For the week ending on March 11, 2023, domestic steel mills made 1,677,000 net tons representing a decrease of 2% y/y or 60,000 tons or the equivalent of 2,400 fewer flatbed truckload equivalents. The capability utilization rate was 75%, down from 78.7% the previous year. The current week’s production represents a 1.9% decrease from the same period in the previous year. Production for the week ending was up 0.8% from the previous week when production was 1,664,000 net tons, and the capability utilization rate was 74.4%.

Regionally, steel production rose by 14,000 tons in the Great Lakes last week, after rising by 13,000 tons a week earlier, according to data from S&P Platts and the American Iron and Steel Institute. Steel mills in this region, which account for around 31% of the weekly tonnage, are clustered mainly along the south shore of Lake Michigan in Northwest Indiana in the Gary, IN, flatbed market. Steel production in the southern region, which accounts for around 43% of weekly production, encompasses many mini-mills and produced 704,000 tons during the week of March 11th, down from 717,000 tons the previous week and 47,000 fewer tons than the previous year or 1,570 fewer truckload equivalents.

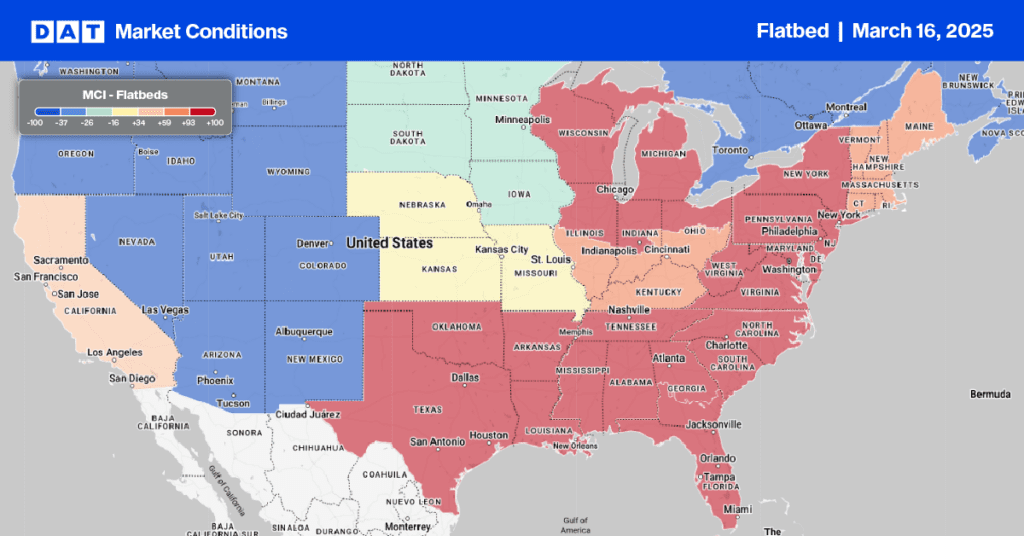

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

Some good news emerged last week in the residential housing sector. According to the U.S. Census Bureau, single-family building permits, a leading indicator of future construction, were up 8% m/m in February, the first monthly increase since December 2021. Single-family home starts, the most freight-intensive for flatbed carriers, were up 1% m/m, with 61% being built in the Southeast Region. Volumes were up 3% w/w across the region, with solid gains reported in Jackson, MS, where volumes increased 13% w/w resulting in outbound spot rates increasing by $0.07/mile to $2.60/mile.

In neighboring Montgomery, flatbed capacity was very tight on slightly lower volumes. Spot rates jumped by $0.42/mile to $2.90/mile for outbound loads, driven by the highest rate since last July on the short-haul lane to Atlanta, which averaged $651/load or $4.00/mile the previous week. Houston remained the number one flatbed spot market following a 15% increase in volume – spot rates increased by $0.03/mile to $2.34/mile. On the high-volume lanes 600 miles west to Lubbock, rates were flat last week at $2.69/mile, while at $2.23/mile, Texas state-level rates are the second-highest in seven years.

Load-to-Truck Ratio (LTR)

Flatbed volumes increased to the highest recorded this year following last’s week 2% increase. As temperatures warm, coinciding with the official start of Spring this week, volumes have increased by 32% in the previous month. Carrier equipment posts remained unchanged, resulting in the last week’s flatbed load-to-truck (LTR) ratio rising by 3% from 15.82 to 16.34.

Spot Rates

Flatbed spot rates continue to increase following last week’s $0.03/mile increase to a national average of $2.19/mile. Linehaul rates have increased $0.07/mile in the last month and are just $0.03/mile lower than in 2018.