Structurally deficient bridges adversely impact all carriers but none more so than flatbed carriers; load securement is critical for flatbeds. “The good news is that states are beginning to employ these new resources to address long-overdue bridge needs,” American Road & Transportation Builders Association (ARTBA) President & CEO Dave Bauer said. As the end of FY 2023 approaches (September 30), states have committed $3.2 billion, or 30% of available bridge formula funds, to 2,060 different bridge projects, with $7.4 billion still to come. That translates into a lot of flatbed freight still to be hauled resulting from the 2021 federal Infrastructure Investment and Jobs Act’s (IIJA) $10.6 billion allocated to bridge repair, with another $15.9 billion available in the next three years.

Eight states committed more than two-thirds of their available bridge formula funds: Idaho (100%), Georgia (100%), Alabama (97%), Arizona (88%), Indiana (81.5%), Florida (80%), Texas (78%), and Arkansas (68%).

The recently released ARTBA analysis of the U.S. Department of Transportation (U.S. DOT) 2023 National Bridge Inventory (NBI) database reported that 36% of U.S. bridges need repair, including 76,600 that should be replaced. ARTBA Chief Economist Dr. Alison Premo Black states, “ If placed end-to-end, these bridges would stretch over 6,100 miles and take over 110 hours to cross at an average speed of 55 miles per hour.”

Among other findings in ARTBA’s analysis, the number of bridges in poor condition declined by 560 compared to 2022. However, it would take 75 years to repair them all at the current pace, so while the recent investment is excellent news for our highways, much more needs to be done to stay ahead of the growing number of bridges needing urgent repair.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

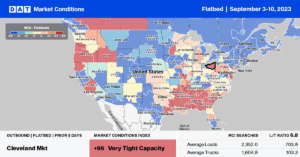

Flatbed capacity was incredibly tight in the Rocky Mountains Region last week, where spot rates in Colorado, Nevada, and Utah jumped by $0.35/mile to average outbound rates of $2.11/mile. Outbound loads in Nevada paid carriers $2.70/mile, with solid gains reported in Reno, where linehaul rates averaged $2.37/mile. In the Las Vegas flatbed market, spot rates averaged $2.67/mile, up $0.14/mile w/w.

After dropping for the prior four weeks, outbound spot rates in Gary, IN, the largest steel production market in the U.S., increased by $0.05/mile to $2.36/mile last week. Next door in Chicago, spot rates were up $0.01/mile to an average of $2.45/mile, while in Joliet, linehaul rates jumped $0.24/mile to $2.56/mile.

Load-to-Truck Ratio (LTR)

Following last week’s 6% w/w decrease, flatbed spot market load post (LP) volume continues to track at around half what it was a year ago. Carrier equipment posts were down by just over 16% w/w, increasing the flatbed load-to-truck ratio (LTR) from 6.32 to 7.06.

Spot Rates

Following the surge in spot rates the week prior, flatbed linehaul rates lost some of their ground last week, decreasing by just over $0.01/mile. At $1.93/mile, the flatbed national average was $0.27/mile lower than last year and only $0.05/mile higher than in 2019.