Volvo Construction Equipment (CE), a significant contributor to flatbed and specialized truckload demand, reported North American net sales were $8.0 billion in fiscal year 2024, down 15% from $9.5 billion the previous year. Sales in North America were down 20% to $2.1 billion. The North America total machine market contracted, largely due to a normalization of replenished dealer and rental fleets in North America, prompting an 8% drop, according to the company.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

“Despite lower volumes, we have been able to maintain a healthy profitability, whilst at the same time introducing new products and services, including a new range of articulated haulers to our existing portfolio,” said Melker Jernberg, President of Volvo CE.

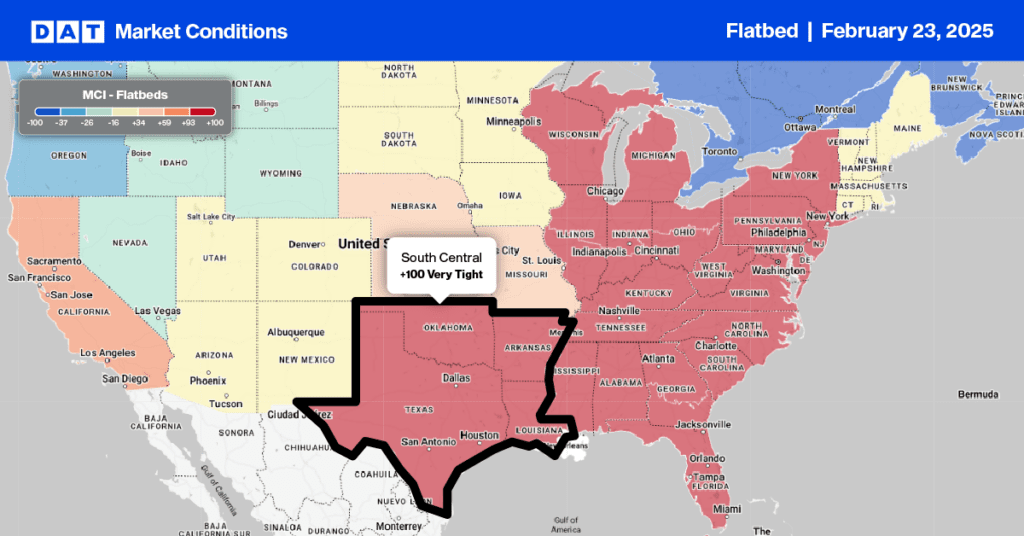

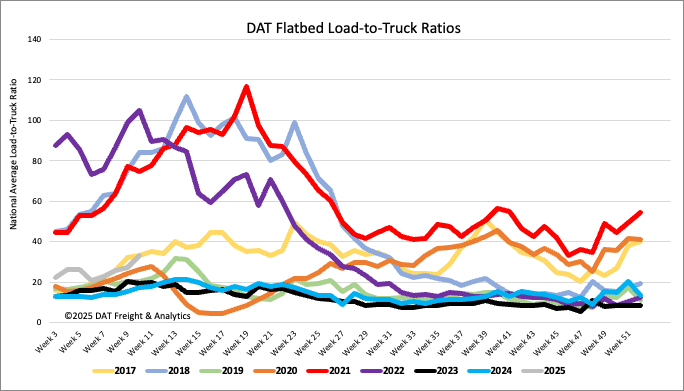

Load-to-Truck Ratio

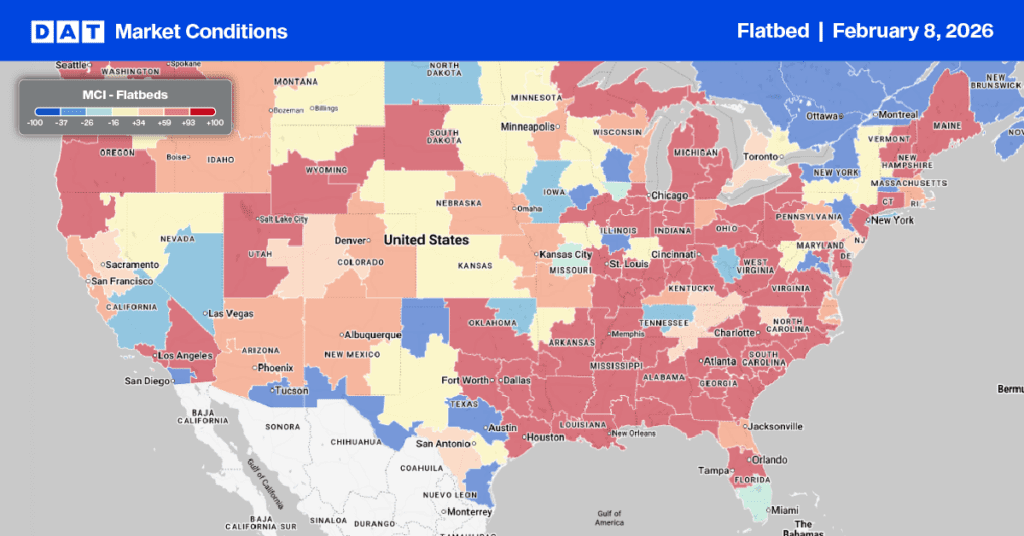

Flatbed load post volumes are just under 30% higher than last year, following last week’s 18% increase. Last week’s flatbed load-to-truck ratio (LTR) ended at 33.20.

Spot rates

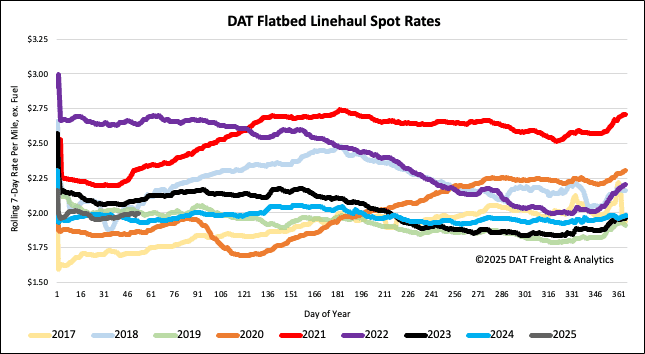

After being flat over the past month, last week’s national average flatbed rate increased by almost $0.02/mile to an average of $2.02/mile. Compared to last year, the current 7-day rolling average is $0.06/mile or 3% higher, $0.06/mile lower than 2018 and identical to 2019.