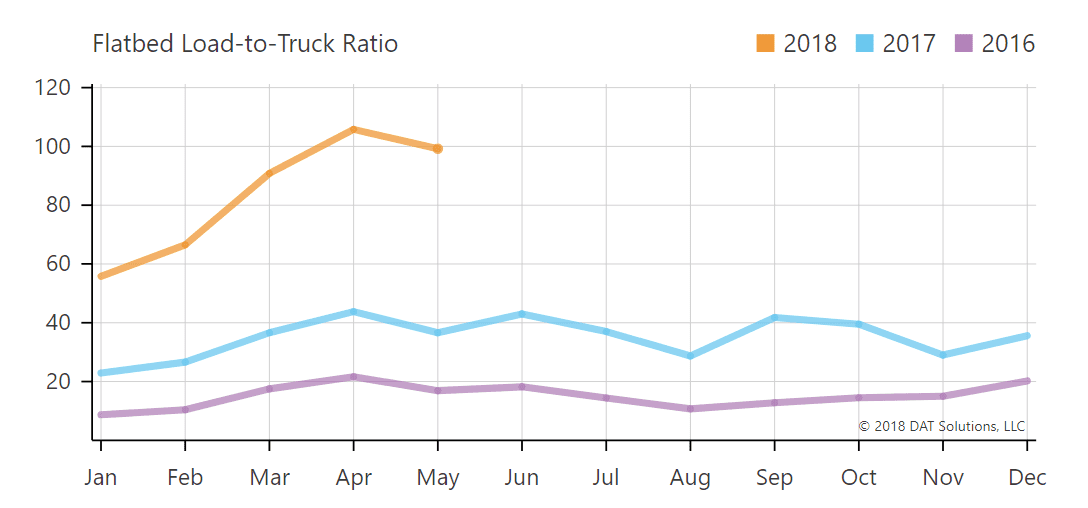

Demand for flatbed loads have been red hot for months, and so are rates. It seems like every week we set a new record for flatbed rates or load-to-truck ratios, or both. Flatbed volumes in June are 32% higher than they were one year ago in our top 78 flatbed lanes, and rates in those lanes are 26% higher than last year at this time.

We are, however, seeing signs that the flatbed market is beginning to cool a bit. Last week the flatbed load-to-truck ratio fell for the second week in a row, dropping 12% to 77.9 loads per truck. While still very high, that’s the lowest load-to-truck ratio since February. Load-to-truck ratios hovered above the 100 mark for seven consecutive weeks in April and May. Also last week, the national average flatbed rate dipped 1¢ to $2.81/mile. That’s a sign that rates are reflecting the declining load-to-truck ratio, but June is still on track to the highest monthly average rate since DAT introduced RateView in 2010, if not ever. So “cooling off” is a relative term.

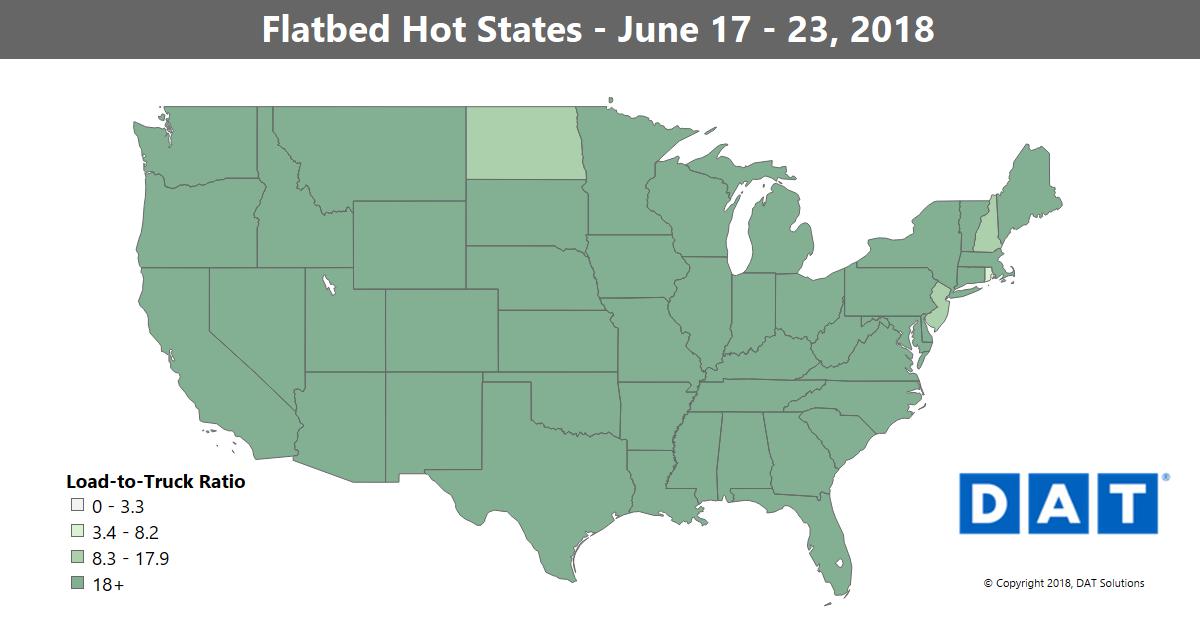

Flatbed demand is extremely strong throughout the country. Last week every state except North Dakota, New Hampshire and New Jersey had a load-to-truck ratio above 18 loads per truck.

RISING MARKETS

Some of the hot spots for flatbeds last week included Las Vegas and Phoenix in the West, and the Raleigh-Greensboro-Roanoke markets in the Southeast. Hot lanes included:

All rates below include fuel surcharges and are based on real transactions between brokers and carriers.

- Las Vegas to Phoenix rates exploded, rocketing up $1.44 to $4.53/mile

- Houston to Bismarck, ND jumped 76¢ to $3.14/mile

- Harrisburg, PA to Buffalo was also up 76¢, to $4.25/mile

- Birmingham to Mobile, AL increased 67¢ to $3.30/mile

FALLING MARKETS

Rates declined on certain flatbed lanes, but these falling lanes are still paying more than $3.00/mile:

- Atlanta to Baltimore, an export lane, tumbled 94¢ to $3.38/mile

- Houston to Oklahoma City slipped 52¢ to $3.44/mile

- Cleveland to Harrisburg, PA dropped 51¢ to $3.89/mile, which is still very high

In April and May the flatbed load-to-truck ratio hovered above 100 loads per truck for seven weeks in a row.

Find loads, trucks and lane-by-lane rate information in DAT load boards, including rates from DAT RateView.