Memphis is known as the “Supply Chain Capital of the World” and “America’s Distribution Center,” a strategically centered transportation hub intersected by Interstates 40 and 55, the Mississippi River, and the convergence of east–west rail routes with north–south routes. Memphis is primarily an outbound distribution freight market for truckload carriers, with 20% more outbound spot loads than unbound loads.

Ted Townsend, president & CEO of the Greater Memphis Chamber, said, “Memphis is the global logistics leader because of the four ‘Rs’: runway, river, road, and rail. We have the busiest cargo airport in the U.S. and second busiest in the world, the third busiest trucking corridor, five Class I railroads, and the fifth largest inland port in the U.S. We are always open, always moving, 24/7, 365 days a year.”

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Memphis is the fifth largest spot market for flatbed carriers with a 2% market share but is expected to grow with the recent announcement of a new electrical steel line at U.S. Steel’s Big River Steel facility in Osceola, Arkansas. The new line is the length of nearly eight football fields at approximately 2,333 feet long and with a 200,000-ton annual capacity. For flatbed carriers, that’s the equivalent of almost 7,000 truckloads annually or 128 weekly.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

The latest data from Baker Hughes reports active domestic oil drilling rigs are down by nearly 30% from four years ago and 20% compared to a year ago. Even though U.S. oil production has been holding at or near record highs since last October, fewer drilling rigs have resulted in lower demand for flatbed loads to oil fields, including the Permian Basin in West Texas. Around half of all drilling rigs are located in the Permian Basin, typically resulting in flatbed solid demand on the Houston to Lubbock lane.

Flatbed volume on this lane is around 2% lower year-over-year (y/y), but with ample available capacity in the Texas market, rates have steadily declined over the last year, averaging $2.33/mile last week, $0.40/mile lower than last year.

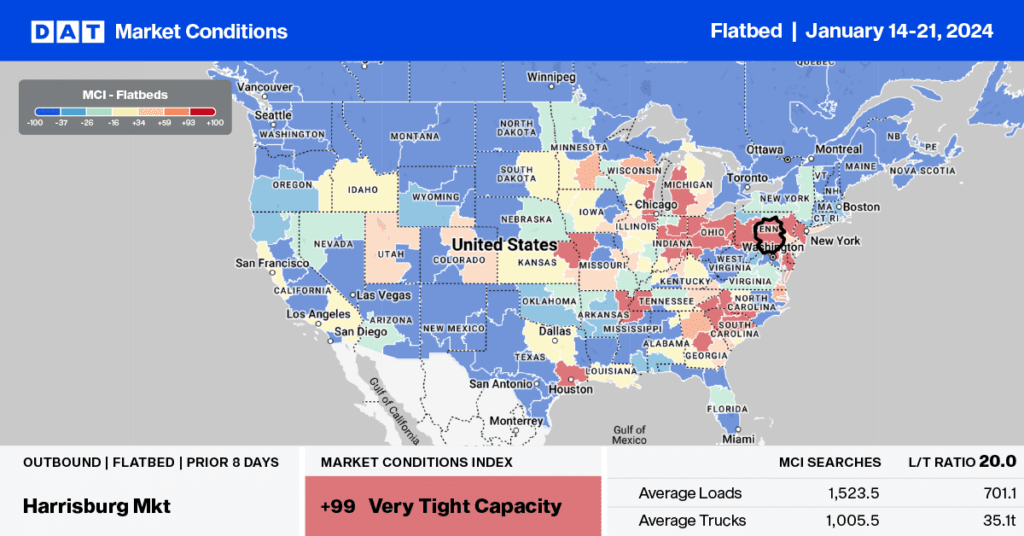

Last week’s cold weather had the most negligible impact on the flatbed market, where linehaul rates increased by $0.13/mile to an average of $2.54/mile across the Midwest Region. Nationally, flatbed spot rates increased by just under 1% last week while the volume of loads moved plunged by 26%. In DAT’s largest flatbed market in Houston, rates increased by 2% while the load volume dropped 33% last week.

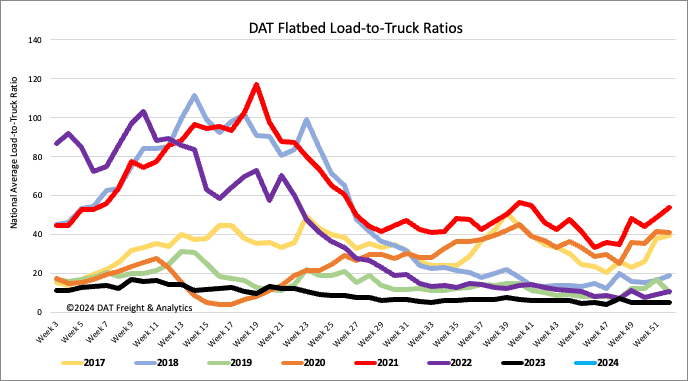

Load-to-Truck Ratio (LTR)

The volume of flatbed load posts (LP) increased slightly last week by 2%, while carrier equipment posts (EP) decreased by 3% w/w, resulting in last week’s load-to-truck ratio mainly remaining flat at 8.37.

Spot rates

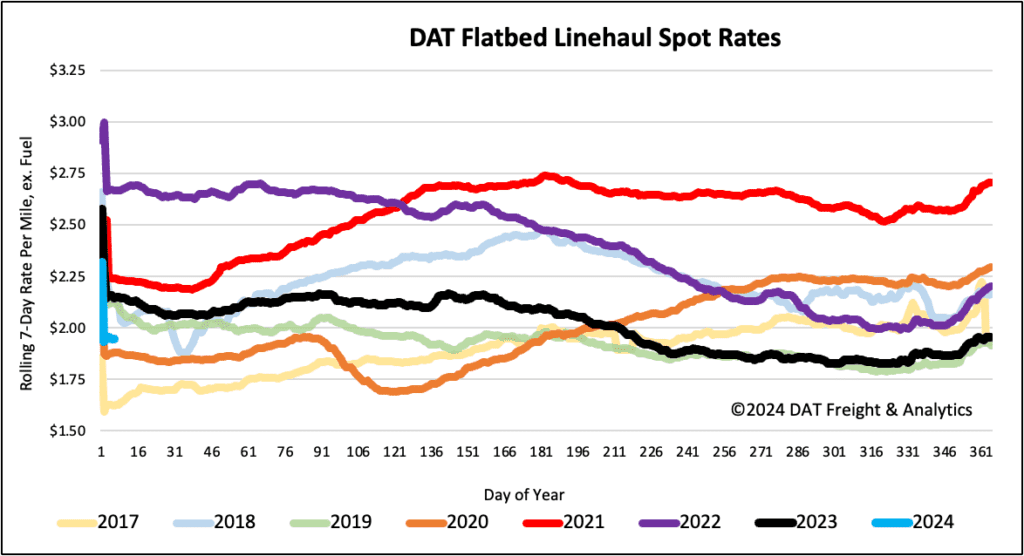

Even though flatbed demand is typically soft during the colder months, last week’s cold temperatures did tighten available capacity. Linehaul rates increased by just over a penny per mile to a national average of $2.00/mile. Compared to prior years, last week’s flatbed spot rates were $0.12/mile lower than last year but $0.12/mile higher than 2020 as the market continued to shed capacity.