The manufacturing industry, a vital driver of the U.S. economy, and flatbed demand dropped at a faster-than-expected rate in February, making it the 16th consecutive month of declines. The Institute for Supply Management’s Purchasing Managers Index (PMI) came in at 47.8 for February, down from 49.1 in January. The PMI is a diffusion index; readings above 50 indicate growth, and below indicate contraction.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

A more worrying sign is the drop in the New Orders Index, a gauge of future demand, which came in at 49.2, down from 52.5 in January. Timothy R. Fiore, Chair of the Institute for Supply Management, said, “The U.S. manufacturing sector continued to contract (at a faster rate than January), with demand slowing, output easing, and inputs remaining accommodative. Three of the six biggest manufacturing industries (Fabricated Metal Products, Chemical Products, and Transportation Equipment) registered growth in February. The first two are “foundational” industries, which provide products and components for other manufacturing industries.”

According to the ISM PMI report, the eight manufacturing industries reporting growth in February — in order — are Apparel, Leather & Allied Products, Nonmetallic Mineral Products, Primary Metals, Plastics & Rubber Products, Fabricated Metal Products, Chemical Products, Miscellaneous Manufacturing, and Transportation Equipment. In the following order, the seven industries reporting contraction in February are: Furniture & Related Products; Machinery; Wood Products; Computer & Electronic Products; Food, Beverage & Tobacco Products; Paper Products; and Electrical Equipment, Appliances & Components.

Market watch

All rates cited below exclude fuel surcharges unless otherwise noted.

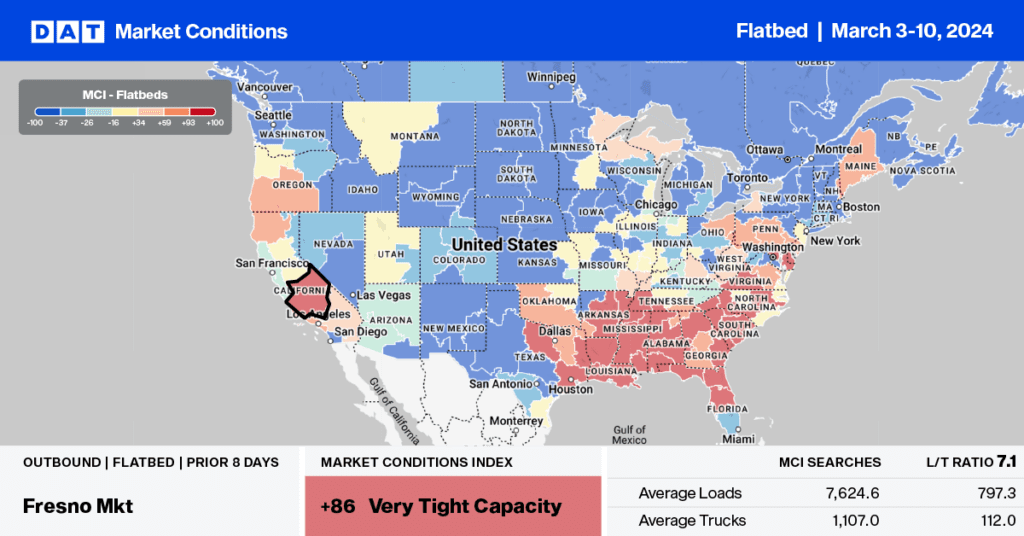

Even though the volume of flatbed loads moved dropped 5% last week, national spot rates increased by $0.01/mile, led by solid gains in Houston, consistently the largest flatbed spot market. Outbound linehaul rates increased by $0.04/mile to $2.08/mile on 12% lower volume of loads moved. On the highest-volume lane between Houston and Lubbock in the Permian Basin oilfield, spot rates were up $0.05/mile to $2.27/mile on a 1% higher volume.

In Chicago, linehaul rates were up by a penny-per-mile to $2.36/mile on a 5% higher volume of loads moved, with carriers paying an average of $2.72/mile for regional loads to Kansas City, KS. As we approach the start of construction season, the volume of loads moving in the Indiana steel belt in the Gary and South Bend markets increased 12% last week. Still, with sufficient available capacity, linehaul rates decreased by $0.01/mile to $2.52/mile for outbound loads.

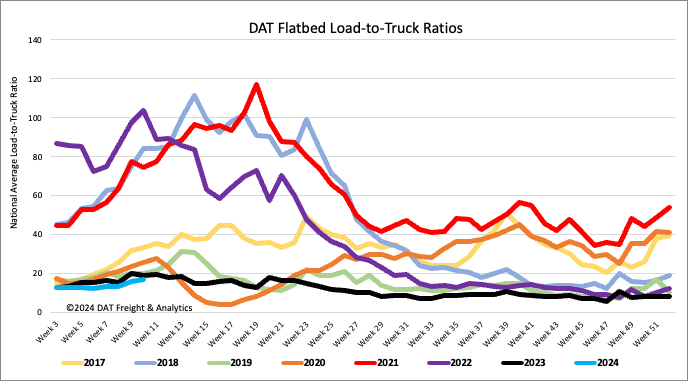

Load-to-Truck Ratio

Flatbed load post volume increased by 15% last week but trailed by the same amount last year. Volumes are 24% lower than in 2020, the week before the global pandemic was declared four years ago. Available capacity increased following last week’s 8% increase in equipment posts, increasing the load-to-truck ratio by 6% to 16.94.

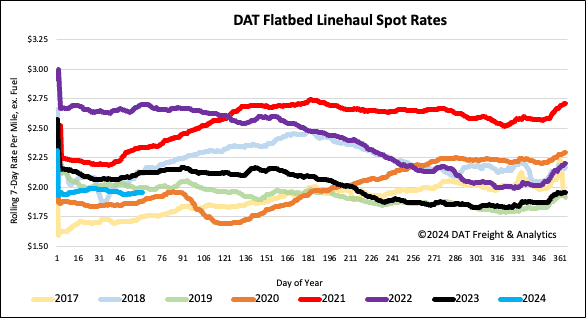

Spot rates

Even though the volume of flatbed loads moved decreased by 5% last week, the freight moving in the spot market is just over 1% higher than last year. Flatbed capacity tightened for the third week as spot rates get set to break through the $2.00/mile mark for the first time since the end of January. At $1.99/mile, flatbed linehaul rates are 0.16/mile lower than last year and $0.06/mile higher than in 2020.