U.S. manufacturing activity fell to a 15-month low in October. The Institute for Supply Management (ISM) reported that its manufacturing Purchasing Managers’ Index (PMI) dropped to 46.5 last month, the lowest level since July 2023, down from 47.2 in September. A PMI reading below 50 indicates contraction in the manufacturing sector, which makes up 10.3% of the economy.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

October marked the seventh consecutive month that the PMI remained below the 50 threshold, but it stayed above the 42.5 level, which typically suggests overall economic expansion. However, the survey may have overstated the weakness in manufacturing; goods spending increased the fastest in 1.5 years during the third quarter. The New Orders Index remained in contraction territory, registering 47.1 percent, one percentage point higher than the 46.1 percent recorded in September.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

This week, we focus on the Lubbock freight market in West Texas’s Permian Basin, a central hub for U.S. oil and gas production and home to around half of oil and gas drilling activity. According to Baker Hughes, the oil and gas rig count, an early indicator of future output, was 585 last week, down 33 rigs or 5% below last year.

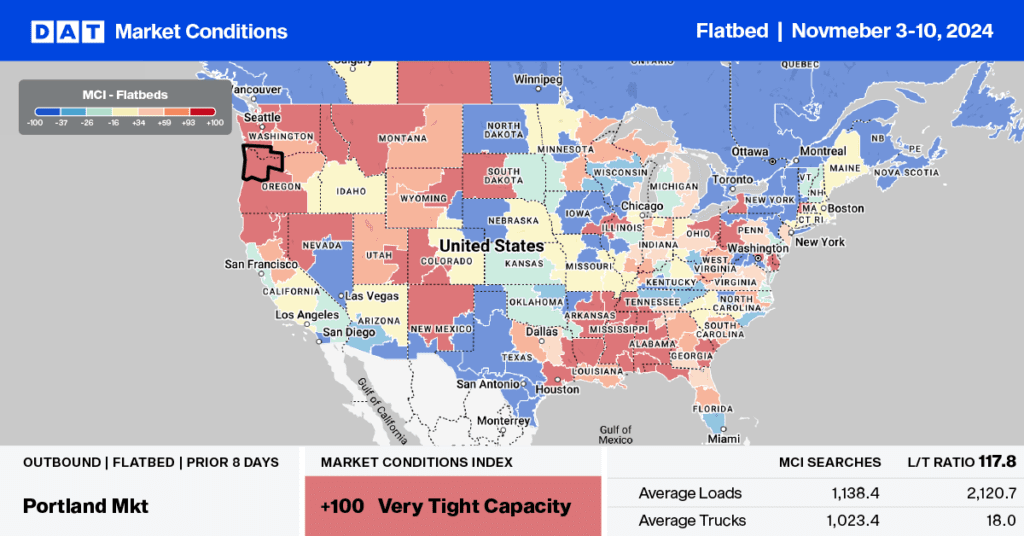

With a change in administration following last week’s national election, there is an expectation that there will be a renewed focus on energy policy on oil production. This should significantly boost the domestic trucking market for flatbed loads from Houston to Lubbock, especially in Texas for drill pipe, casing, and machinery loads. This is the highest-volume lane for flatbed carriers in Texas, where loads moved are already 32% higher than last year, driving up spot crates by 9% year-over-year to an average of $2.42/mile.

Load-to-Truck Ratio

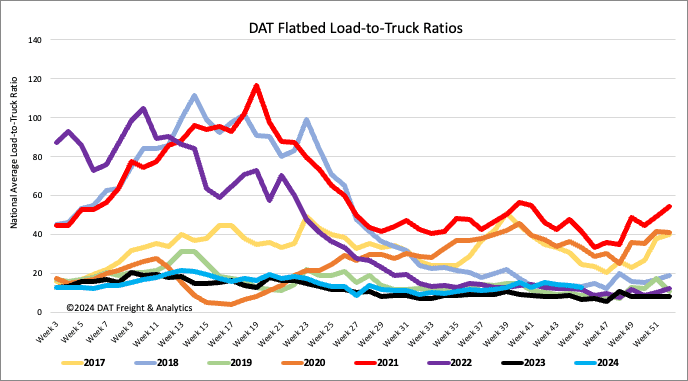

Last week, national flatbed load postings fell by 5% and 11% m/m. Compared to last year, volumes are 35% lower following the recent surge in flatbed activity resulting from hurricanes Milton and Helene last month. Loads moved in the Southeast fell 8% last week and by 9% in Lakeland, FL, after being up 53% in the last month. Meanwhile, the number of carrier truck postings remained unchanged, resulting in the flatbed load-to-truck ratio decreasing slightly to 13.08.

Spot rates

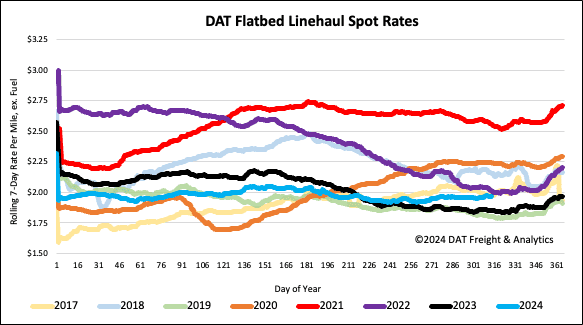

Last week, flatbed linehaul rates increased by $0.02/mile to a national average of $1.99/mile despite a 12% decrease in the volume of loads moved. Currently, spot rates are $0.12/mile higher than they were last year and identical to the three-month trailing average and 2017 when that year’s spot market started to gain momentum.