Flatbed demand remained soft in December, impacted by a cooling demand for oil and gas exploration and lower single-family housing construction. The latest data from the U.S. Census Bureau reports that single-family starts plunged in December, dropping by 8.6% compared to November. The rate of single-family home construction is still 16% higher than the prior year but 20% lower than the record-high set in December 2020. Flatbed demand for oil field freight, including drill pipe, casing, and machinery, is being impacted by 20% fewer drilling rigs last week, according to data from Baker Hughes.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The November Trucking Ton-Mile Index (TTMI), produced by Professor Jason Miller at Michigan State University, shows soft demand for truck transportation in the USA. November’s seasonally adjusted data were unchanged from October and 1% lower than November 2022. According to Professor Miller, “TTMI continues to point to weak demand for truck transportation. Given historical patterns, these data throw a big bucket (maybe a 55-gallon drum) of cold water on the bullish calls for the trucking sector to see a substantial uptick as soon as the end of Q1 2024.”

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

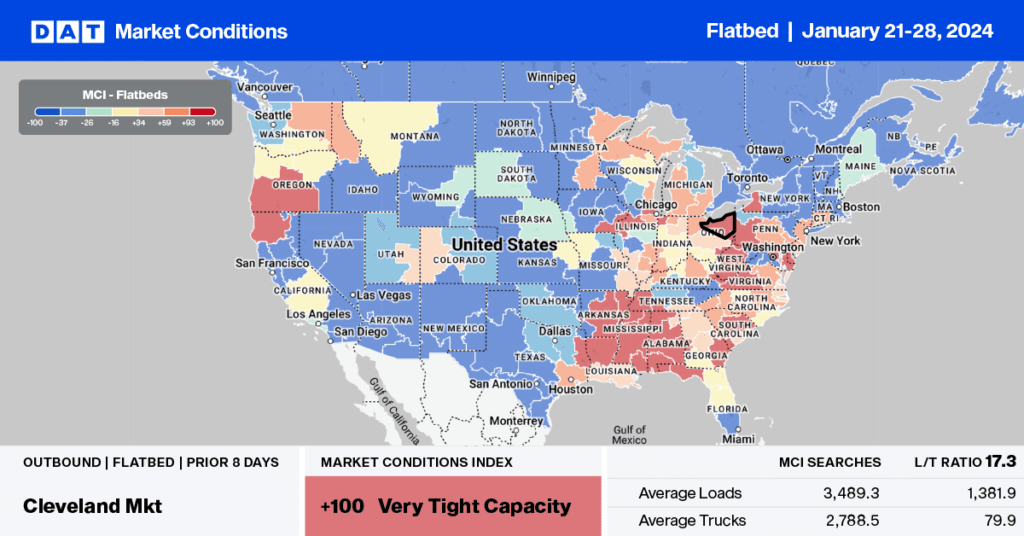

The Baltimore flatbed spot market took the number two position last week with a 3% load post market share, slightly behind Montgomery, AL. Baltimore is the number one port on the East Coast for roll-on/roll-off and breakbulk freight, and following December’s 8% m/m increase in imports, there has been a surge in flatbed volume, resulting in spot rates climbing by $0.14/mile to $2.40/mile in the last two weeks. At $2.54/mile, outbound state average Maryland rates are the second best in seven years.

After dropping for most of January, Texas outbound linehaul rates improved last week, increasing by $0.03/mile to $1.92/mile, while in Alabama, rates increased for the fourth week following last week’s $0.10/mile increase to $2.36/mile. The Montgomery freight market, the top spot market in the nation last week, reported tight capacity, with outbound rates increasing by $0.14/mile to $2.51/mile.

Flatbed capacity was noticeably tighter in Arkansas last week, with spot rates jumping by $0.21/mile to $2.22/mile for outbound loads. In the larger Little Rock market, spot rates are 10% higher y/y, while loads moved are 27% lower.

Load-to-Truck Ratio (LTR)

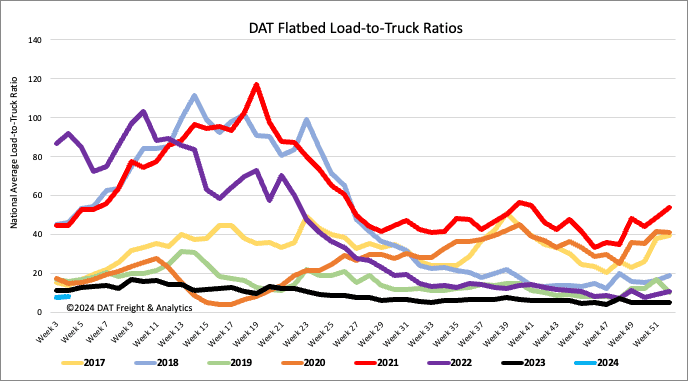

Spot market flatbed load post (LP) volumes were flat last week, remaining close to 50% lower than last year and in 2020. Carrier equipment posts (EP) were also unchanged, resulting in last week’s load-to-truck ratio remaining 8.11.

Spot rates

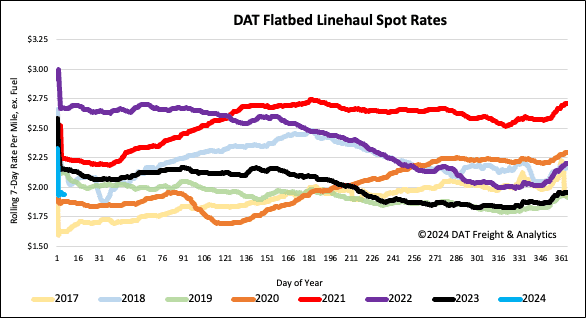

Flatbed spot rates remained over $2.00/mile for the second week following last week’s $0.02/mile increase. At $2.02/mile, linehaul rates are $0.07/mile lower than last year but $0.15/mile higher than in 2020 as the market continued to shed capacity.