Texas flatbed carriers are enjoying some of the best outbound spot rates in the past seven years. At an average linehaul rate of $2.19/mile, only last year has been higher for the third week of the year when rates were $2.54/mile. Boosted by more substantial imports across the southern border and through the Port of Houston, 2023 is shaping up another good year for flatbed freight demand in the Lone Star state. Inbound average flatbed rates are also the second-highest in seven years at an average of $2.26/mile.

While not a sizeable outbound spot market compared to Houston, Dallas, and Ft. Worth, Laredo is a growing freight market for imports and exports, and one flatbed carrier must keep an eye on. Between the World Trade and Columbia Bridges in Laredo, about 14,000 commercial trucks cross the bridges each day, making the Port of Laredo the number 1 inland port along the US-Mexico border and the nation’s third-busiest port among more than 450 airports, seaports, and border crossings, according to the U.S. Census Bureau data analyzed by WorldCity.

According to the Laredo Economic Development Corporation (LEDC), Laredo is home to 251 freight forwarders, 656 trucking/transportation companies, and 120 U.S. Customs Brokers with goods shipped through Laredo traveling to more than 60 countries. Trade at Port Laredo for November increased by 13.74% y/y, the most recent U.S. government data. For the first 11 months of 2022, Laredo truck crossings were up 2% y/y. Motor vehicles parts were the most valuable commodity imported in November, up 21% y/y, followed by passenger vehicles (up 48% y/y), tractors (up 48% y/y), computers (up 24% y/y), and commercial vehicles, up 3% y/y.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

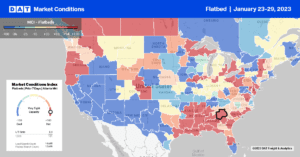

Although state-level rates in Texas cooled again last week, decreasing by $0.04/mile to $2.11/mile, that’s still the second-highest rate in the previous seven years, with only last year being higher when outbound spot rates averaged $2.53/mile. In the McAllen market in southern Texas, flatbed rates increased by $0.07/mile to $2.16/mile last week, while loads 350 miles north to Houston were $0.30/mile higher than the December average at $2.41/mile the previous week. In the Pacific Northwest, load posts increased by 20% w/w with tighter capacity reported in the Medford market, where spot rates increased by $0.36/mile to $2.59/mile. Loads from Medford to Stockton, CA, were around $0.10/mile higher y/y at $3.93/mile last week, and on the high-volume lane further south to Ontario, rates were higher, averaging $2.35/mile the previous week.

Flatbed capacity was noticeably tight in the Southeast last week following a $0.03/mile increase to a $2.26/mile regional average. Most of the gains came from Mississippi, where rates jumped by $0.12/mile last week to $2.52/mile for outbound loads. Regional loads west to Houston averaged $2.18/mile the previous week, about where rates have been for the last three months but still around $0.33/mile lower than the previous year. In the Mobile, AL, market, spot rates increased by $0.18/mile to $2.68/mile last week, with similar gains reported in nearby Montgomery. Loads from there to Lakeland at $2.67/mile were $0.30/mile higher than in December and lower by the same amount as the previous year.

Load-to-Truck Ratio (LTR)

Volumes were up almost 2% last week, and even though they are 80% lower y/y, load posts are around 23% lower than pre-pandemic year week four volumes. Flatbed load posts were also half what they were this time in 2018 at the start of the flatbed rate rally that lasted well into July of that year. Carrier equipment posts remained at their highest level in seven years and 73% higher than the previous year. Last week, more load and equipment posts resulted in the load-to-truck (LTR) ratio remaining relatively flat at 11.35, the lowest since 2016.

Spot Rates

Flatbed national average linehaul rates have lost the least ground since the start of the year following last week’s $0.02/mile decrease. Including the last two pandemic-influenced years, flatbed spot rates in the previous seven years typically decrease by 6% during the year’s first month compared to this year’s 10% decline. At $2.08/mile, flatbed linehaul rates are $0.58/mile lower y/y and just $0.07/mile lower than in 2018.