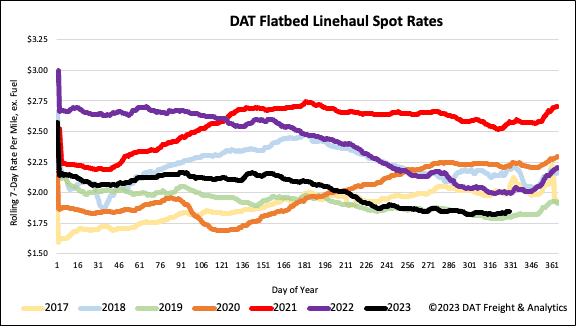

The current flatbed market is one of the softest in many years, and the second half of this year has mirrored 2019, a poor year for truckload carriers. The national average flatbed linehaul rate, at $1.83/mile excluding fuel, has tracked closely with 2019 levels for the last three months and, as of this week, is just $0.04/mile higher. Digging deeper into what’s traditionally a strong flatbed region, spot rates in the Southeast average $2.01/mile, just $0.03/mile higher than in 2019, underscoring how soft the flatbed market is for carriers with exposure to residential construction.

Over 60% of the flatbed market’s freight-intensive single-family homes are built in the Southeast region, where housing start volumes dropped 5% last month (although they were still 9% higher than last year), according to the U.S. Census Bureau. In October, 970,000 new single-family homes were started, 111,000 more than last year and 59,000 more than in 2019. The leading indicator of future construction and flatbed demand, single-family building permits, increased by 0.5% m/m and 15% y/y. Multi-family housing starts jumped 4.9% m/m; permits increased 2.2%.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

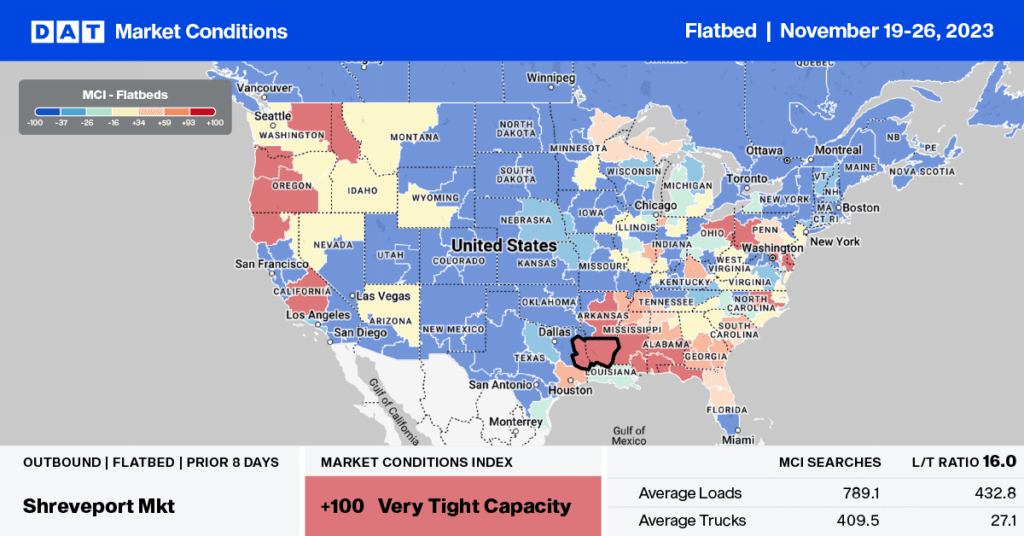

Available flatbed capacity was predictably tight in the Pacific Northwest (PNW) last week as Christmas tree shipping volumes hit the market. Outbound PNW flatbed rates averaged $2.42/mile, up $0.17/mile w/w, with solid gains in Oregon reported following last week’s $0.01/mile increase to $2.72/mile. Outbound Portland spot rates averaged $2.60/mile, up $0.01/mile w/w with 1,200-mile loads to Denver paying carriers $2.70/mile.

In Arkansas, flatbed spot rates jumped by $0.22/mile last week to an average of $2.08/mile, with long-haul loads to Brooklyn, NY, almost $0.80/mile higher at $2.84/mile. Atlanta outbound flatbed loads paid carriers an average of $2.02/mile last week and almost the same on the high-volume spot market lane to Lakeland, FL.

Load-to-Truck Ratio (LTR)

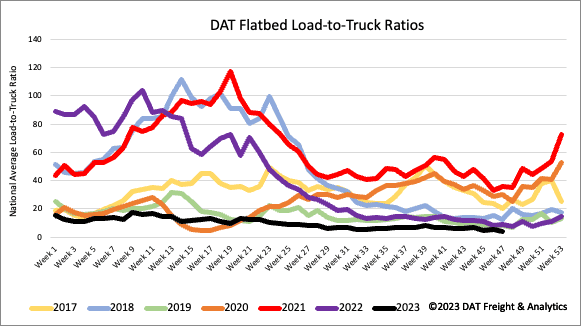

The volume of flatbed load posts (LP) dropped in line with seasonal trends during Thanksgiving following last week’s 50% w/w decline. Carrier equipment posts (EP) decreased 36% w/w, resulting in last week’s flatbed load-to-truck ratio (LTR) decreasing to 4.06.

Spot rates

After decreasing by $0.01/mile the week prior, flatbed linehaul rates increased by the same amount last week, averaging $1.88/mile. Linehaul rates are $0.15/mile lower than last year and only $0.05/mile higher than in 2019. Compared to the pre-pandemic average for Week 45, last week’s national average was $0.08/mile lower and $0.37/mile lower than in 2018.