The Institute for Supply Management (ISM) Manufacturing PMI was 50.3% in February, down from 50.9% in January. This shows that the overall economy has been expanding for 58 months after a contraction in April 2020. A Manufacturing PMI® above 42.3% usually indicates economic growth.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

The New Orders Index dropped to 48.6%, falling back into contraction. This is a decrease of 6.5 percentage points from January’s 55.1%. Panelists reported that companies are adjusting to initial challenges from the new administration’s tariff policy, which has led to staff reductions and a pause on new orders. Prices have increased because of the tariffs, resulting in backlogs for new orders, delays from suppliers, and impacts on inventory. Even though the tariffs will not start until mid-March, spot commodity prices have already risen about 20%, according to the ISM.

The 10 manufacturing industries reporting growth in February — listed in order — are: Petroleum & Coal Products; Miscellaneous Manufacturing; Primary Metals; Wood Products; Food, Beverage & Tobacco Products; Electrical Equipment, Appliances & Components; Chemical Products; Plastics & Rubber Products; Fabricated Metal Products; and Transportation Equipment. The five industries reporting contraction in February are: Furniture & Related Products; Textile Mills; Nonmetallic Mineral Products; Computer & Electronic Products; and Machinery.

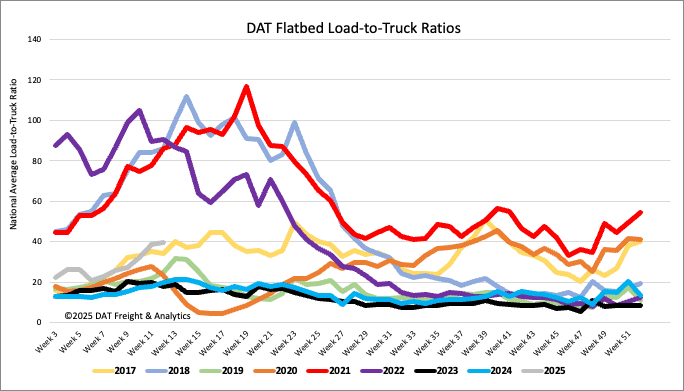

Load-to-Truck Ratio

Flatbed load post volumes increased for the seventh week following last week’s 2% gain. Volumes are 24% higher than last year and 9% lower than the long-term average for Week 9, excluding the pandemic-impacted years. Last week’s flatbed load-to-truck ratio (LTR) ended at 39.51.

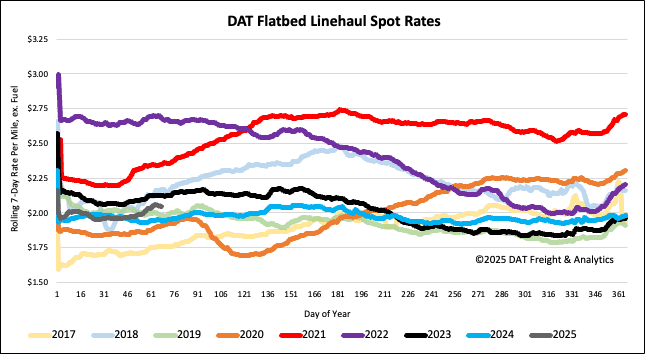

Despite volumes flattening out last week after rising 7% in the last month, the national average flatbed rate increased another $0.03/mile last week to just over $2.07/mile. Compared to last year, the current 7-day rolling average is $0.10/mile or 5% higher, $0.12/mile lower than 2018 and $0.07/mile higher than 2019.

Spot rates

Despite volumes flattening out last week after rising 7% in the last month, the national average flatbed rate increased another $0.03/mile last week to just over $2.07/mile. Compared to last year, the current 7-day rolling average is $0.10/mile or 5% higher, $0.12/mile lower than 2018 and $0.07/mile higher than 2019.