According to the Association of Equipment Manufacturers (AEM), sales of farm tractors and combine harvesters continue to lag the 5-year average by around 30%, based on the latest numbers. U.S. sales of 4-wheel-drive tractors increased 9.4% in May compared to 2023, although total farm tractor sales are down 11.5% y/y, while combine harvester sales dropped 17.7% compared to last year. Sales of 2-wheel-drive tractors comprised most of the monthly sales and were down 11.7% m/m in May and 10% year-to-date (YTD).

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

According to AEM Senior Vice President Curt Blades, “After the resilience of the last five years, we’re starting to see softness in pockets of the market. Although the total year-over-year numbers show declines, subcategories of the market remain strong, particularly larger equipment. The subcompact tractor market shows some year-over-year challenges following record highs during the pandemic.”

Canadian sales of 4-Wheel-Drive tractors also increased year-to-date in May, with an uptick of 5.7%, but fell 7.5% compared to May 2023. Total Canadian combines sales jumped 58.4% compared to May 2023 and are up 23.8% year-to-date. Total Canadian agriculture tractor sales are down 10.7% compared to last year and dropped 14.5% year-to-date.

Market watch

All rates cited below exclude fuel surcharges, and load volume refers to loads moved unless otherwise noted.

Canadian flatbed carriers have been experiencing some of the lowest linehaul rates and demand in a decade, forcing some to park their trucks and trailers. One regular cross-border steel carrier told DAT, “We didn’t load out of Ontario this week as there are no loads back from the Ohio River region – we’re basically begging for backhauls.” Flatbed spot rates between Canada and the U.S. are 7% lower year over year and 35% lower than the peak in April ’22, while in the opposite direction, U.S. loads into Canada are 4% lower and 39% lower over the same time frames.

Since March of this year, there has been a noticeable decoupling of bi-directional spot rates, suggesting a shift in cross-border volume. This trend is exacerbated on key lanes such as Toronto to the Ohio River region, where bidirectional spot rates decoupled in May ’23 with a spread averaging just over $1.00/mile ($2.74/mile Ontario to Ohio vs. $1.74/mile Ohio to Ontario). This is compared to the 10-year average spread of just $0.28/mile and $0.09/mile during the four years between February 2014 and July 2018.

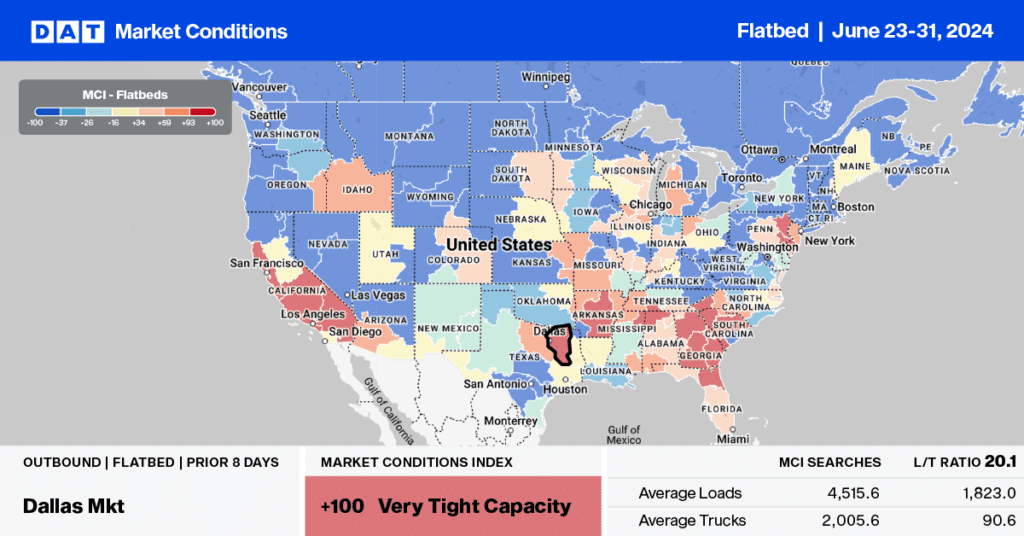

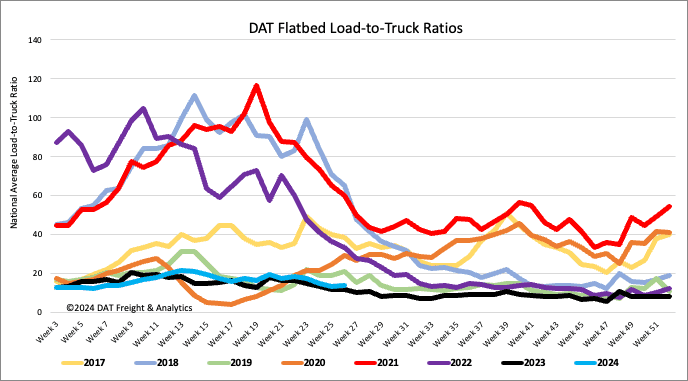

Load-to-Truck Ratio

Flatbed load post volumes were mainly flat last week and identical to last year, but still the second-lowest since 2017. Carrier equipment posts were 2% w/w and 15% y/y lower, leaving last week’s flatbed load-to-truck ratio mostly unchanged at 13.73.

Spot rates

After dropping by $0.02/mile the week prior, flatbed spot rates regained some ground following last week’s $0.01/mile increase. At $2.08/mile, the national average flatbed rate is $0.05/mile lower than last year on a 9% higher volume of loads moved in Week 26 last year.