Steel output in the U.S. in the week ending September 3rd fell by 7.7% compared with the same time frame in 2021, according to the American Iron and Steel Institute (AISI). Adjusted year-to-date (YTD) production is 61,3188,000 net tons, at a capability utilization rate of 79.9%, down 3.7% from the 63,690,000 net tons during the same period last year. In flatbed truckload equivalent terms, that’s approximately 79,000 fewer truckloads of steel this year.

Tonnage is down in all but the northeast region from a y/y perspective. The Great Lakes region has seen the most significant decline and is down 15% from 2021 and, not seasonally adjusted, is down 3,178,000 tons or approximately 105,000 truckloads. A lot of tonnage has shifted to the Southern region in recent years, and y/y comps show a 13% decline with about 10,000 fewer truckloads. Current YTD volumes are trending closer to 2016 levels; however, the regional mix has shifted, with the Southern region taking the top spot. While tonnage has declined domestically, according to AISI’s latest report, imports are up 28.5% from the same period in 2021. The largest suppliers were Canada (4,709,000 NT, up 1%), Mexico (3,894,000 NT, up 35%) and South Korea (1,962,000 NT, up 10%).

The current Russia – Ukraine war and energy crisis are affecting the steel industry in opposite ways. In Pueblo, CO, the EVRAZ Rocky Mountain Steel factory mill along with a partnership with Lightsource BP, finished in late 2021 a 300-megawatt solar farm occupying 1,800 acres that will provide 90% of the mill’s energy usage, an industry first. The mill is currently undergoing an expansion to add the new electric arc furnace, which will produce railroad rails up to 100 meters long, and will be completed in 2023. Although due to the Russian-Ukraine invasion, the future of this steel mill is now a bit more uncertain. EVRAZ, Russia’s largest steel and mining company, announced they are selling their North American properties, including the mill in Pueblo, CO. Due to the sanctions, a sale may not be quick and easy; however, Pueblo city leaders are still confident in the mill’s progress, as the mill had several owners in the past.

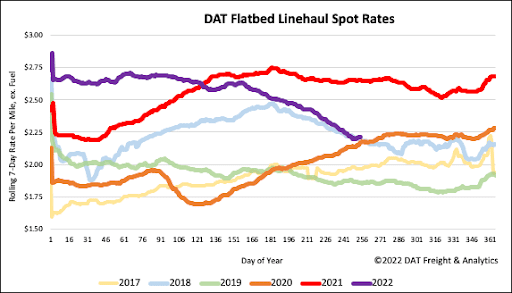

All rates cited below exclude fuel surcharges unless otherwise noted.

After decreasing for the three weeks, Los Angeles outbound flatbed linehaul rates increased by $0.06/mile last week to an average of $2.36/mile. Loads 270 miles to Las Vegas were paying much higher at $3.37/mile, although that’s almost $0.50/mile lower than the previous year. In the Southeast Region, flatbed capacity was scarce last week, pushing up spot rates by nearly $0.30/mile to an average outbound rate of $2.94/mile. In one of the largest markets in the country, flatbed rates jumped in Atlanta following last week’s $0.17/mile increase to $2.71/mile for outbound loads, while in nearby Savannah, rates were up by $0.36/mile to $2.90/mile.

Loads from Savannah to Memphis dropped to their lowest level in 12 months at $2.19/mile – almost $0.70/mile lower than the previous year. In Gary, IN, flatbed rates increased by $0.47/mile last week to an average of $3.19/mile, reversing the downward trend in August even though load posts were down 18% w/w. In Houston, average outbound rates dropped for the fourth week to an average of $2.67/mile, while on the oilsands lane to Edmonton, spot rates at $2.40/mile are around $0.60/mile higher than the previous year.

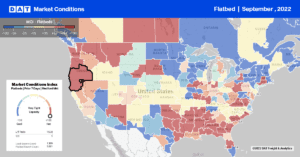

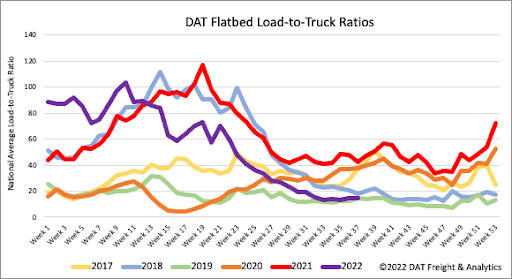

Flatbed load posts are around 50% lower compared to the previous year but within 4% of 2018 levels, which was a good year for flatbed carriers from a demand perspective. Load posts decreased 15% w/w and are now down by 12% in the last month as the flatbed market continues to cool. Equipment posts are very similar to 2019 following last week’s 12% decrease, which is around 40% higher than the previous year. As a result, the flatbed load-to-truck (LTR) ratio remained mostly unchanged at 14.28 last week.

After dropping by $0.41/mile since June, flatbed linehaul rates were flat last week at $2.24/mile. Spot rates are now $0.44/mile lower than the previous year and just 1% or $0.03/mile higher than in 2018, when flatbed carriers were on the tail-end of a strong year from a demand perspective.