The most recent release of the for-hire trucking ton-mile and revenue indexes (TTMI), based on output across 41 freight-generating industries, indicates that June’s seasonally adjusted ton-mile index shows freight demand continues along the bottom of a trough with no signs of a seasonal uptick.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Seasonally adjusted trucking ton-miles decreased 0.4% in June from May, down 0.7% from June 2023. According to Professor Jason Miller, a respected supply chain expert at Michigan State University, “The “good” news” is that this is one of the smallest negative seasonally adjusted year-over-year readings since the start of the current freight recession, providing more evidence that we are indeed at a bottom regarding demand.”

Miller said, “The Concerning sectors driving the year-over-year weakness, we continue to see negative year-over-year readings for quarrying and oil & gas well drilling, nonmetallic mineral product manufacturing, machinery manufacturing, fabricated metal product manufacturing, primary metal manufacturing, furniture manufacturing & wholesaling, lumber & construction supplies wholesaling, metal wholesaling, and machinery wholesaling. The common theme is that all these sectors are interest rate centric regarding demand.”

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

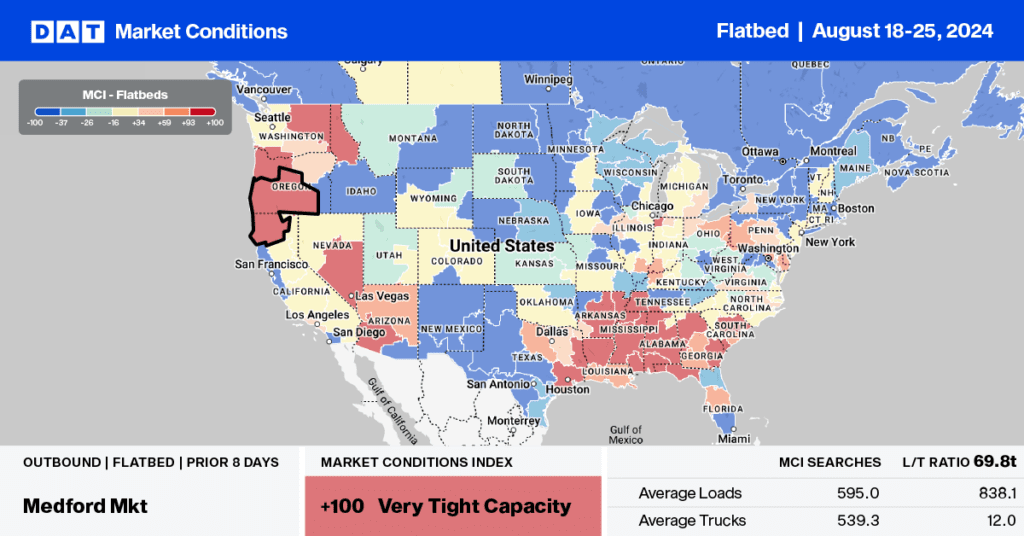

This week, we are focusing on the Birmingham spot market, which is the largest in the Southeast for flatbed carriers. Even though linehaul rates cooled slightly last week to $2.42/mile, the outbound average is $0.02/mile higher than last year, with a 30% increase in the volume of loads moved. On the high-volume lane from Birmingham to Lakeland, FL, flatbed spot rates are $0.18/mile higher than last year, averaging $2.62/mile with an 18% increase in the volume of loads moved. Ratecast predicts that linehaul rates will peak on this lane at $2.68/mile on September 8 before beginning to slowly decline over the winter.

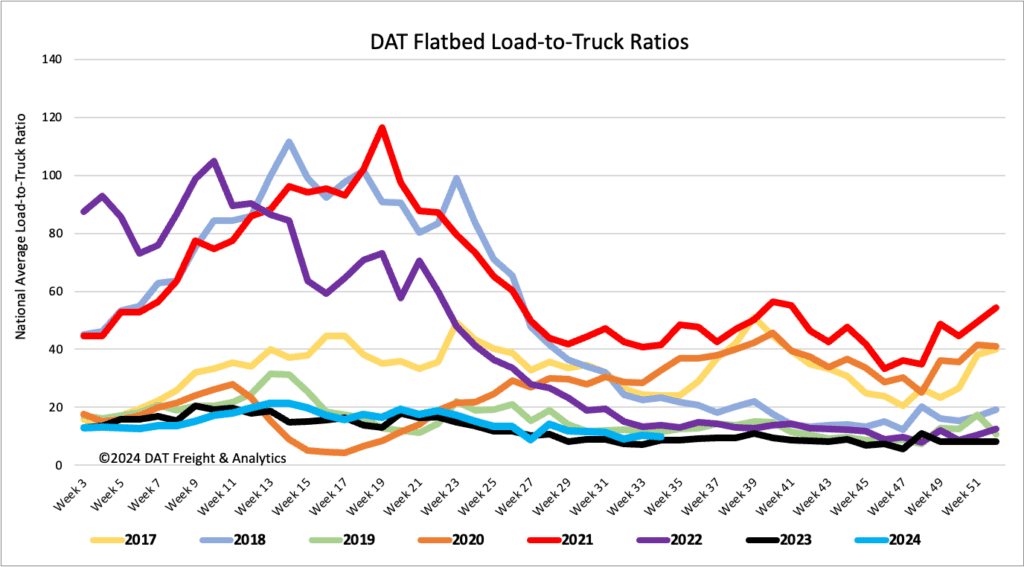

Load-to-Truck Ratio

Flatbed load post volumes decreased by 5% last week, 7% lower than last year. Carrier equipment posts mainly were flat, resulting in last week’s flatbed load-to-truck ratio decreasing by 4% to 9.96.

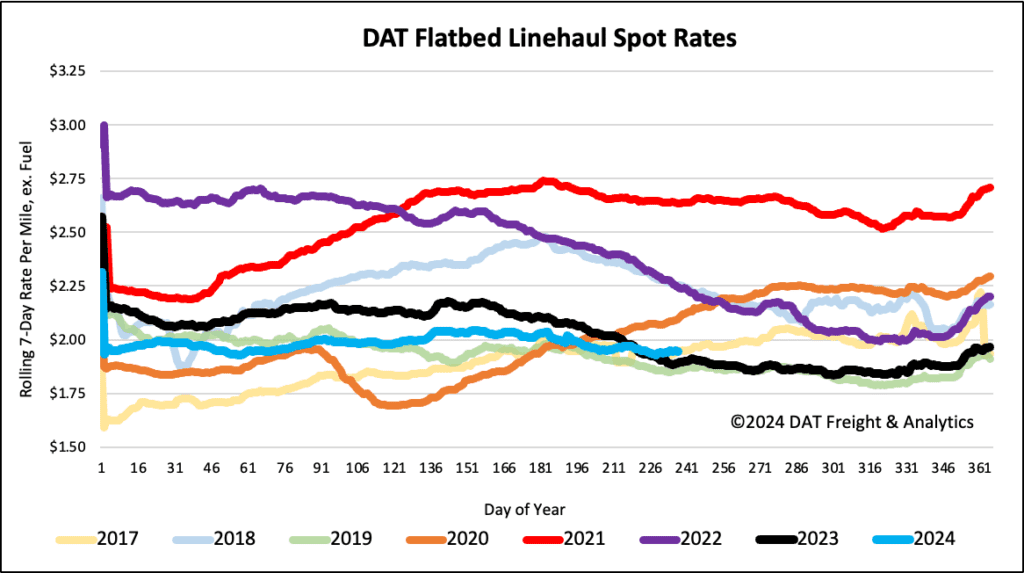

Spot rates

The national load volume increased by 4% last week and last year, while flatbed linehaul rates remained flat at $1.97/mile and almost $0.05/mile higher than last year.