The Fannie Mae Home Purchase Sentiment Index (HPSI) increased 2.1 points in February to 72.8, inching higher for the third consecutive month, due primarily to increased optimism around home-selling conditions. The HPSI is a reliable indicator of demand for flatbed carriers invested in the residential construction market. Each month, approximately 1,000 American adults (age 18 and older) who make or share in their household’s financial decisions participate in the National Housing Survey (NHS).

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

In February, 65% of consumers said it’s a good time to sell a home, up from 60% last month. The share of those who believe it’s a good time to buy a home ticked up slightly this month but remains at an extremely pessimistic 19%. Additionally, many consumers continue to believe that mortgage rates will go down over the next 12 months, although on net, that component fell slightly this month. Overall, the full index is up 14.8 points year over year.

Federal Reserve Chair Jerome Powell testified before the House Financial Services Committee on March 6 and said, “Any decrease in interest rates in 2024 depends on the path of the economy, and we would like to see more data that confirm and make us more confident that inflation is moving sustainably, down to 2%.”

Market watch

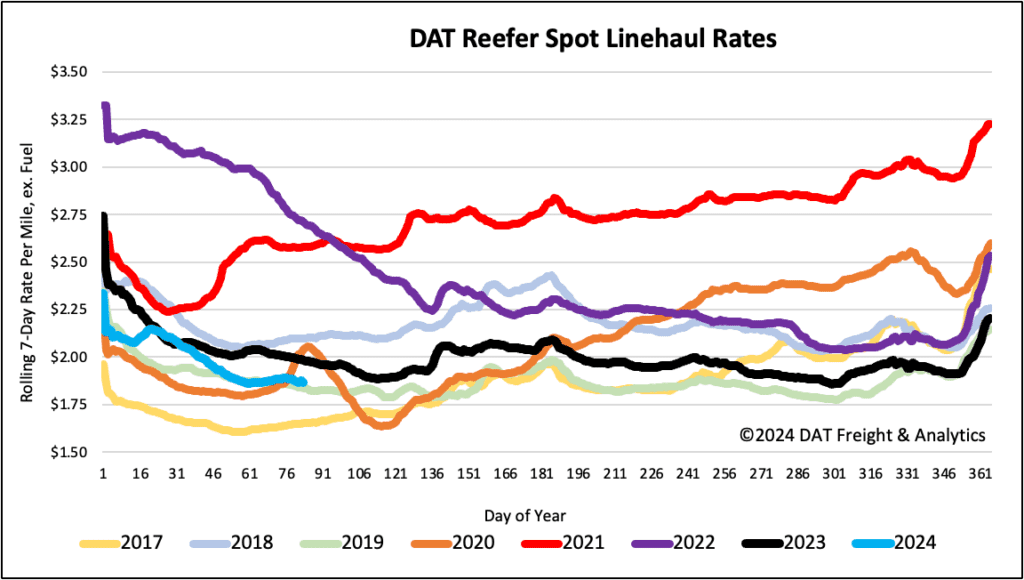

All rates cited below exclude fuel surcharges unless otherwise noted.

There was a surge in outbound volume in the Phoenix flatbed market following last week’s 23% increase in loads moved. Linehaul rates jumped by $0.14/mile to $1.42/mile for outbound loads, with most of the volume and rate gains reported on the Phoenix to Los Angeles regional lane. Linehaul rates spiked by $0.31/mile to an average of $1.38/mile on a 50% higher volume of loads moved, which have more than doubled in the last year.

Available capacity tightened in Houston following last week’s $0.06/mile increase to $2.15/mile for outbound loads. Loads moved were down 3% weekly but remained up 18% last month. Houston to Lubbock volumes were up 9% weekly, pushing up spot rates by $0.06/mile to $2.36/mile.

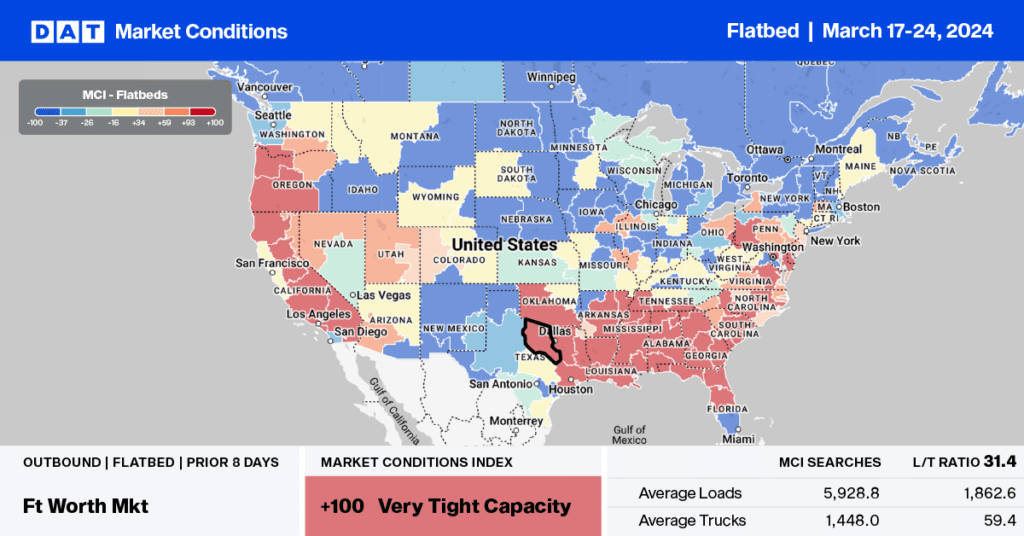

Load-to-Truck Ratio

Flatbed load post volume increased for the seventh consecutive week following last week’s 6% w/w gain. Spot market volumes have increased 29% over the last month but trailed last year by 7%. Available capacity decreased following the 4% drop in equipment posts, increasing the load-to-truck ratio by 10% to 19.72.

Spot rates

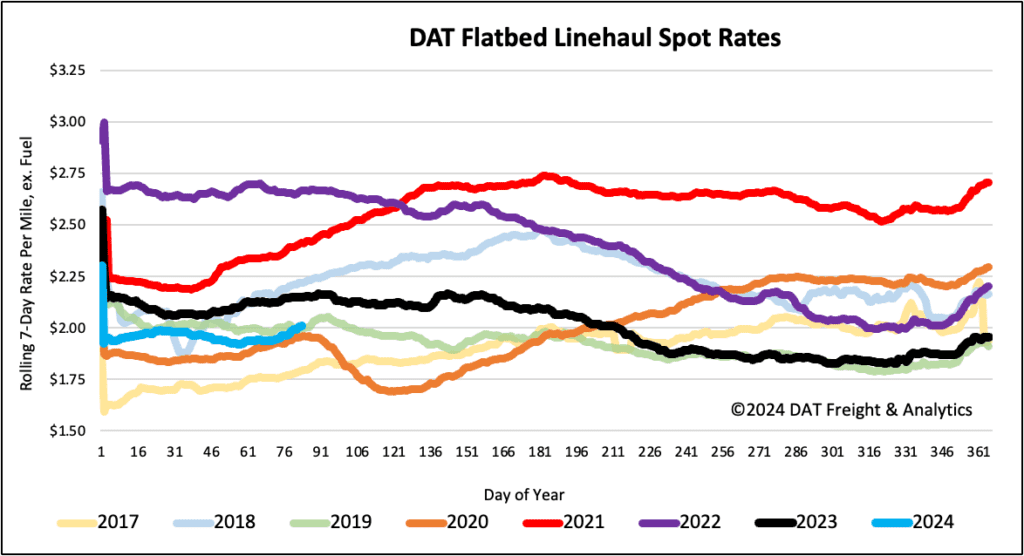

The volume of flatbed loads moved slowed last week after increasing by 12% in the last month. Freight moving in the flatbed spot market is just over 1% higher than last year, with spot rates up $0.03/mile last week to a national average of $2.03/mile. Flatbed linehaul rates are 0.14/mile lower than last year and $0.02/mile higher than in 2019.