In February, the U.S. housing market displayed mixed signals, with a significant rise in housing starts contrasted by a drop in building permits. According to the U.S. Census Bureau, housing starts jumped to an annual rate of 1.501 million, an 11.2% increase from January, largely driven by the single-family sector. However, this figure is still 2.9% below February 2024 levels.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Building permits, an indicator of future construction, fell 1.2% to an annualized rate of 1.456 million, continuing a downward trend and indicating a 6.8% year-over-year decrease. Single-family permits remained stable, while multi-family authorizations dropped significantly, reflecting weaker demand in the rental market.

Housing completions decreased by 4.0% in February to 1.592 million, with a 6.2% year-over-year decline, although single-family completions increased by 7.1%.

Overall, while rising housing starts indicate builders are responding to demand, declining permits raise concerns about future construction activity. Monitoring economic data and interest rates will be crucial for assessing the sector’s trajectory.

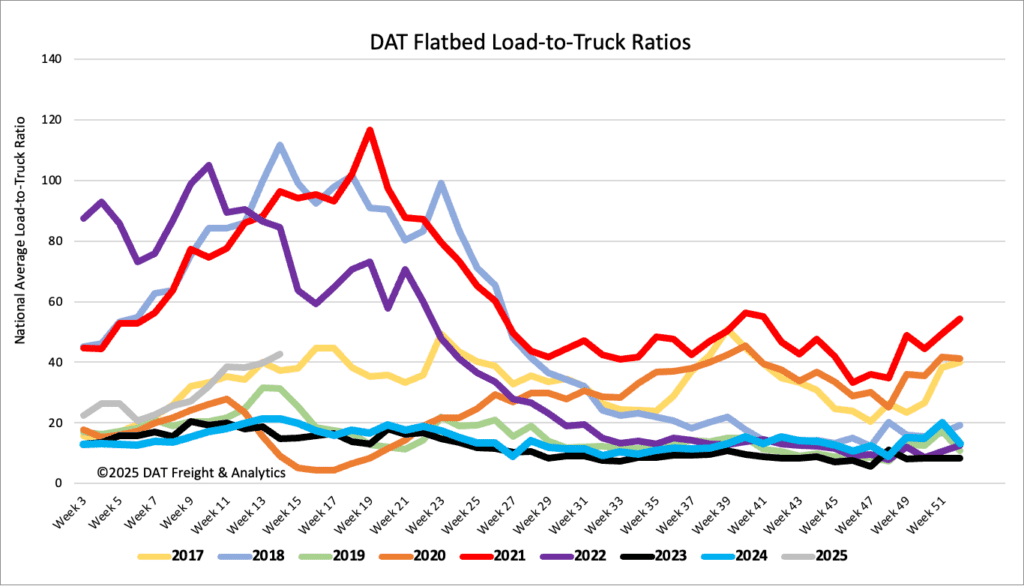

Load-to-Truck Ratio

Flatbed load post volumes increased for the ninth week following last week’s 3% gain. Volumes are 30% higher than last year and now 2% higher than in 2017 as that year began the slow recovery following the 2016 soft market. Last week’s flatbed load-to-truck ratio (LTR) ended at 46.92.

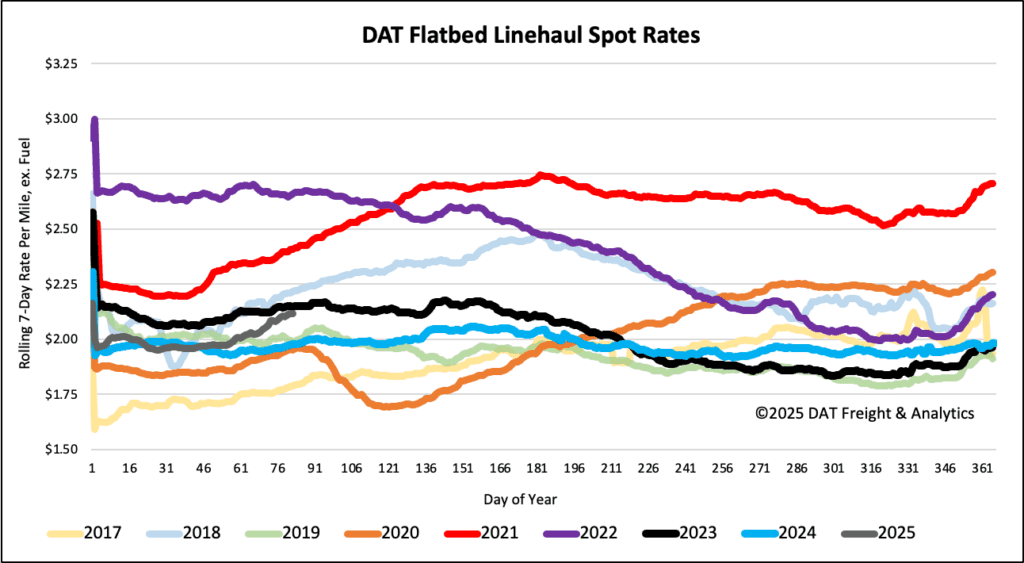

Spot rates

Flatbed is off to the best start to a year since 2017 when the market was up 13% year-to-date (YTD). This year, the national 7-day rolling average flatbed rate is up 8% YTD. Flatbed spot rates jumped by $0.04/mile last week, the largest weekly gain this year. Carriers were paid an average of $2.09/mile last week, up for the sixth week and $0.14/mile or 7% higher than last year, $0.10/mile lower than 2018 and $0.13/mile higher than 2019.