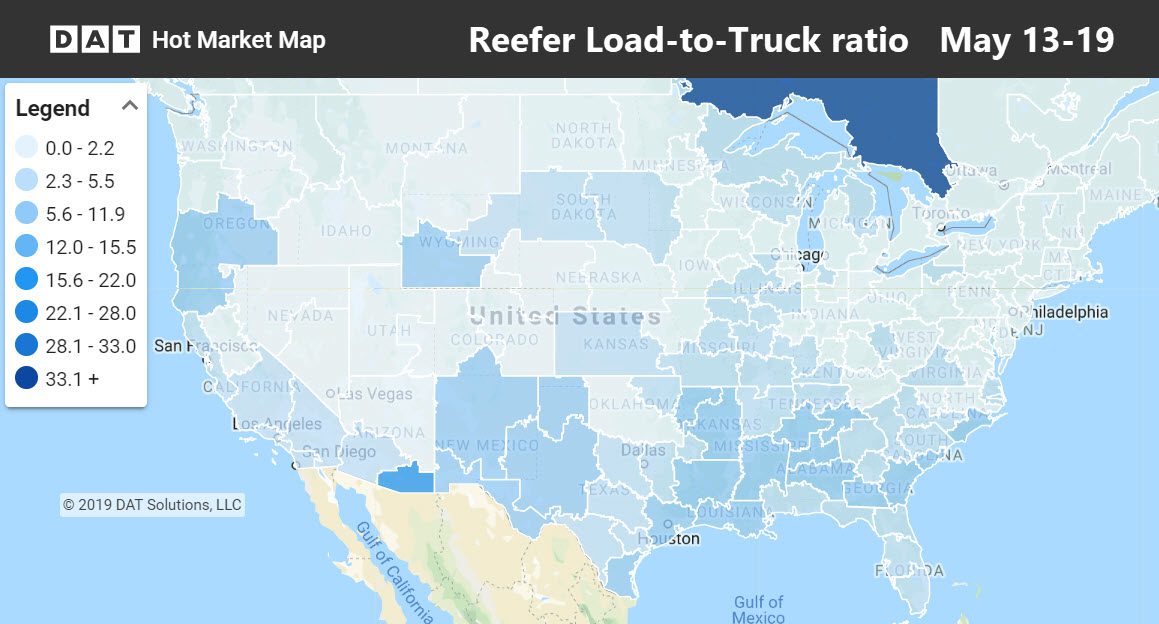

First the bad news: Refrigerated truckload freight took a step back last week due to weakness in Florida and some California markets. Miami volumes dropped more than 15%, and outbound loads from California were down 7%. As you can see from the Hot Market Map below, it’s pretty pale for this time of year.

Now the good news: Overall reefer load volumes are higher than they were at this time last year, and reefer load posts did increase late in the week, so things could turn around. The national average reefer rate for May is now at $2.17 per mile — 2¢ higher than the April average — and rates are expected to rise in the next few weeks.

The national average load-to-truck ratio for reefers increased to 2.6 loads per truck last week.

Rising rates

On the top 72 reefer lanes, only 23 lanes had rising rates. Holding up best was the Los Angeles market. The average rate coming out of L.A. increased 4¢ per mile, while there was a 1¢ average gain coming out of Ontario, CA. The lanes with the largest rate increases last week all came from California. And if you’re wonder about the dark blue area on the Hot Market Map above, that’s the Tucson, AZ market. Last week Tucson had 1,356 load posts and only 86 truck posts, for a load-to-truck ration of 15.7.

- Fresno to Seattle rose 11¢ to $2.75/mi. (Fresno is just getting started)

- Ontario, CA to Chicago moved up 16¢ to $2.12/mi.

- Los Angeles to Denver jumped 30¢ to $2.90/mi.

Falling rates

The Grand Rapids market has been soft, with falling prices on several lanes. In fact, rates were down throughout the Midwest.

- Grand Rapids to Cleveland plunged 60¢ to $2.75/mi.

- Green Bay to Des Moines fell 57¢ to $2.18/mi.

- Miami to Atlanta dropped 43¢ to $2.06/mi.

Related: Van rates stuck in holding pattern

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.