Both housing starts and new permits missed market expectations last week. The flatbed freight intensive single-family home sector was flat in September. However, multifamily units — which includes apartment buildings and condominiums — decreased 5% since August but remained up 38% since the start of the year.

Find loads and trucks on the largest load board network in North America.

Note: All rates exclude fuel unless otherwise noted.

Single-family housing starts and permits — which contribute significantly to flatbed volumes — are now down 1.5% and 6.5% year-over-year respectively. The September numbers mark the first time since the pandemic started that monthly home starts have decreased compared to the same time in 2020. After starting 90,000 more single-family homes in August, the September total of 1.08M was 17,000 fewer than September 2020.

“Single-family construction continued along recent, more sustainable trends in September,” says Chuck Fowke, Chairman of the National Association of Homebuilders (NAHB). “Lumber prices have moved off recent lows, but the cost and availability of many building materials continues to be a challenge for a market that still lacks inventory.”

“Builder confidence increased in October, which confirms stabilization of home construction at current levels,” adds Robert Dietz, NAHB Chief Economist.

After flatbed capacity loosening since May, the market tightened last week on the 430-mile run from Cleveland, OH to Roanoke, VA as rates broke through the $4.00/mile barrier. Seven-day rates averaged $4.22/mile on that lane, which is up $0.53/mile higher than the average for September and just $0.09/mile lower than the 2021 peak in May.

In neighboring Pittsburgh, capacity was also tight following last week’s $0.14/mile increase in spot rates to $3.66/mile. On the automotive steel lane from Pittsburgh to Rapid City MI, rates hit a 12-month high of $4.18/mile last week. It’s up $0.67/mile since September.

In Gary IN, the largest producer of raw steel in the U.S., spot rates cooled last week dropping by $0.15/mile to an average outbound rate of $3.21/mile.

Spot rates

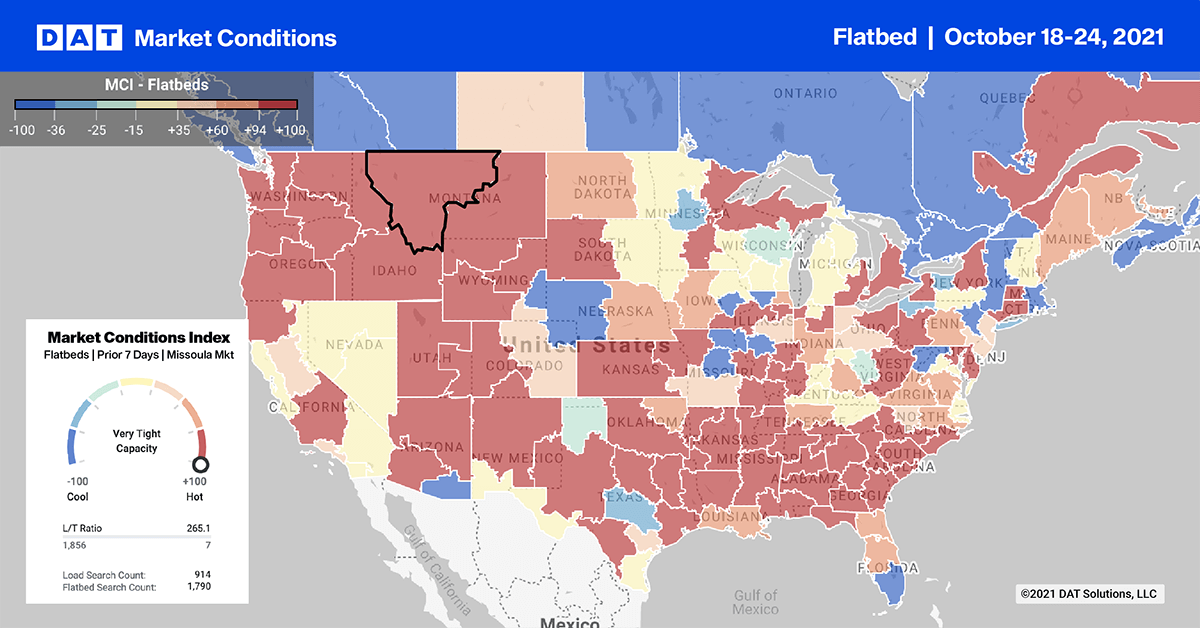

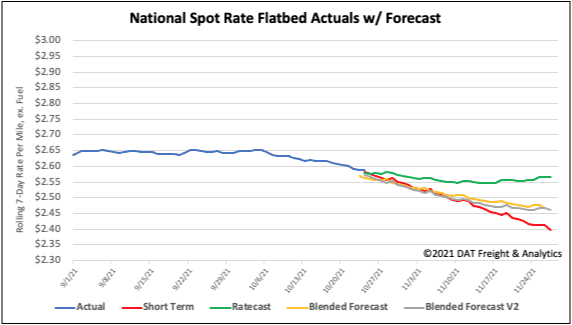

Flatbed capacity continued to ease last week as spot rates dropped another $0.04/mile to a national average of $2.59/mile. Compared to the same week last year, flatbed spot rates are still 14% or $0.36/mile higher and $0.42/mile higher than 2018.

How to interpret the rate forecast:

- Ratecast: DAT’s core forecasting model

- Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset

- Blended Scenario: More heavily weighted towards the longer-term models

- Blended Scenario v2: More heavily weighted towards the shorter-term models