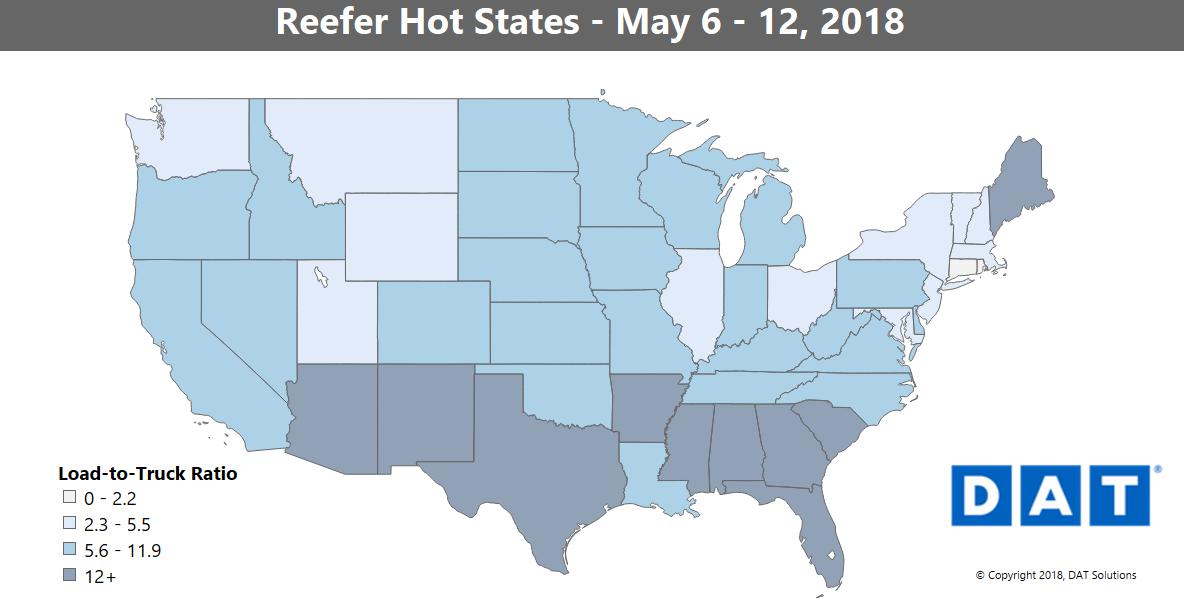

Reefer load counts and rates continued to climb last week, boosted by produce markets across the country. Last week was the fifth in a row for rising volumes, and prices continued to surge out of the Southeast.

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

HOT MARKETS

Florida led the way again last week, with outbound rates in Lakeland and Miami up 15% and 8% respectively.

- Lakeland to Atlanta surged 58¢ to $2.96/mile

- Lakeland to Charlotte climbed 39¢ to $3.18/mile

- Miami to Atlanta was also up 39¢ to $3.11/mile

- Lakeland to Chicago jumped up 32¢ to $2.50/mile

It wasn’t just Florida though:

- Asparagus crops helped boost volumes in Michigan, and the lane from Grand Rapids to Madison, WI, rose 43 cents to $3.15/mile

- Reefer rates also rose in Nogales, AZ, an entry point for Mexican produce

- Outbound load counts also climbed in McAllen, TX, another border crossing market

FALLING

The ripple effect of Florida hitting its peak was some lower prices elsewhere, as buyers adjusted their sourcing:

- Atlanta to Philadelphia was down 48¢ at an average of $2.60/mile

- Philly to Miami adjusted down to $1.65/mile, balancing the more expensive loads coming out of Miami

- Chicago to Atlanta declined 24¢ to $2.50/mile, as rates rose on northbound lanes out of Atlanta

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.