According to the National Association of Home Builders (NAHB), builder confidence dropped for the eighth month in August as the declining housing market weathered rising interest rates and ongoing supply chain disruptions. For the first time since May 2020, the NAHB/Wells Fargo Housing Market Index (HMI) dropped below 50, coming in at 49 in August. The HMI is a diffusion index, meaning any value over 50 indicates a growing market, whereas values under 50 indicate contraction.

NAHB Chairman Jerry Konter and home builder said, “Ongoing growth in construction costs and high mortgage rates continue to weaken market sentiment for single-family home builders, and in a troubling sign that consumers are now sitting on the sidelines due to higher housing costs, the August buyer traffic number in our builder survey was 32, the lowest level since April 2014.”

The latest from the Census Bureau for residential construction in July supported the lack of confidence expressed by builders in the HAHB HMI. Single-family building permits came in 4.3% lower m/m and are now down 11.5% y/y.

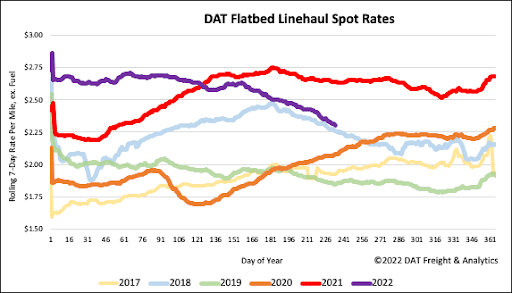

All rates cited below exclude fuel surcharges unless otherwise noted.

Higher import volumes into Houston continue to drive freight volume into the truckload market, although brokers and shippers found sufficient capacity in major lanes. On the top outbound lane to Ft. Worth, spot rates averaged $3.52/mile last week or about $0.20/mile lower than the previous month but $0.25/mile higher than the same week in 2021. The number two lane out of Houston is to El Paso – rates dropped to $3.25/mile last week, almost the same as last year but down $0.50/mile since June.

In the Midwest in Gary, IN, flatbed spot rates dropped to $2.03/mile last week for loads to Pittsburgh, the lowest in 12 months after almost double that rate just four months ago. In Baltimore, spot rates have been steadily decreasing since the March peak in machinery imports, dropping just over $1.00/mile to $2.07/mile for outbound loads to Chicago last week. Flatbed rates from Baltimore to Davenport, IA, have increased $0.30/mile to an average of $2.55/mile in the previous few weeks and dropped $0.70/mile since March.

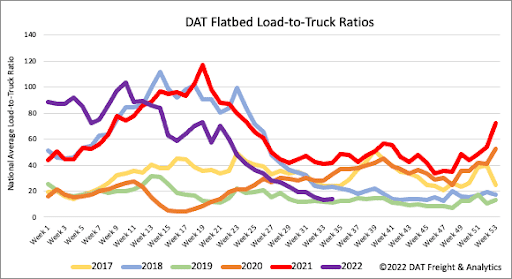

Flatbed load posts continue to track closely with 2018 levels following last week’s 2% w/w increase, the first increase in the previous five weeks. Load posts are now 52% lower than last year after dropping 25% in the previous month. Even though carrier equipment posts decreased 2% w/w, they remain at all-time high levels and 3% higher than the prior record-high in 2019. As a result, the flatbed load-to-truck (LTR) ratio increased by 4% w/w to 13.89.

For the third week in succession, flatbed linehaul rates have dropped by $0.04/mile, with the national average flatbed rate excluding fuel ending last week at $2.34/mile. That’s $0.33/mile lower y/y but still $0.05/mile than the hot 2018 flatbed market. Compared to prior non-pandemic years, it is still $0.38/mile higher. Flatbed linehaul spot rates have dropped $0.33/mile YTD, with $0.31/mile of that occurring since the end of May.