More than 25 million Christmas trees will be sold this year, according to the National Christmas Tree Association. But few people will ever give a thought to how their tree got from the farm to their local Christmas tree lot.

We wondered. So we asked Carl Johnson, President of Pac West Transport Services, a freight brokerage located in Portland, Oregon. Pac West specializes in temperature-sensitive freight, and started brokering Christmas trees shortly after the company was founded 32 years ago. Here’s what Johnson told us.

When does the Christmas tree season begin and end?

It started already for us. We ship trees out of Oregon and Washington primarily, and greens for wreaths start moving in October. Then trees for Hawaii are loaded into containers in the first week of November, followed by trees for the Midwest and the East Coast. The week before Thanksgiving is the busiest time of year, by far. That’s when we move loads to Texas, then California and other Western states. Everyone wants fresh trees on their lots on the day after Thanksgiving.

What’s different about Christmas trees, compared to other commodities?

Once the tree is cut, it’s dying. Similar to produce, there is a short window to keep them healthy and fresh-looking. They have to be transported to their destination, and delays are not an option.

What type of trailers do you typically want for hauling Christmas trees?

It’s not what I want but what the customer wants, and they can have very different requirements. In general, a shorter haul to California can go in a van, but anything to the Midwest or East Coast requires a reefer to protect the trees from both heat and freezing. Most customers want ice blown over the top of the trees to keep them cold and prevent them from drying out. I do have some Texas customers who only want vans, even on such a long trip. They believe the air from the reefer unit dries the trees out and the chute for the air flow limits the number of trees that will fit in the trailer.

Christmas trees are often cut and moved by helicopter to small trucks that transport them to a staging area for loading onto big rigs. Photo by Carl Johnson.

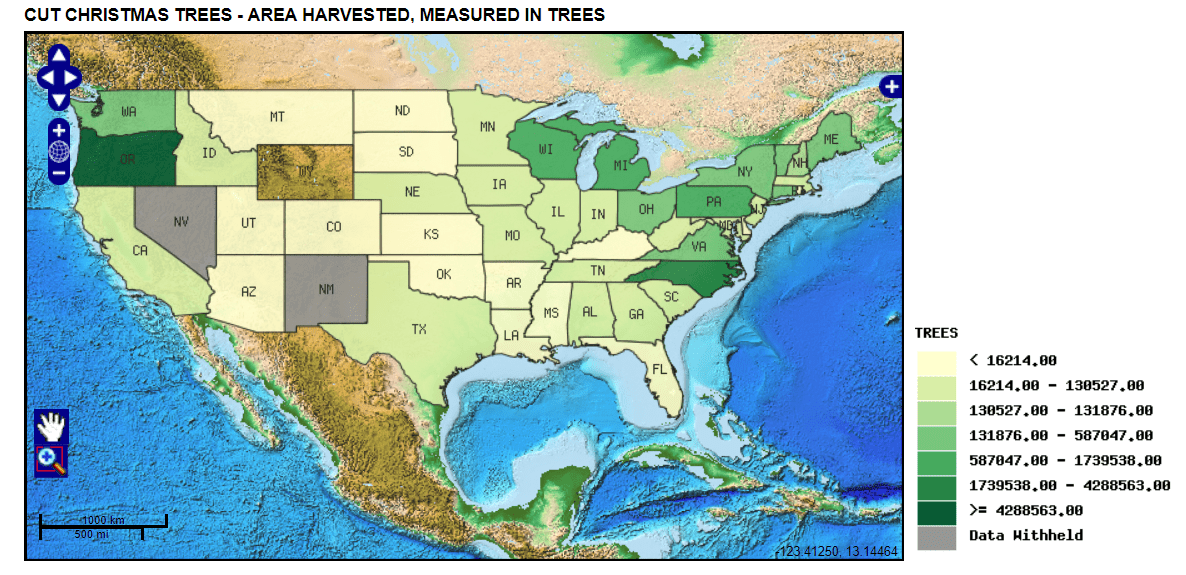

This map shows which states harvest the most Christmas trees, with dark green representing more trees. Oregon is the number-one state for tree production, followed by North Carolina and Michigan. Data from USDA’s most recent Census of Agriculture in 2012.

How do you find trucks during Christmas tree season? Is it different from other times of year?

To Pac West, the carrier is as important as the shipper. We build relationships year round, and gather carrier information regarding types of equipment, capacity, and preferred lanes. We start contacting carriers and securing equipment in August and September. But even being as proactive as possible, the week of Thanksgiving is still one of the most challenging times of the year.

What are the loading and unloading sites like?

After 28 years, I have seen everything from large, spacious staging areas loading a dozen trucks at once, to single loading sites halfway up a mountain, where they need a chained-up tractor to pull the truck back onto the road. Trees are brought in by helicopter and are loaded up. This makes it very important to have our trucks arrive on time. A single late truck can put the shipping location off schedule for the rest of the day.

Do you use DAT products to help you?

Yes, we use the DAT Power load board, integrated with RateView and CarrierWatch. We also use DAT Broker TMS. I feel they are all critical to our success.

Carl Johnson, Pac West Transport