In the flatbed and RGN (removable gooseneck) market, distinct orange colored Doosan machinery appear to be gaining market share in the construction machinery space, at least measured by the volume of truckload machinery moves on our highways. Doosan is the oldest running company in South Korea and was ranked as one of the world’s top 10 largest heavy equipment manufacturers in 2018. It is the parent company of Bobcat and Škoda Power and was acquired by HD Hyundai (former Hyundai Heavy Industries Group) in 2021.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

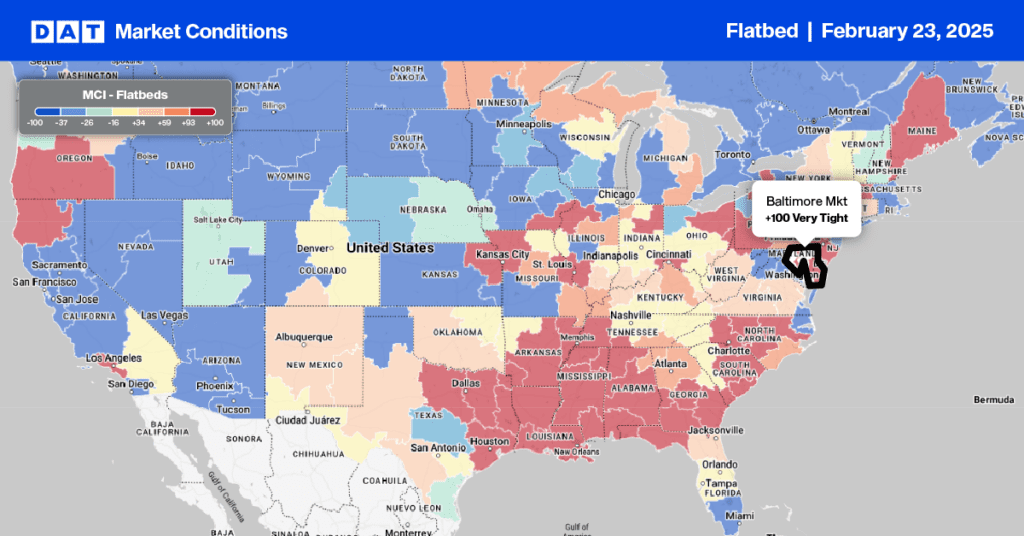

As a significant importer of machinery into the U.S., you’re most likely to see Doosan machinery arrive in the Ports of Savannah (57%) and Tacoma (20%), while the majority of all machinery imported brands will land in Baltimore. According to import data from S&P Platts, imported machinery shipments were down 23% last year after being mostly flat for the two years prior. Baltimore handled almost a quarter of machinery imports last year, followed by Tacoma (11%), Galveston (10%), Brunswick (8%), and New York (7%).

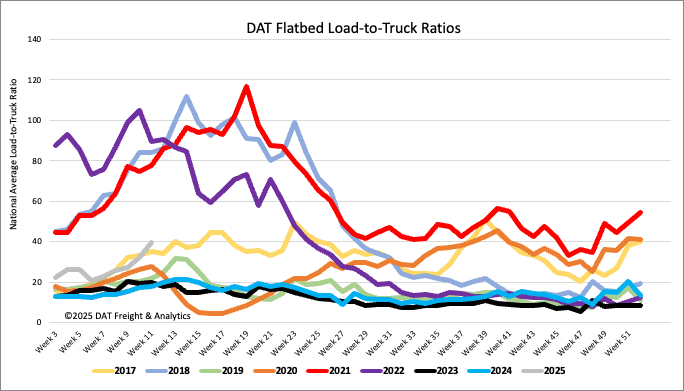

Load-to-Truck Ratio

Flatbed load post volumes increased for the sixth week following last week’s 14% gain. Volumes are 41% higher than last year and just 4% lower than the long-term average for Week 9, excluding the pandemic-impacted years. Last week’s flatbed load-to-truck ratio (LTR) ended at 39.40.

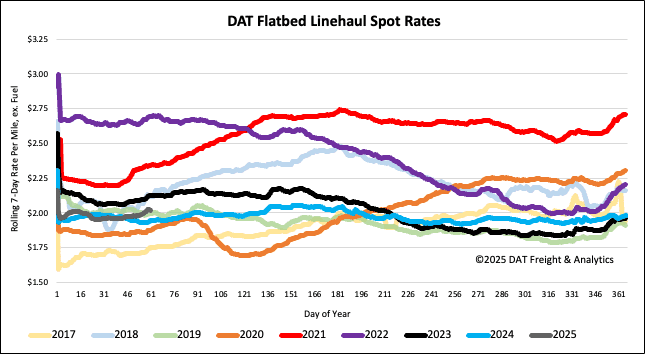

Spot rates

Last week’s national average flatbed rate recorded its best weekly gain this year, up almost $0.03/mile to just over $2.04/mile. Compared to last year, the current 7-day rolling average is $0.07/mile or 4% higher, $0.10/mile lower than 2018 and $0.02/mile higher than 2019.