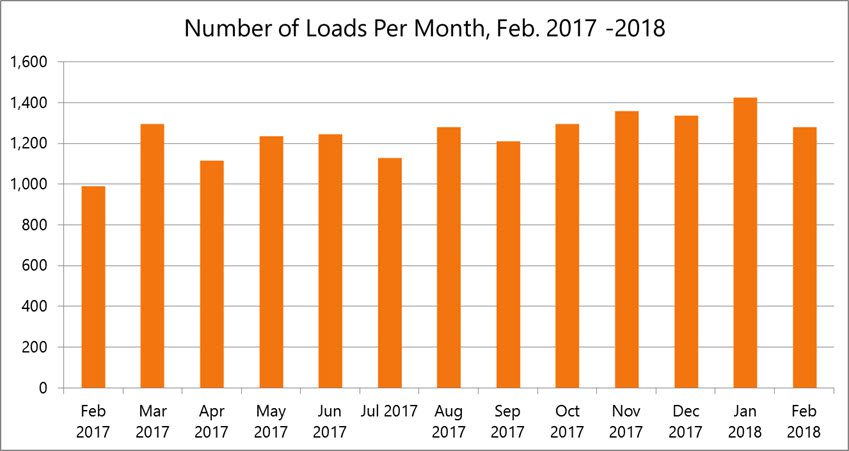

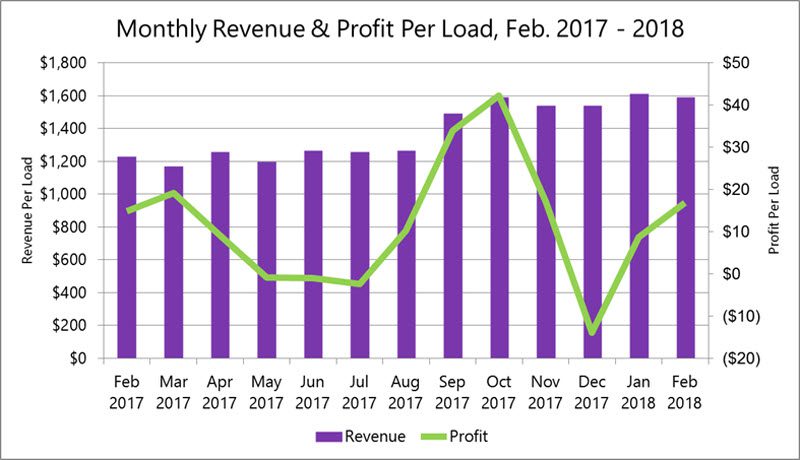

Freight brokers moved 29% more loads in February, at 13% higher revenue per load, compared to February 2017. That combination led to a 67% average increase in total revenues for the group. Average revenue per load remains high, and profit per load recovered seasonally in February.

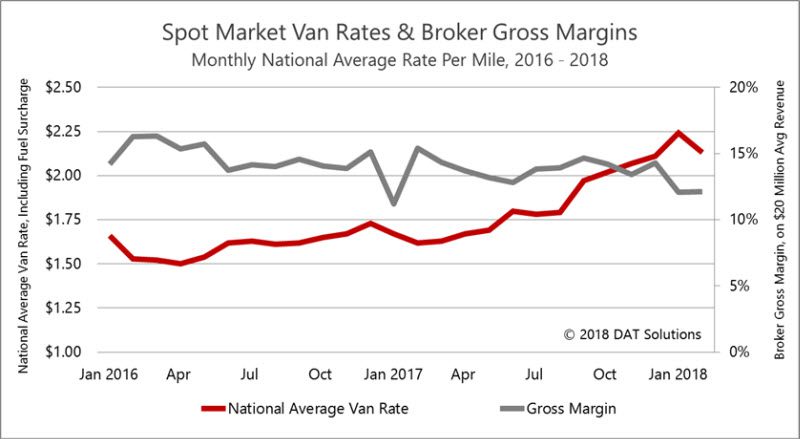

Gross margins have not recovered, because it was still hard to secure enough trucks in February to meet continuing demand. The combination of unseasonably high demand and tight capacity kept pressure up on truckload rates, causing margin compression for some brokers in the group.

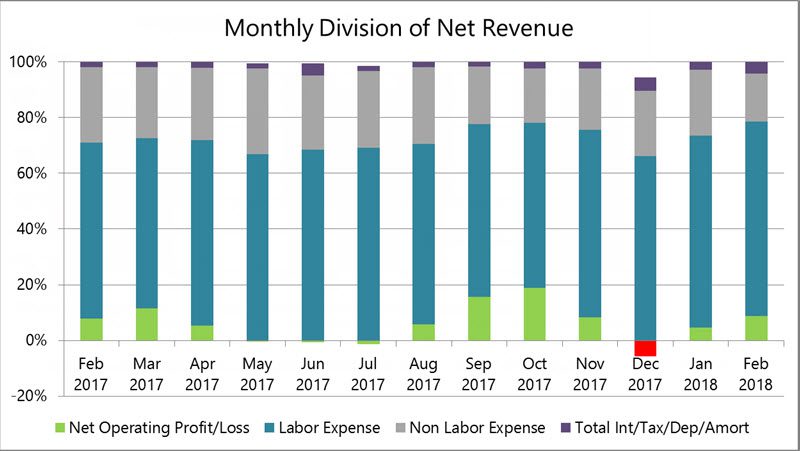

At the same time, brokers cut expenses to soften the impact of that margin compression. Its impact on net operating profit was mitigated by reductions in both labor and non-labor expenses. While labor costs were up year over year, as a percent of net revenue, they have come down significantly since December. Non-labor expense as a percentage of net revenue was at a record low of 17% in February.

This benchmark report is administered by DAT Keypoint, and draws data from an aggregate of more than 100 DAT customers, based on more than 25 key performance indicators. The group’s 2017 average annual revenue of $19.5 million grew 26% compared to 2016.

To receive future monthly updates in your inbox, subscribe to the DAT Broker Benchmark Report.

Gross margin is still hovering at 12% due to elevated rates. Even though rates fell seasonally during February, they’re still 31% above last year’s levels. Rates rose because of capacity shortfalls, which in turn were caused by three factors: (1) atypical off-season demand, (2) bad weather, and (3) small fleets’ ongoing adjustment to electronic logging devices (ELDs) since the mandate went into effect in mid-December.

Brokers cut costs in February, to help offset the impact of skinny gross margins on net operating profits. Although labor expense increased as a percent of net revenue in February, labor costs fell 8% in dollar terms month over month, to the lowest point since September. Non-labor expense dropped to the lowest point in more than a year, achieving a record low at 17% of net revenue.

The DAT Broker Benchmark project analyzes revenues, expenses and profits, based on more than 25 key performance indicators available in DAT Keypoint, the transportation management system developed exclusively for freight brokers. Need a TMS? Request a demo.

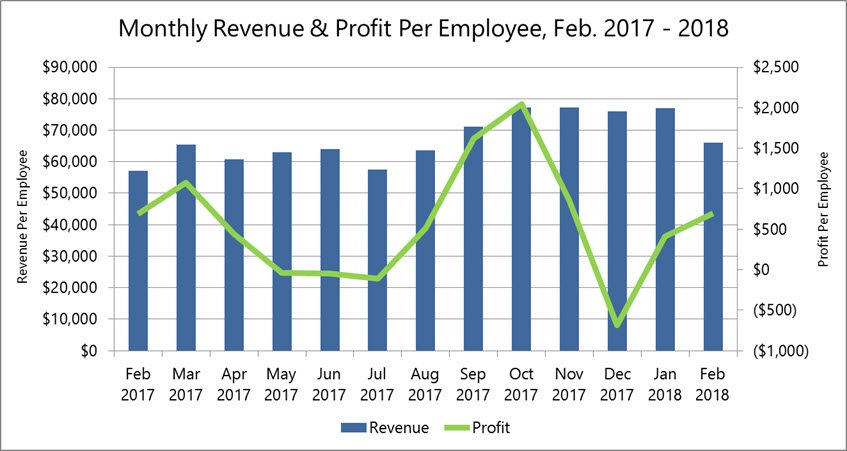

Profit per employee increased 69% for the month, compared to January, even though revenue lost 14%. On a year-over-year basis, revenue was 16% higher and profit added 1.1% per employee, compared to February 2017.

Brokers moved 29% more loads in February compared to the same month in 2017, but load counts dropped 10% compared to January. That’s a normal trend for February.

Average revenue per load remained high at $1,590 in February, and profit recovered to $16.81 per load. That’s not great, but it’s up 95% compared to January’s results of $8.63 per load. It’s also 13% ahead of the group’s average profit of $14.87 per load in February 2017.

DAT Keypoint is the transportation management system designed exclusively for freight brokers. Need a TMS? Request a demo.