Even though sweet potatoes are a fall crop, they are available all year round with North Carolina producing around 67% of the annual volume. Peak-shipping season coincides with Thanksgiving when 12% of annual volume, or close to 1,400 truckloads, will be shipped during the month of November from the Tar Heel State.

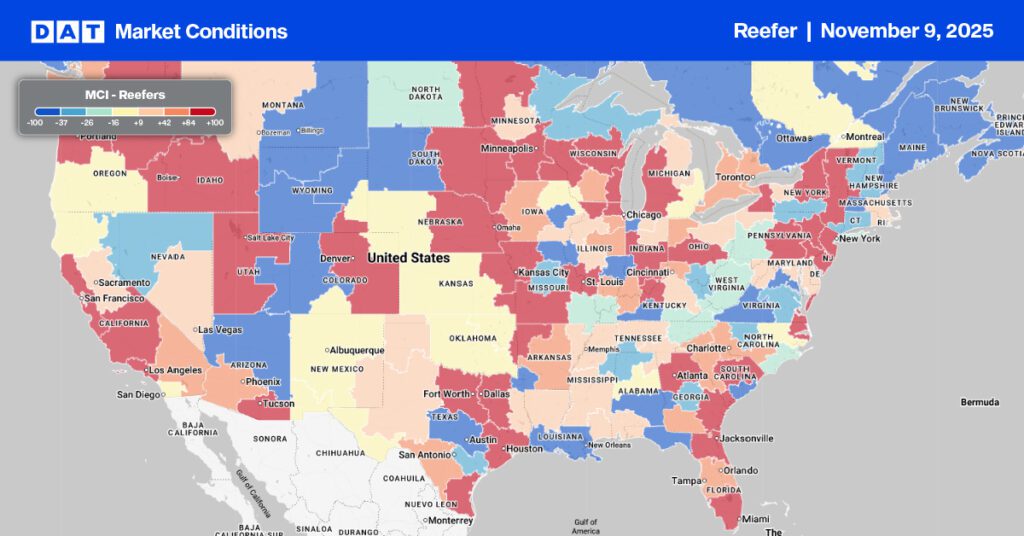

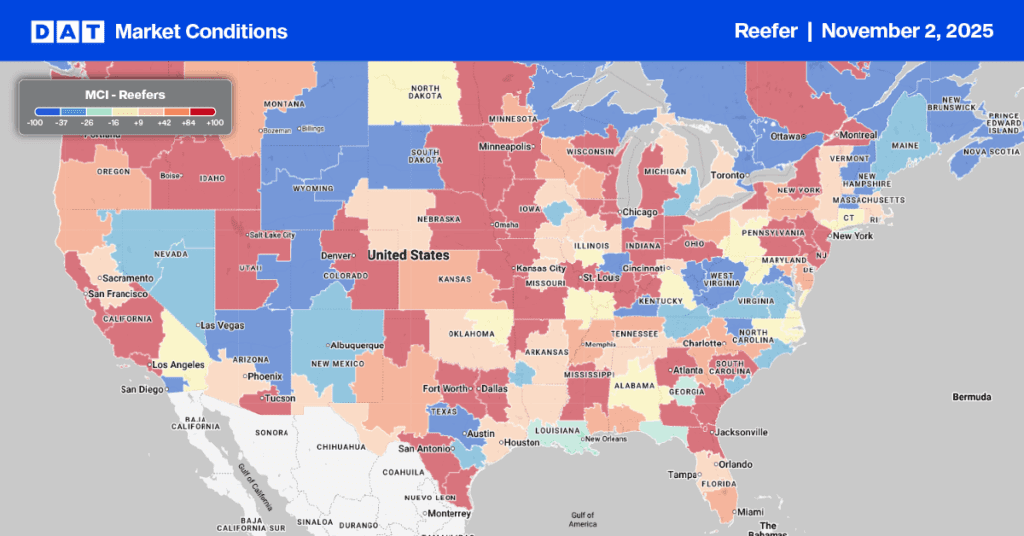

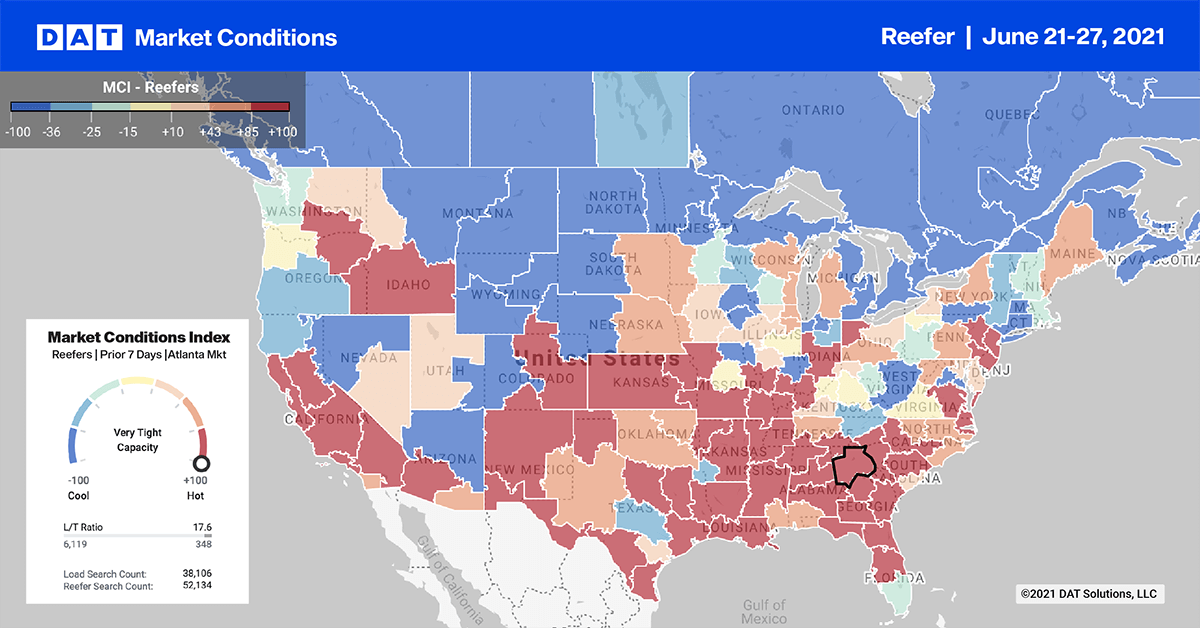

North Carolina freight volumes have been averaging close to 300 truckloads of sweet potatoes per week. But according to the latest USDA Truckrate report, a shortage of trucks was reported last week in eastern North Carolina (Wilmington and Raleigh markets), Louisiana and Mississippi.

Louisiana is the second-largest producer of sweet potatoes with 13% of annual volume with Mississippi and Central California following at 8% and 7% respectively.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

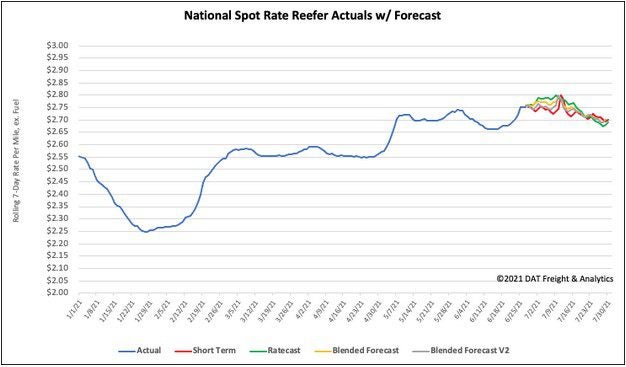

Even before peak-season arrives, growers have been facing record-level spot rates to move loads this year. The current average reefer spot rates to all destinations are at $2.80/mile this week. This is up $0.30/mile since the start of June.

On high-volume lanes to New York City from Wilmington, NC, reefer loads are paying $4.36/mile this week, which is up $0.58/mile since January this year. It’s up almost $2.00/mile since the same time last year. Loads from Wilmington to Boston are paying $4.08/mile, which is up $1.40/mile since the same time last year.

The USDA reported a shortage of trucks to haul onions last week out of the Albuquerque market. Loads to Denver reached an all-time high at $3.26/mile last week. On the 1,751-mile run to Orlando in the Lakeland market, spot rates averaged $2.58/mile last week, up $0.49/mile since February.

Even loads to Atlanta, which have averaged around $2.00/mile over the last 12-months are up to $2.43/mile. In the number one port crossing zone in Laredo, loads to Atlanta are averaging $3.07/mile this week. Loads have been climbing steadily since May 2020 when they were just $1.91/mile, representing a 60% increase.

Further east in Mobile, AL, spot rates have skyrocketed to $3.29/mile this week, which is up $1.40/mile since this time last year.

Spot rates

The reefer sector recorded the biggest gain last week with spot rates increasing by $0.05/mile to an all-time record high of $2.75/mile. Reefer rates are now $0.78/mile higher this time last year and $0.39/mile higher than this time in 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models