment Manufacturers. “Despite concerns around input costs for farmers, we are still seeing the larger units, harvesters and heavy-duty tractors, lead sales trends, indicating positive outlooks, especially among row crop farmers.”

According to PIERS, the Tractor TEUs are up 27% y/y through August. This increase could indicate that some of the past demand is being fulfilled. The import tractor tonnage had significant growth in January, June, and July, with an increase of 40% y/y and greater. Most tractor imports arrive through Savannah, Los Angeles, Houston, Baltimore, and Norfolk ports. The Los Angeles port has seen a 58% y/y increase in tractor tonnage. Houston is up 41% y/y in tonnage, and Savannah is up 26% y/y.

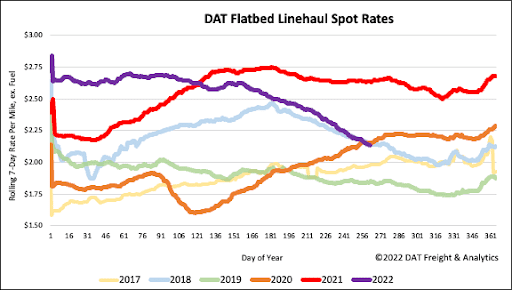

All rates cited below exclude fuel surcharges unless otherwise noted.

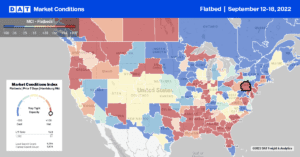

Market conditions are expected to tighten in the coming weeks in the Southeast Region, where around 56% of new single-family homes were started in July, according to the U.S. Census Bureau. Even though the number of housing starts was 23.5% lower in July than the previous year, the number of houses started but not completed has increased by 23.5% over the same timeframe. Another indicator of demand for housing in the Southeast is that single-family homes were approved but not started, which is 16.3% higher than last year, suggesting there is still plenty of activity in the housing market for flatbed carriers to consider leading into hurricane season. Regional flatbed spot rates have been relatively flat in the last month, averaging around $3.05/mile.

According to Fannie Mae, consumer sentiment is, however, not so optimistic. The Fannie Mae Home Purchase Sentiment Index® (HPSI) decreased 0.8 points in August to 62.0, its sixth consecutive monthly decline, as high home prices and elevated mortgage rates continue to weigh on consumer sentiment, particularly home-selling sentiment. Consumers reported that homebuying conditions have improved, but 73% say it’s a “bad time to buy.” Consumers are neutral about the future path of home prices for the first time since the pandemic, with an increasing share this month reporting that prices will decline.

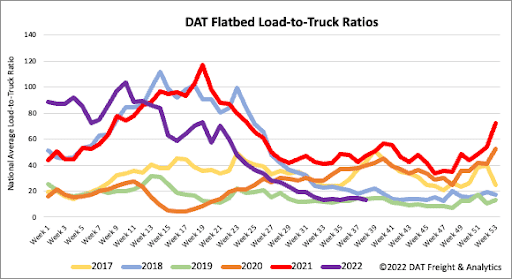

Flatbed load posts are around 60% lower compared to the previous year and 2% lower than 2018 levels, which was a good year for flatbed carriers. Load posts also increased 8% w/w from the short work week. Equipment posts are up 18% w/w and 45% y/y highlighting the softening flatbed market largely due to the housing market slowdown. As a result, the flatbed load-to-truck (LTR) ratio decreased by 8% w/w from 14.3 to 13.1.

Flatbed linehaul rates continued to fall last week to $2.13/mile, down $0.05/mile w/w. Again, highlighting the reduced demand in the flatbed market, spot rates are now $0.50/mile lower than the previous year and fell $0.01 below the 2018 rate.