Redfin’s economists expect more home sales in 2025, largely due to pent-up demand. However, some would-be homebuyers will still be priced out, with home prices climbing and mortgage rates near 7%. Rental prices, however, should stay flat while wages increase, improving affordability for renters. Politicians from both sides of the aisle have pledged to lower housing costs for working-class Americans and build more homes; we are hopeful that will happen over the next several years.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

For flatbed carriers looking for demand signals in 2025, Redfin predicts fewer construction regulations will lead to more homebuilding. Redfin expects homebuilders to construct more single-family homes in 2025, though it will take a few years for the increase in homebuilding to make buying a house significantly more affordable.

Redfin notes the Republican sweep of the White House, Senate, and House has improved builder confidence by bringing renewed optimism that regulatory burdens may ease. Builders will also bank on the fact that the mortgage-rate lock-in effect will limit the amount of existing inventory competing with new builds.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

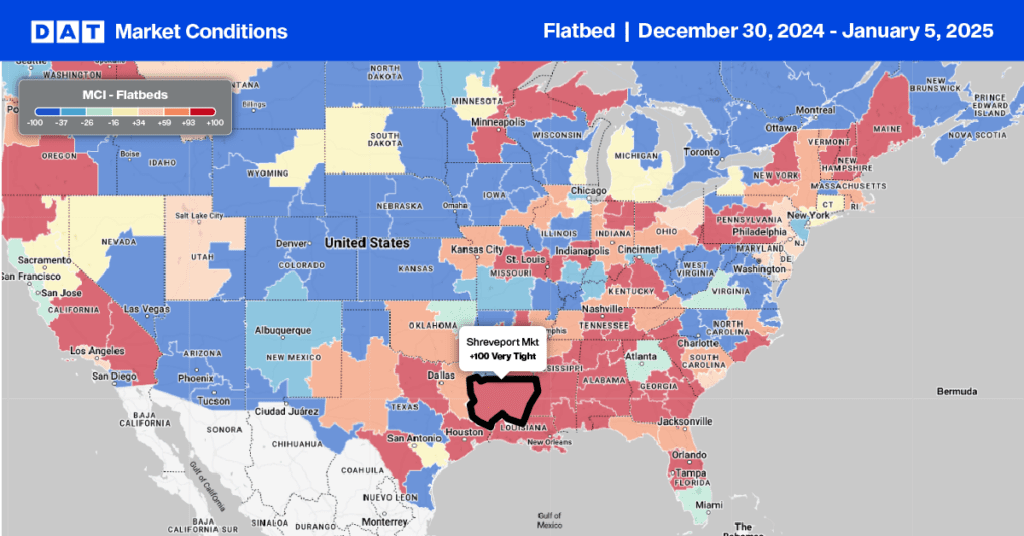

This week, we focus on the Shreveport, LA, freight market, strategically located near major transportation routes, including the I-20 corridor, railways, and the Red River, making it an attractive hub for industrial and manufacturing activities. Shreveport has a strong history in automotive manufacturing, most notably with the former General Motors (GM) plant and in more recent times, has seen growth in advanced manufacturing sectors, including aerospace, defense, and technology-driven industries.

Shreveport is not a large freight market, but makes up part of the Southeast Region, where capacity is traditionally tight. According to DATs Market Condition Index, outbound flatbed capacity is expected to remain tight over the coming week. Truckload volumes are around 60% higher than last year, while spot rates are almost 5% higher, averaging $2.69/mile.

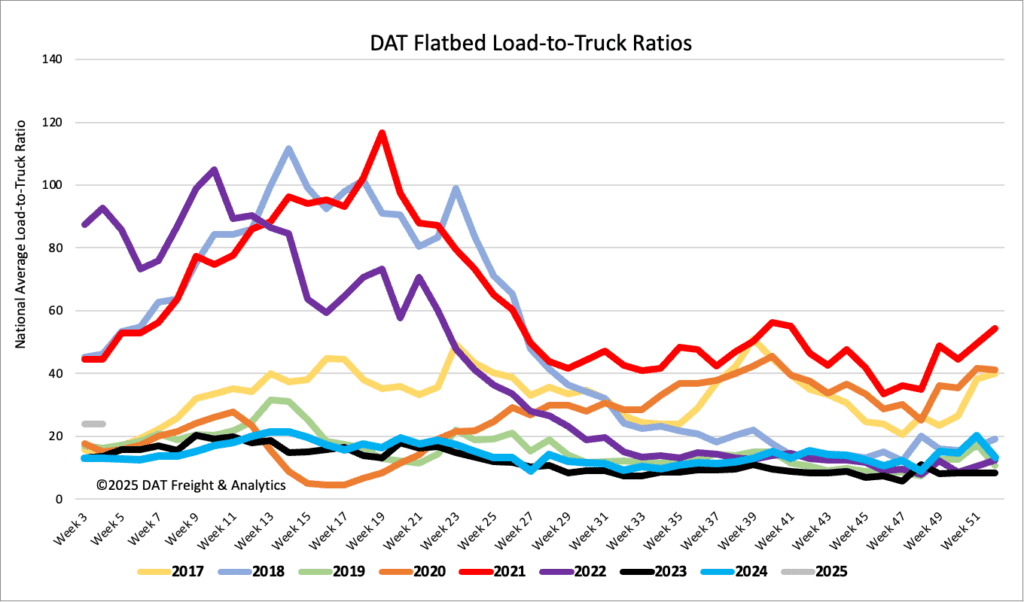

Load-to-Truck Ratio

With New Year’s Day falling on a Wednesday this year, last week was a two-day shipping week, making sequential and year-over-year comparisons ineffective. New Year’s Day fell on a Monday the prior two years, making the start of those years bigger shipping weeks. Still, flatbed load and equipment post-daily averages were consistent with Week 1 activity in prior years. As a result, last week’s flatbed load-to-truck ratio (LTR) started off 2025 at 23.96.

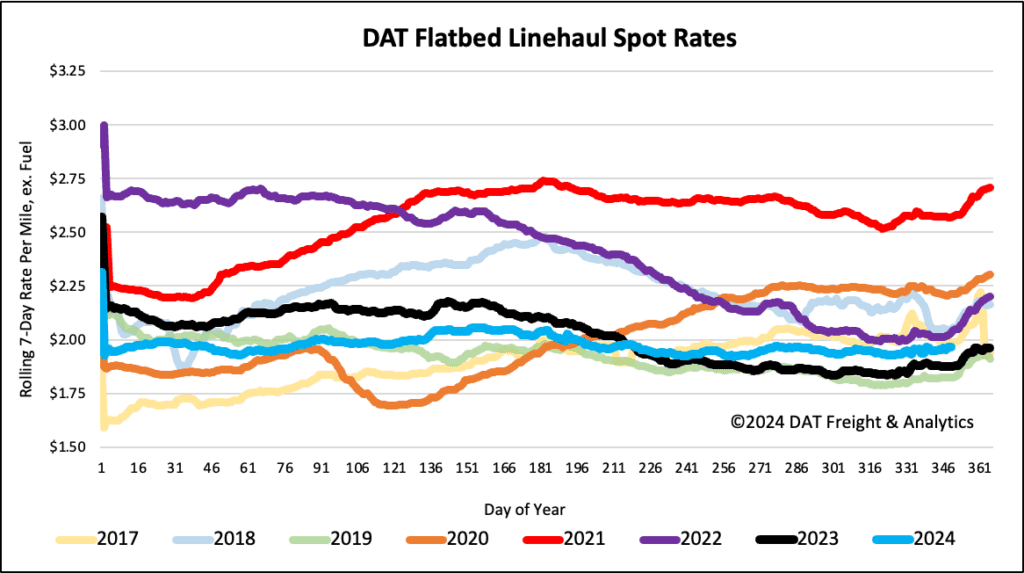

Spot rates

Last week, flatbed linehaul rates decreased by $0.01/mile to a national average of $1.98/mile. Spot rates starting in 2025 are $0.03/mile (2%) lower than Week 1in 2024 and just $0.02/mile lower than the 2024 yearly average. Compared to the Week 1 average from 2016, last week’s national average was $0.03/mile lower.