Port closures and mandatory evacuations are underway in parts of Texas and Louisiana ahead of Hurricane Laura, projected to make landfall on Wednesday.

Most operations at the Port of Galveston and Port of Houston were halted by Tuesday afternoon. Much of the region’s refining capacity was also shuttered. The Port of Houston handles about 70% of the container cargo making land in the Gulf, so even a brief closure will have ripple effects across the spot market and supply chain for weeks to come.

Texas Gov. Greg Abbott suggested wind is likely to cause the most damage from Laura, unlike the unprecedented rain and flooding the city suffered three years ago this week during Hurricane Harvey. Houston is the nation’s fourth most populous city.

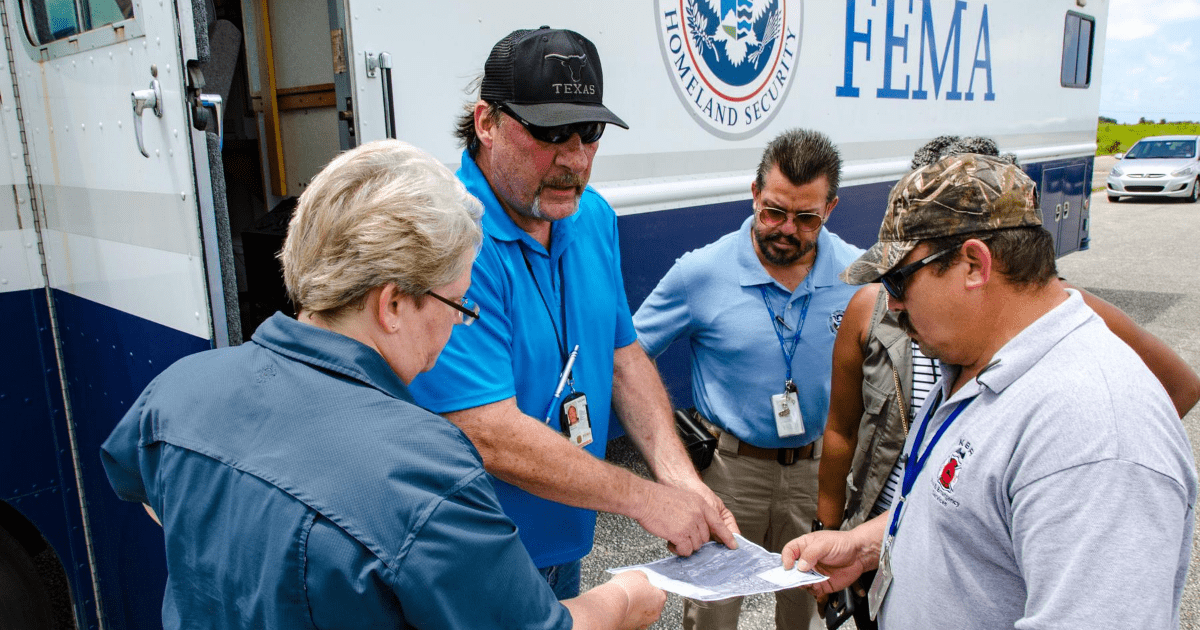

John Esparza, president and CEO of the Texas Trucking Association, said truckers have been pre-positioning empty equipment and emergency supplies near the areas expected to feel Laura’s wrath since last weekend and are prepared to move in as soon as it is deemed safe. The Market Conditions Map from DAT Freight & Analytics showed high demand for trucks along the Texas and Louisiana coasts, with shippers looking to move freight out of the storm’s path and anticipating disruptions.

Find recources for emergency freight.

He lamented the timing of the storm, noting that the “the freight market has begun to stabilize” in the months since the COVID-19 pandemic began in March.

“Additional stress to the system, such as a large weather event, certainly can create an imbalance,” Esparza said. “We may not be able to respond as quickly as pre-COVID.”

Demand for some consumer goods have spiked since the pandemic began. On a recent conference call, Derek Leathers, Werner Enterprises’ president and CEO, cited a shift in food and beverage consumption to grocery stores from restaurants as an example of the jolt to established supply chain patterns.

The imbalance created by these demand changes, combined with manufacturing slowdowns, have led to an increase in deadhead miles for many truck drivers, including those with Werner.

Esparza noted the Gulf region has gotten used to severe storms this time of year, with hurricanes Rita, Ike and Harvey each providing a template on how the supply chain can more quickly recover from severe weather events.

He also credited the enhanced role technology continues to play on speeding response efforts to get delayed freight loads to their final destinations.

The DAT One network quickly connects carriers with freight brokers and shippers.

Refinery closures compound disruptions

Ahead of the Gulf Coast evacuations, numerous refineries in southeastern Texas and southwestern Louisiana announced they were temporarily halting operations.

Among the closures are Motiva Enterprises’ 600,000-barrel-a-day refinery and chemical operations in Port Arthur, TX and ExxonMobil’s refinery in nearby Beaumont, TX and Phillips 66’s facility in Lake Charles, LA.

Motiva said it was already working to “ensure reliable fuel supply in our communities after the storm passes.” More than half of total U.S. refining capacity is on the Gulf Coast.

The Gulf was previously breathing a sigh of relief as a weakened Tropical Storm Marco caused less damage than initially feared.

However, the Port of New Orleans halted operations on Monday, leading to delays for several freight rail and intermodal operators likely to be further compounded by Laura.