The Port of New Orleans (Port NOLA) is uniquely located on the Mississippi River near the Gulf of Mexico — with access to 30-plus major inland hubs such as Memphis, Chicago, and Canada via 14,500 miles of waterways, six Class I railroads and interstate highways. The trucking industry plays a vital role in the daily movement of goods, with more than 2,000 trucks hauling cargo in and out of Port NOLA daily. Even though breakbulk non-containerized import volumes are expected to be slightly softener than in the past two years, carriers can expect another good year for freight. DAT Freight and Analytics spot market volumes increased by 44% last year compared to 2021.

According to Cameron Gibson, business development manager for the Port NOLA, in an interview with the Journal of Commerce, “With all these projects going up (on) the Mississippi River and coastal Louisiana, we have a bright outlook for project cargo coming through the Port of New Orleans for new construction projects. These include a $13.2 billion LNG export facility in Plaquemines Parish, a $740 million Magnolia Power renewable energy plant south of Plaquemines, a $780 million expansion of the BASF methanol facility, a $2 billion clean ammonia production facility in Geismar and a new 350,000 square foot tire warehouse and distribution center in St. Mary Parish.

Flatbed carriers should continue to see solid volumes of project cargo, steel, plywood, natural rubber, and a range of bagged commodities throughout 2023.

Market Watch

All rates cited below exclude fuel surcharges unless otherwise noted.

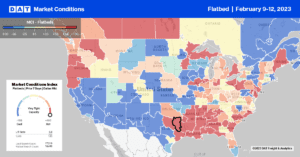

The Montgomery, AL, flatbed market only just missed out on the number one spot last week to Houston. Volumes were up 4% w/w helping push up spot rates for the fourth week by $0.22/mile to $2.78/mile. Loads to Lakeland at $2.94/mile are $0.04/mile higher than the previous year’s, while shorter-haul loads to Jacksonville at $2.59/mile were $0.23/mile higher than the January average.

In Houston, load posts were up by 18% w/w resulting in spot rates increasing by $0.08/mile to $2.30/mile for outbound loads. High-volume lanes included Lubbock and Laredo, where there was sufficient available capacity to meet demand resulting in lower rates on each lane. Loads to Lubbock in the Permian basin oilfield were at a 12-month low of $2.55/mile, while loads to Laredo dropped under $2.00/mile for the first time in 12 months.

In the Pacific Northwest, there was a surge in volume following Portland’s 77% w/w increase in load posts. Outbound spot rates jumped by $0.33/mile to an average of $2.58/mile with capacity tight on the short-haul lanes north to Seattle. Spot rates on this lane at $832/load or $4.80/mile are the highest since last June and $100/load higher than the previous year. Loads 630 miles south to Stockton were paying $2.31/mile, which was around $0.20 lower than last month’s average.

Load-to-Truck Ratio (LTR)

Flatbed load posts increased for the third week following last week’s 5% w/w gain and are on track to follow prior years’ seasonal increase through Spring. Volumes are still 30% lower than the six-year average for Week 6 and just over half what they were in 2018. Carrier equipment posts remained at their highest level in seven years and are around 10% higher than in 2020 following last week’s 3% w/w increase. More load and equipment posts resulted in the load-to-truck (LTR) ratio increasing slightly from 13.04 to 13.20.

Spot Rates

Flatbed linehaul spot rates increased for the third week following last week’s penny-per-mile gain. At $2.10/mile, flatbed rates are $0.06/mile higher than in 2018, as that year’s flatbed rate rally was just getting started. Last week’s $2.09/mile national average was $0.58/mile lower than the previous year.