Last week’s release of the U.S. Bank National Shipments Index reported contracted a 4.6% decline during the final quarter of 2022. That drop is the most significant sequential decline since the first quarter of 2021 after decreasing for the last five quarters. Compared to the final quarter of 2021, the index contracted 7.1%, the most significant year-over-year decrease since the third quarter of 2020 when the economy was in the depths of the pandemic.

U.S. Bank report that in addition to less household spending on goods, a significant decline in housing activity, both in terms of new home construction and existing home sales, and slowing manufacturing activity also impacted truckload freight volumes. Of the five regions tracked by U.S. Bank, only shipments in the Southwest region increased by 0.4% sequentially during the year’s final quarter, which was the region’s third straight quarterly improvement. The national index decline was led by a double-digit drop in the West Region, which dropped 10.6% from the third quarter due to primarily decreased import volumes.

Compared to the final quarter of 2021, only the Southwest region posted higher freight volumes than the previous year due to higher cross-border activity and import volumes from Asia. Freight shipments in the Midwest dropped 6.6% y/y, while the Northeast (11.1%) saw the largest decrease from the final quarter of 2021.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

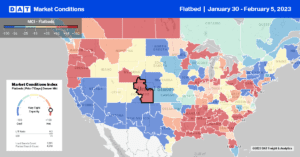

In Montgomery, AL, one of the largest flatbed spot markets in the Southeast, load posts increased by 22% last week, pushing spot rates up by $0.04/mile to $2.56/mile for outbound loads. Loads on the high-volume lane 470 miles to Lakeland, FL, at $2.72/mile, were $0.05/mile higher than the January average. The Southeast is rich in lumber and steel production, reporting steel production tonnage up for the second week following last week’s 1.5% gain, although regional volumes remain down by 3.6% y/y.

In the largest steel production flatbed spot market in Gary, IN, load posts were up by 30% w/w following last week’s 1% w/w increase in steel output. Outbound spot rates from Gary remained flat, though at $2.69/mile the previous week. In nearby Chicago, flatbed rates increased by $0.13/mile last week to $2.73/mile following a 17% w/w increase in load posts. On the high-volume west to Kansas City, MO, loads were paying $3.06/mile, the highest since October and within $0.05/mile of the previous year.

In the Pacific Northwest, Oregon state-level rates are identical to 2018 at $1.79/mile after dropping by $0.04/mile last week. In Medford, flatbed capacity tightened for the third week following last week’s $0.08/mile increase to $2.53/mile. Loads 450 miles north to Seattle were at their highest in six months at $3.26/mile and $0.09/mile higher than the previous year, while loads south to Los Angeles at $2.10/mile were the lowest in 12 months.

Load-to-Truck Ratio (LTR)

Flatbed load posts increased for the second week following last week’s 6% w/w gain. Volumes are still 77% lower than the previous year and around half what they were in 2018, underscoring how slow demand is in this sector. Although carrier equipment posts remained at their highest level in seven years, they did improve slightly last week, decreasing by 8% w/w. Last week, more load and fewer equipment posts resulted in the load-to-truck (LTR) ratio increasing from 11.35 to 13.04.

Spot Rates

The flatbed sector was the only equipment type to post a gain last week, with the national average linehaul rate increasing by almost a penny per mile. After dropping around $0.50/mile in the second half of last year, the rate of decline in flatbed spot rates has slowed considerably down to just 3% YTD. Last week’s $2.09/mile national average was $0.17/mile higher than in 2018, although spot rates are still around $0.60/mile lower than the previous year.