The shipments component of the Cass Freight Index fell 1.9% m/m in October after a 1.7% decline in September. The index was unchanged in seasonally adjusted (SA) terms from September, falling just 0.1%. Shipments declined by 2.4% y/y in October after a 5.2% y/y drop in September.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

According to Tim Denoyer from ACT Research, author of the Cass Report, “In a sign that private fleet growth continues to affect for-hire demand, the ongoing softness in shipments comes as Class 8 tractor sales rebounded from supply constraints in Q2. Although goods demand growth drives broad freight volume growth, as seen in intermodal, imports, and freight GDP, it still needs to reach the for-hire market.”

After rising 13% in 2021 and 0.6% in 2022, this index declined 5.5% in 2023. With normal seasonality, the index will fall about 3% y/y in November and 4% for the entire year. The expenditures component of the Cass Freight Index, which measures the total amount spent on freight, fell 1.5% m/m in October, partly due to another decline in fuel prices.

Market Watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

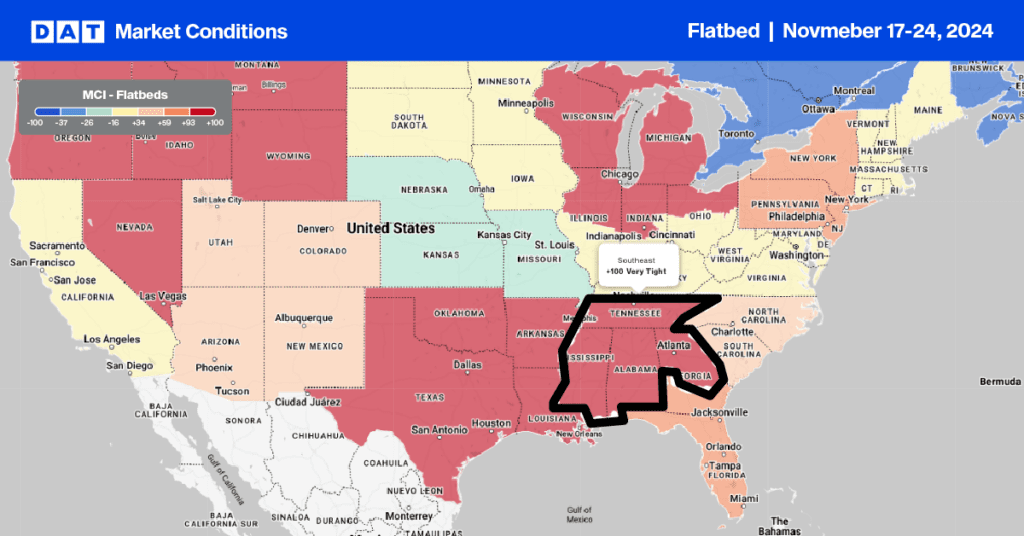

This week, we focus on the Southeast Region, which is home to steel production and single-family housing construction. According to S & P Platts, steel production in the South Region (Tennessee, Mississippi, Alabama, and Georgia), the largest steel-producing region, September volumes were down 7.7% year-over-year (y/y). Residential housing construction also slowed in October, dropping 10.2% month-over-month (m/m) and 1.8% y/y in the South Region, where just half of single-family were constructed last month.

Truckload carriers are also starting to see lower demand and spot rates; linehaul rates have dropped 7% in the last month while the volume of loads has decreased 4%. On the high-volume flatbed lane from Jackson, MS, to Houston, demand has been strong in the last week, with volumes up 66% w/w, although sufficient available capacity resulted in rates dropping 2% w/w to $2.59/mile. This time a year ago, regional flatbed rates averaged $2.13/mile; this year, the November average is $0.28/mile higher at $2.41/mile.

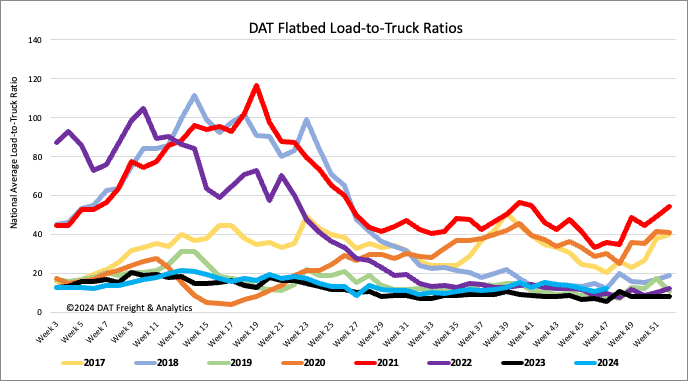

Load-to-Truck Ratio

Last week, national flatbed load postings regained some of the prior week’s losses, increasing 6% w/w. Meanwhile, the number of carrier equipment postings decreased by 11%, increasing the flatbed load-to-truck ratio by 19% w/w to 12.63.

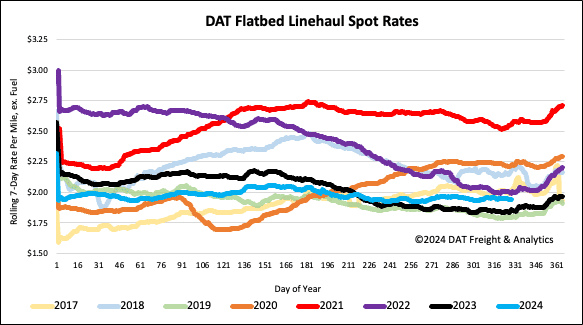

Spot rates

Last week, flatbed linehaul rates increased by just under a penny-per-mile to a national average of $1.97/mile, on a 4% increase in the volume of loads moved. Spot rates are $0.09/mile higher than last year, $0.05/mile lower than in 2022, and $0.02/mile lower than the three-month trailing average.