Demand in the flatbed market relies on the housing market for the transportation of construction materials. The recent interest rate hikes have slowed down the housing market in recent months; however, in August, we saw an uptick in the new housing starts. In August, single-family housing starts, which account for the largest share of homebuilding, increased 3.4% m/m to 935,000 units, after a steady decline since March. However, single-family housing starts are down 14.6% y/y. Single-family housing starts in the Midwest had the most significant m/m increase at 20.8%. However, the southern region still carries the largest volume of single-family housing starts and is up 2.1% m/m. Housing starts for housing with five units or more expanded by 28.6% to 621,000 units, and this is the highest amount of monthly multi-unit starts since 1986, which also was in a time of high inflation.

“Single-family production is running at a weakened pace due to elevated mortgage rates and high construction costs that have led to a major slowing of the housing market and exacerbated housing affordability,” said Jerry Konter, chairman of the National Association of Home Builders (NAHB).

Builder confidence remains low, according to the latest National Association of Home Builders (NAHB)/Wells Fargo Housing Market Index (HMI). The builders’ survey for newly-built single-family homes fell three points in September to 46. In addition, all three HMI categories declined, the current sales conditions dropped three points to 54, sales expectations in the next six months declined one point to 46, and traffic of prospective buyers fell one point to 31.

“Builder sentiment has declined every month in 2022, and the housing recession shows no signs of abating as builders continue to grapple with elevated construction costs and an aggressive monetary policy from the Federal Reserve that helped pushed mortgage rates above 6% last week, the highest level since 2008,” said NAHB Chief Economist Robert Dietz. “In this soft market, more than half of the builders in our survey reported using incentives to bolster sales, including mortgage rate buydowns, free amenities, and price reductions.”

All rates cited below exclude fuel surcharges unless otherwise noted.

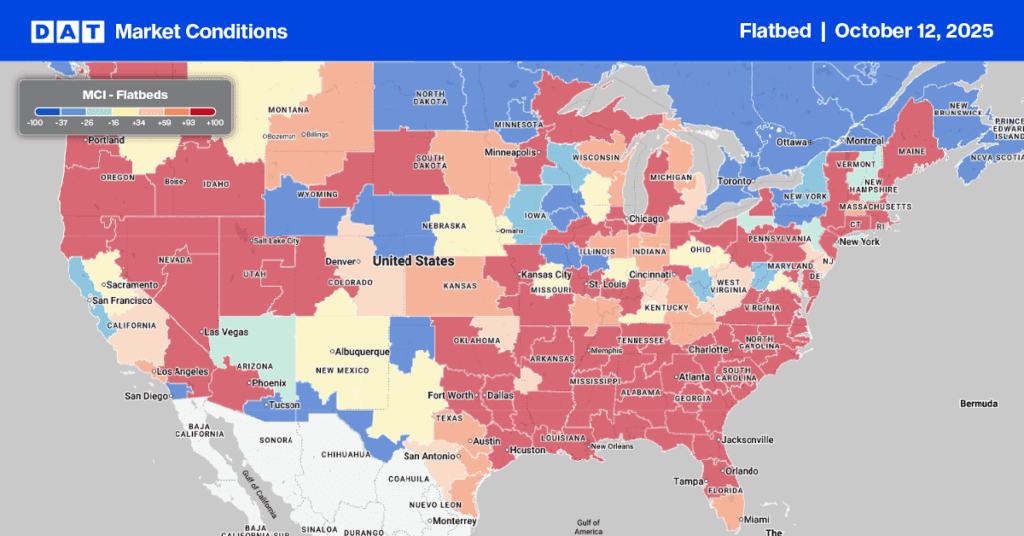

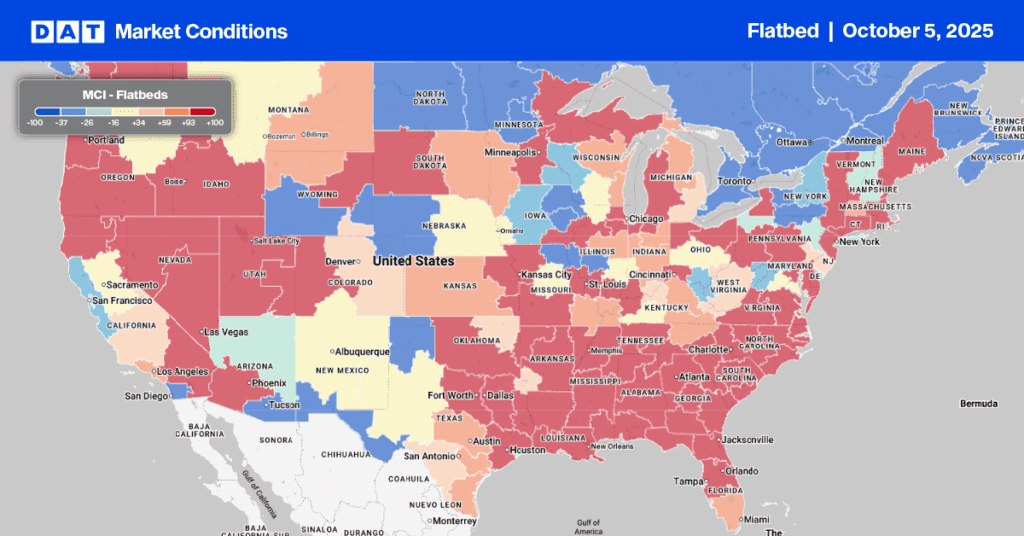

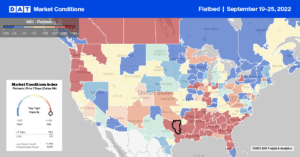

In Houston’s number one flatbed market, outbound capacity continued to loosen for the fourth week following last week’s $0.03/mile decrease to $2.57/mile. The volume of loads being moved between Houston and Ft. Worth increased by just over 13% last week, insufficient to reverse the downward trend in spot rates at $3.42/mile the previous week. That’s $0.54/mile lower than the peak in May this year but $0.20/mile higher than the last year. On the number two outbound lane to El Paso from Houston, loads moved were up 9% w/w with rates following a similar three-month trend down to $2.95/mile last week.

In the two largest outbound flatbed markets in the Pacific Northwest, load posts surged in Medford and Portland markets, almost doubling last week. Capacity was very tight in Medford, where spot rates increased by $0.13/mile to $2.86/mile, while in the much larger Portland market, capacity loosened as spot rates dropped by $0.10/mile to $2.38/mile. Outbound flatbed capacity was tight in Florida last week ahead of this week’s much-anticipated arrival of Hurricane Ian, the first major hurricane in that state since 2018. Outbound spot rates were up 6% last week to an average of $1.91/mile.

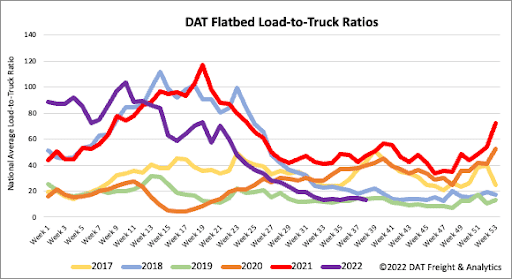

The flatbed load-to-truck ratio continues to track seasonally with pre-pandemic years with the exception of 2017 (yellow line) when Category 5 hurricanes Irma and Maria made landfall in September, such is the impact of hurricane season on the flatbed market. Load posts are around 64% lower compared to the previous year and even 10% lower than 2018 levels, which was a great year for flatbed carriers. Flatbed equipment posts were flat last week and along with 4% fewer load posts, the load-to-truck (LTR) ratio decreased by 4% w/w from 13.05 to 12.57.

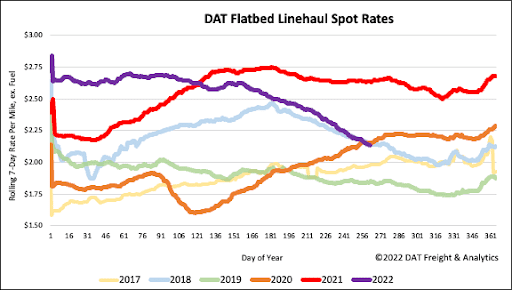

After dropping by $0.49/mile since the start of the year and $0.47/mile since the beginning of June, flatbed linehaul spot rates flattened out last week, remaining unchanged at $2.18/mile. Compared to the previous year, spot rates are $0.52/mile lower and just $0.01 lower than in 2018.