U.S. sales of agricultural tractors decreased by 19.2% in September 2024 compared to the previous year, according to new data from the Association of Equipment Manufacturers (AEM). Combine sales also declined during the month, showing a drop of 40.7% compared to 2023. Larger broad-acre 4WD farm tractors were 15% lower month-over-month (m/m), while the high-volume less than 40 horsepower segment reported a 21% m/m decline.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

“September’s agricultural tractors and combines sales follow a summer that experienced a cyclical slowdown,” said AEM Senior Vice President Curt Blades. “These declines indicate overall softness in the agricultural economy.” Similarly, Canadian sales of agricultural tractors also fell in September 2024, finishing 24.9% lower than in 2023, while combine sales dropped significantly by 51.9% compared to the previous year.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

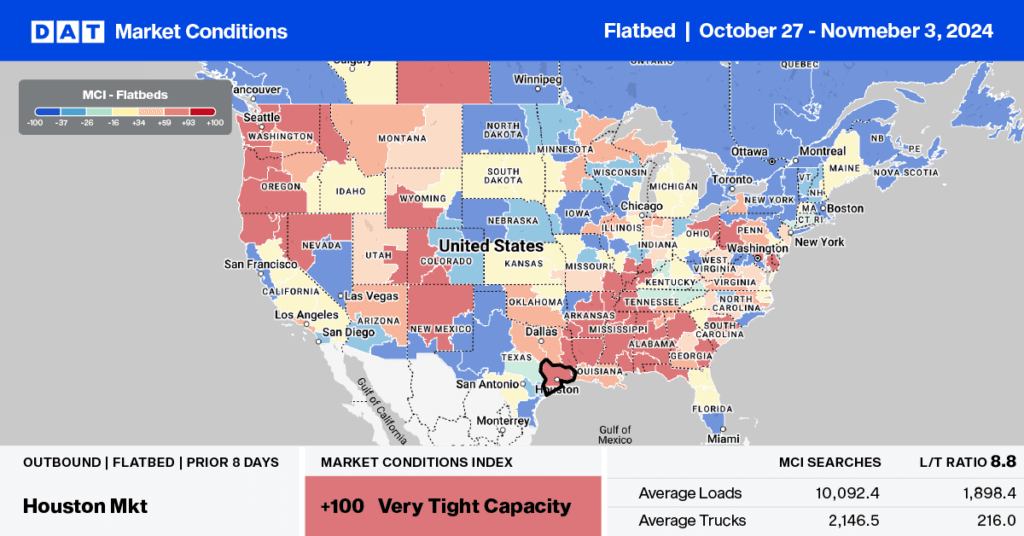

This week, we focus on the El Paso, TX, freight market and a significant trucking border crossing between the United States and Mexico. It’s strategically located along the U.S.-Mexico border, across from Ciudad Juárez in Mexico. Ciudad Juárez is a vital gateway for cross-border trade and manufacturing hub, with numerous factories relying on trucking to move raw materials from the U.S. to Mexico and finished products for distribution. El Paso is also connected to major interstate highways like I-10, facilitating freight movement to other U.S. cities such as Houston, Dallas, and Los Angeles.

On the inbound freight lane from Houston, loads moved are currently 22% higher year-over-year (y/y), with linehaul rates averaging 7% higher at $2.40/mile. Houston to El Paso is typically tied for the busiest flatbed lane, with Houston to Lubbock, TX, in the Permian Basin in West Texas, accounting for around 15% of weekly truckload volume.

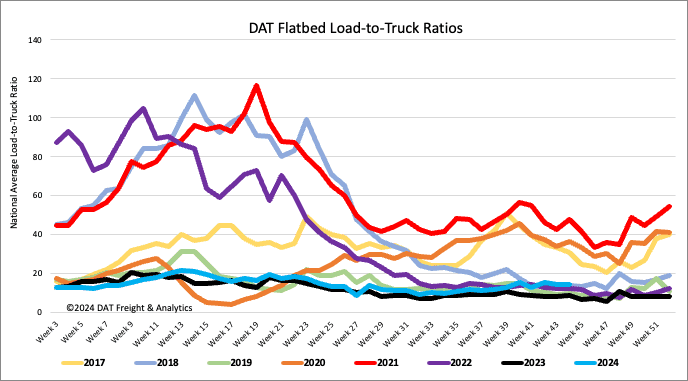

Load-to-Truck Ratio

Last week, national flatbed load postings fell by another 8%. However, these postings are still 9% higher than they were last month and up 24% compared to last year. Meanwhile, the number of truck postings from carriers decreased by 9% week-over-week. As a result, the flatbed load-to-truck ratio remained mostly unchanged at 14.34.

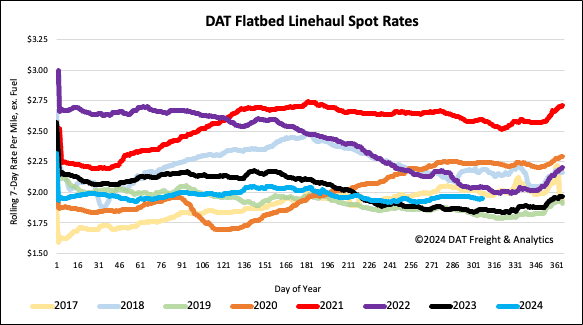

Spot rates

Last week, flatbed linehaul rates held steady at a national average of $1.97/mile despite a 2% decrease in the volume of loads moved. Currently, spot rates are $0.09/mile higher than they were last year, although they are slightly more than $0.01/mile lower than the three-month trailing average. When compared to 2017, the spot rates for Week 44 are $0.05/mile lower.