The Fannie Mae Home Purchase Sentiment Index® (HPSI), which is a good indicator of demand for flatbed carriers, increased modestly in January from December.

“Interestingly, lower-income and renter groups were more optimistic this past month across nearly all of the sentiment index’s components,” said Doug Duncan, Fannie Mae Senior Vice President and Chief Economist.

Low interest rates are playing into lumber prices, with increased demand for single-family housing driven by the coronavirus pandemic.

“Softwood lumber prices are now about 112% higher than they were a year ago and have jumped 10% in just the past week,” according to Random Lengths. “There has also been a surge in home remodeling, as people sit at home longer and put money that they would have spent on going out or traveling into their houses and properties.”

For carriers and brokers this points to strong demand for building materials and lumber as well as durable goods used during the home fit-out stage (large appliances and furniture).

Find flatbed loads and trucks on the largest on-demand freight marketplace in North America.

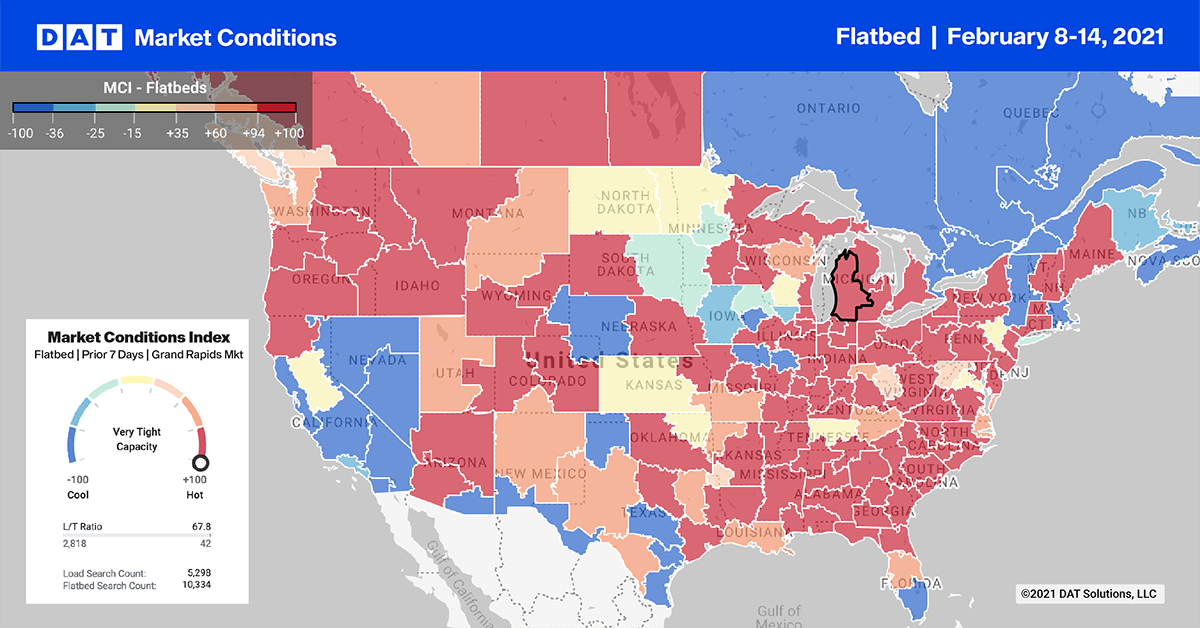

Load posts in the top 10 flatbed markets increased by 7% week over week, driven by large increases in Decatur, AL, and Montgomery, AL, where outbound load post volumes were up 13% and 30% w/w respectively.

Outbound rates in Montgomery jumped $0.24/mile to $3.24/mile, as capacity tightened considerabl. Farther north in Cleveland, a 6% w/w increase in volume pushed rates up by $0.06/mile to $2.96/mile. Available capacity in Little Rock, AR, eased, as rates dropped $0.16/mile to $2.50/mile in average.

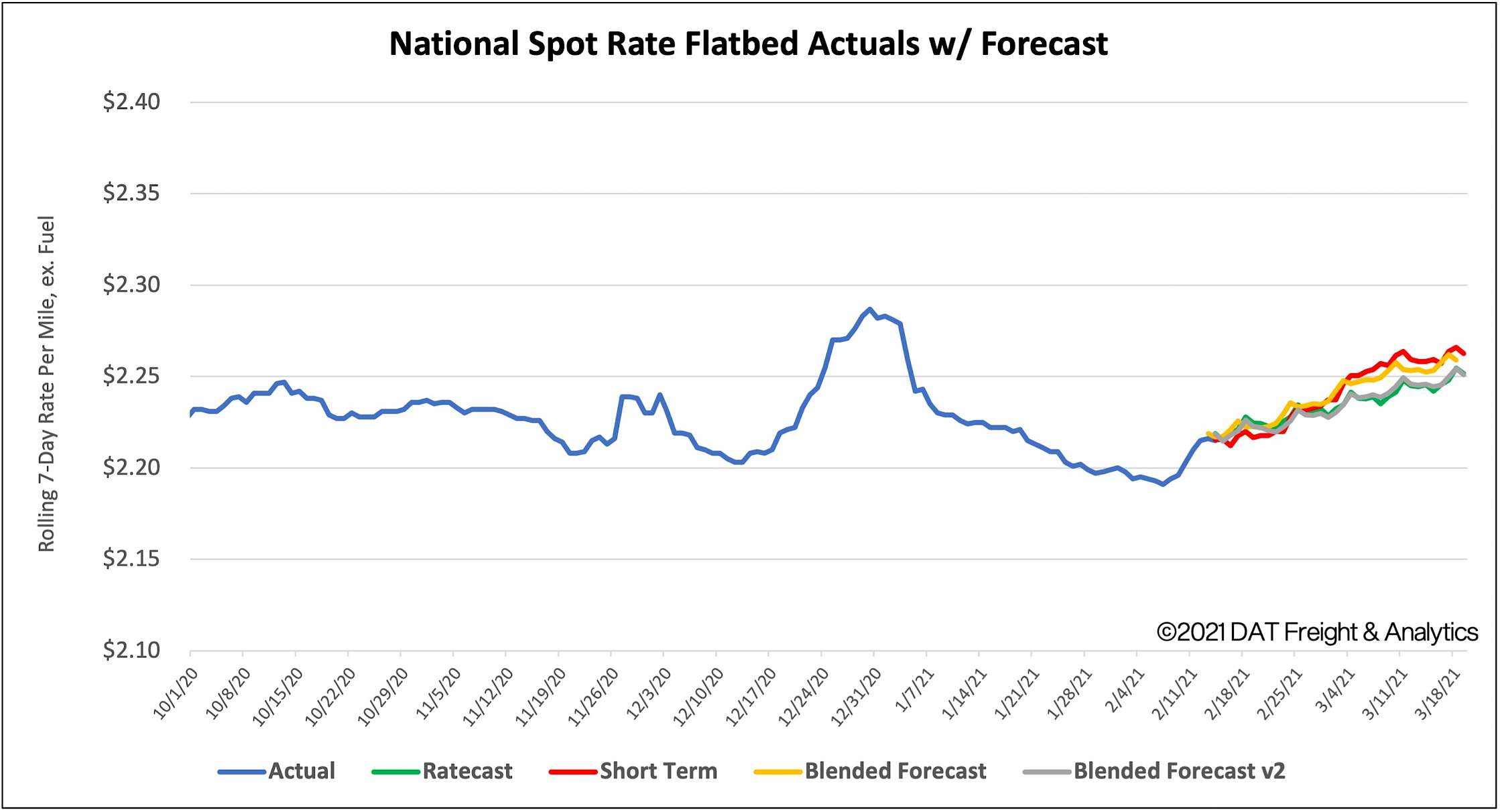

Spot rates

Flatbed spot rates inched higher last week moving up by $0.02/mile to $2.21/mile excluding fuel. Compared to the same week in 2020, flatbed rates were $0.37/mile higher last week.

How to interpret the rate forecast

1. Ratecast Prediction: DAT’s core forecasting model estimate showing continued optimism and rate growth.

2. Short Term Scenario: Formerly the pessimistic model that focuses on a more near-term historical dataset.

3. Blended Scenario: More heavily weighted towards the longer-term models.

4. Blended Scenario v2: More heavily weighted towards the shorter-term models.

> Learn more about Ratecast predictions available in RateView.