Logistics metrics such as transportation, warehousing, and Inventory are leading economic indicators and can point toward potential movements in the overall economy. As we look for signals the freight economy is improving, the monthly Logistics Managers Index (LMI) gives us an insight into what to expect. The LMI surveys logistics professionals who are CSCMP members working at the director level or above, generating macro-level information on Inventory, warehouse, and transportation trends.

According to Zac Rogers, an assistant professor of operations and supply chain management at Colorado State University and co-author of the LMI, “We continue to see very different outcomes for the overall economy and the logistics industry. This dichotomy is most clearly seen in employment figures. While 209,000 workers were added in June, 14,000 freight and parcel carriers were cut, and 6,900 warehousing and storage jobs were lost. In the past, we expect to see transportation and warehousing ramping up hiring in late summer ahead of peak season. However, analysts do not see the same “urgency” toward hiring in the logistics industry this year.”

The July LMI recorded a new all-time low at 45.4 (-0.2). The overall index has only contracted three times in its nearly seven-year history; all of those contractions have occurred in the last three months. The overall score is down 15.2 points from a year ago and 29.1 points from July 2021. Rogers explained this is driven by continued weakness in transportation and softening in the warehousing metrics that were stalwarts throughout 2021. Inventory Levels are down (-1.0) to 41.9, the steepest rate of contraction in the index’s history. Decreasing inventories have led to slowing growth rates for both Warehousing Utilization and Warehousing Prices, with Warehousing Capacity increasing. The growth rate for Transportation Capacity is slowing while Transportation Prices are declining at their slowest pace since April.

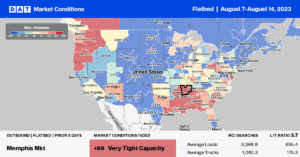

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

At $2.40/mile, outbound flatbed rates in Michigan are very close to 2019, following last week’s $0.22/mile increase. Flatbed rates surged last week in the larger Grand Rapids market, increasing by $0.86/mile to an average of $3.23/mile. Short-haul loads east to Detroit were $23/load higher last week, averaging $743/load, while loads to nearby Ft. Wayne, IN, were flat at $655/load. Loads to Gary, IN, were the lowest in 12 months, averaging $596/load last week.

Flatbed capacity tightened in the Pacific Northwest last week, with solid gains reported in Portland, where rates increased $0.12/mile to an outbound average of $2.36/mile. At $2.65/mile, state-level rates in Oregon are almost the same as in 2018. Portland to Stockton, CA, loads paid carriers $2.39/mile, while Denver loads averaged $2.18/mile, which is $0.08/mile higher than in 2022.

In the Midwest, in the Indianapolis market, flatbed rates increased $0.09/mile last week to $2.66/mile for outbound loads, while next door in Ft. Wayne, rates jumped $0.21/mile last week to an average of $2.74/mile.

Load-to-Truck Ratio (LTR)

Flatbed spot market volumes have dropped 31% in the last month following last week’s 16% decrease, the lowest recorded for Week 32 since 2016. Load posts are 61% lower than in 2022, almost half what they were in 2019. Carrier equipment posts were primarily flat last week, resulting in the flatbed load-to-truck ratio (LTR) increasing slightly from 6.77 to 5.63. In the previous six years, the only other time the flatbed LTR was below 6.0 was during the early days of the pandemic in 2020.

Spot Rates

Flatbed linehaul spot rates have dropped $0.25/mile – or 11% – since Mother’s Day following last week’s $0.05/mile decrease. At $1.95/mile, the national average flatbed spot rate is under $2.00/mile for the first time this year and $0.39/mile lower than in 2022. Compared to 2019, flatbed spot rates are only $0.06/mile higher.