According to the American Trucking Associations’ advanced seasonally adjusted For-Hire Truck Tonnage Index, trucking activity contracted in December, the second decrease in as many months. “For the first time since March and April truck tonnage contracted for two consecutive months,” said ATA Chief Economist Bob Costello.

Tonnage fell 1.8% in November and a further 1.1% in December, bringing the two-month total decrease to 2.9%, pushing tonnage to its lowest level since January 2024. The index, which is based on 2015 as 100, was down 3.2% from the same month last year.

Find flatbed loads and trucks on the largest on-demand freight marketplace in North America.

The ATA release noted, “Sluggishness in factory output continues to weigh on freight volumes, but another drag on the index has been fleet growth at private carriers, which is holding back how much freight is flowing to for-hire carriers.”

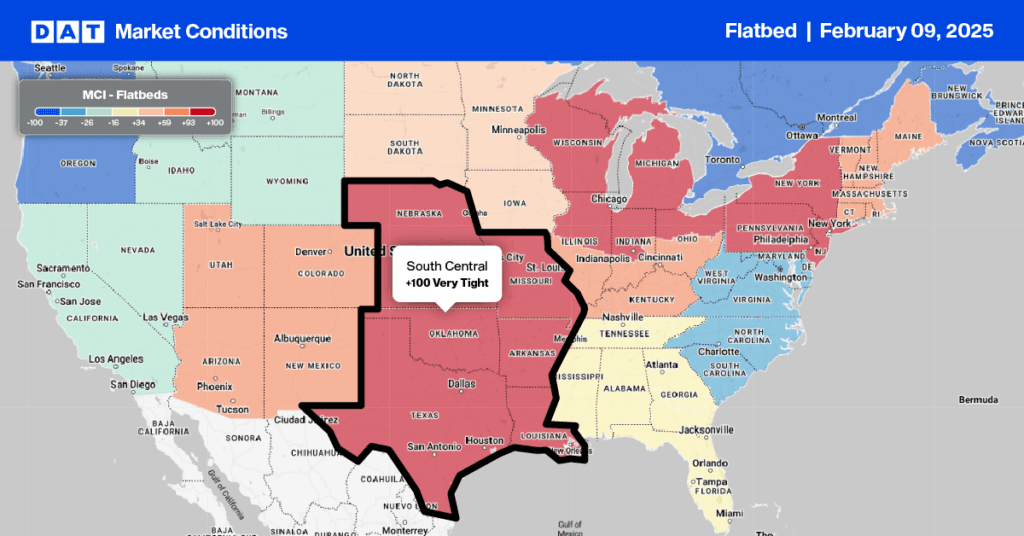

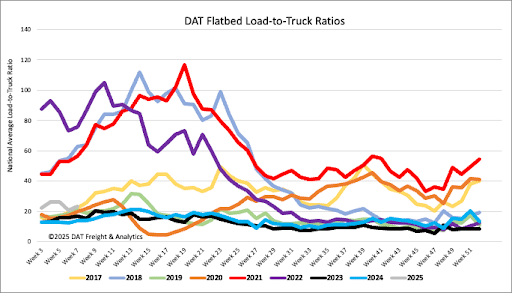

Flatbed load posts were up 4% last week, 14% higher than last year but 17% lower than the Week 6 average going back to 2016 (excluding 2020, 2021, and 2022). Last week’s flatbed load-to-truck ratio (LTR) ended at 26.35.

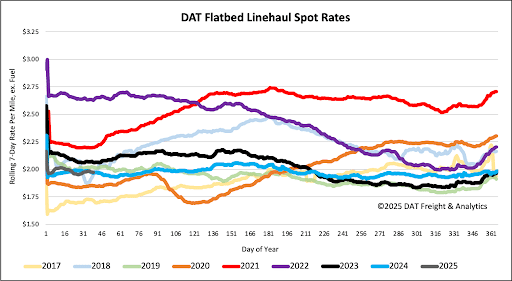

There was no change in last week’s national average flatbed rate for the third week, which paid carriers an average of $2.00/mile. That’s identical to the flatbed spot rate for the last two years. At $2.00/mile, linehaul rates were $0.01/mile higher than last year and $0.02/mile higher than in 2018 as that year’s rate rally got underway.