The Logistics Manager’s Index (LMI) was recorded at 62.8 in February 2025, signaling growth in the logistics industry. This index is influenced by various factors, including inventory levels, costs, warehousing capacity and utilization, transportation capacity and utilization, and pricing. It reflects the fastest expansion rate in nearly three years, primarily driven by increases in inventory and associated costs.

Get the clearest, most accurate view of the truckload marketplace with data from DAT iQ.

Tune into DAT iQ Live, live on YouTube or LinkedIn, 10am ET every Tuesday.

Uncertainty regarding tariffs has already impacted businesses, prompting Canadian companies to diversify their markets away from the U.S. Meanwhile, Chinese firms are either increasing production or relocating it to nearby countries. U.S. consumer sentiment has decreased to 64.7, and inflation expectations have risen to 4.3%. Additionally, the Chicago Fed National Activity Index has declined, indicating economic contraction.

There has been a significant increase in inventory levels and costs. While imports at major ports have risen, they are expected to decline with the introduction of new tariffs. Furthermore, warehousing capacity has tightened, particularly for smaller facilities, resulting in higher warehousing prices.

Although the economy remains strong, it faces challenges due to uncertainties in global trade. The rising inventory levels and costs indicate a shift from just-in-time (JIT) practices to just-in-case (JIC) strategies, which could pose risks for inflation.

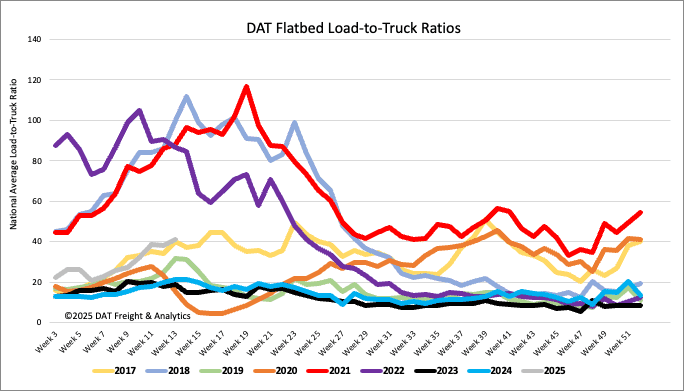

Load-to-Truck Ratio

Flatbed load post volumes increased for the eight week following last week’s 7% gain. Volumes are 34% higher than last year and 5% lower than the long-term average for Week 11, excluding the pandemic-impacted years. Last week’s flatbed load-to-truck ratio (LTR) ended at 41.12.

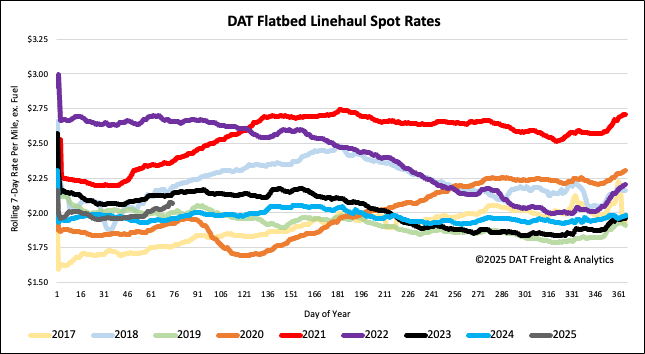

Spot rates

The national 7-day rolling average flatbed rate has now increased for the fifth week following another $0.02/mile w/w gain. At $2.09/mile, flatbed linehaul rates are $0.11/mile or 6% higher, $0.12/mile lower than 2018 and $0.07/mile higher than 2019.