Some important flatbed demand indicators came out recently on the manufacturing side of the economy. This is good news, although output growth remains constrained by material shortages.

Economic activity in the manufacturing sector increased by 0.4% in August, recording 15 consecutive months of growth. The New Orders Index came in at 66.7%, which was up 1.8% over July while the Backlog of Orders Index registered 68.2%, 3.2% higher than the July reading.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

According to Timothy R. Fiore, Chair of the Institute for Supply Management:

“Business Survey Committee panelists reported that their companies and suppliers continue to struggle at unprecedented levels to meet increasing demand. All segments of the manufacturing economy are impacted by record-long raw-materials lead times, continued shortages of critical basic materials, rising commodities prices and difficulties in transporting products. The new surges of COVID-19 are adding to pandemic-related issues — worker absenteeism, short-term shutdowns due to parts shortages, difficulties in filling open positions and overseas supply chain problems — that continue to limit manufacturing-growth potential.”

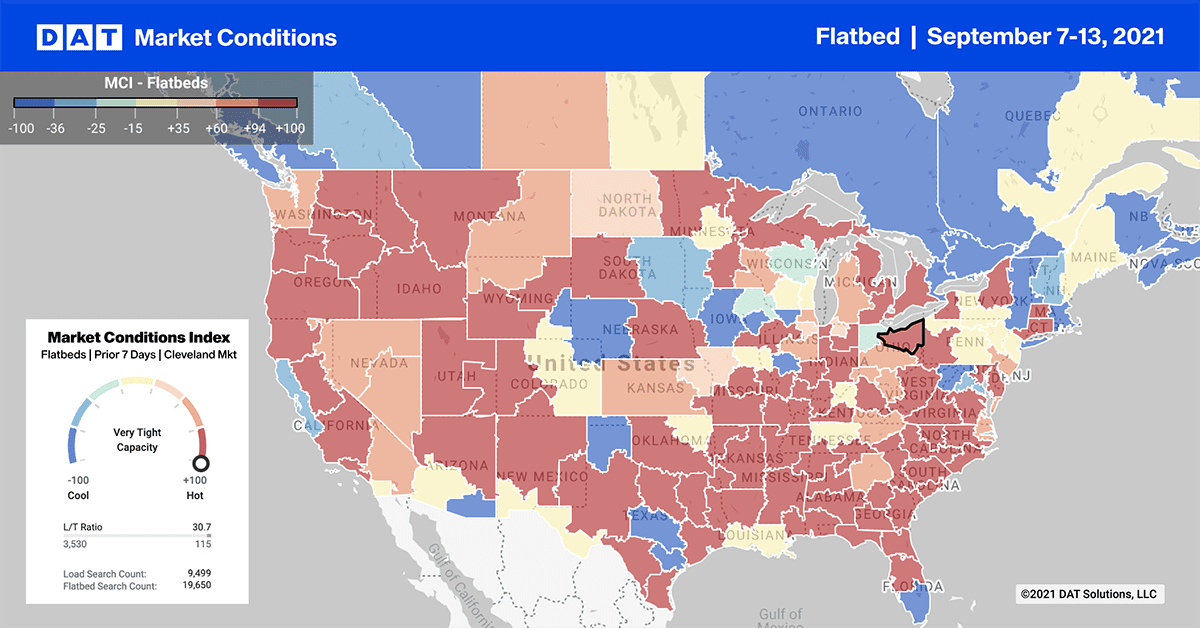

Inbound loads into the flood-ravaged Gulf Coast region attached a premium last week. Monthly load volumes into the New Orleans freight market increased by 31% week-over-week and 78% month-over-month:

- Spot rates on loads from Jacksonville to New Orleans averaged $2.72/mile last week, which is $0.60/mile higher than the August average and $1.16/mile higher than the same week in 2020

- Spot rates surged on the 348-mile Houston to New Orleans lane, increasing by $1.22/mile over the August average to reach $4.04/mile last week — $1.58/mile higher than the same week last year

On the West Coast, spot rates broke through the $4.00/mile mark for loads from Reno to Seattle. That lane averaged $4.07/mile last week — $1.10/mile higher than the same time in 2020.

Spot rates

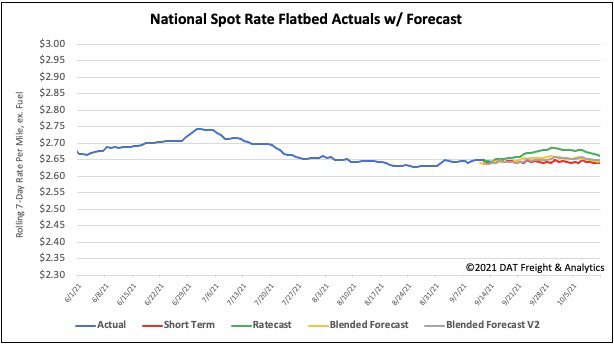

After decreasing steadily for most of July and August, flatbed spot rates have now been inching up for the last three weeks following last week’s $0.01/mile increase. National average flatbed rates are now at $2.65/mile, which is $0.48/mile higher than the same week last year and the same time in 2018 (when the last flatbed rate rally was cooling rapidly).

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models